If you’ve ever felt confused by the terms “statement balance” and “current balance” on your credit card statement, we’re here to clear things up.

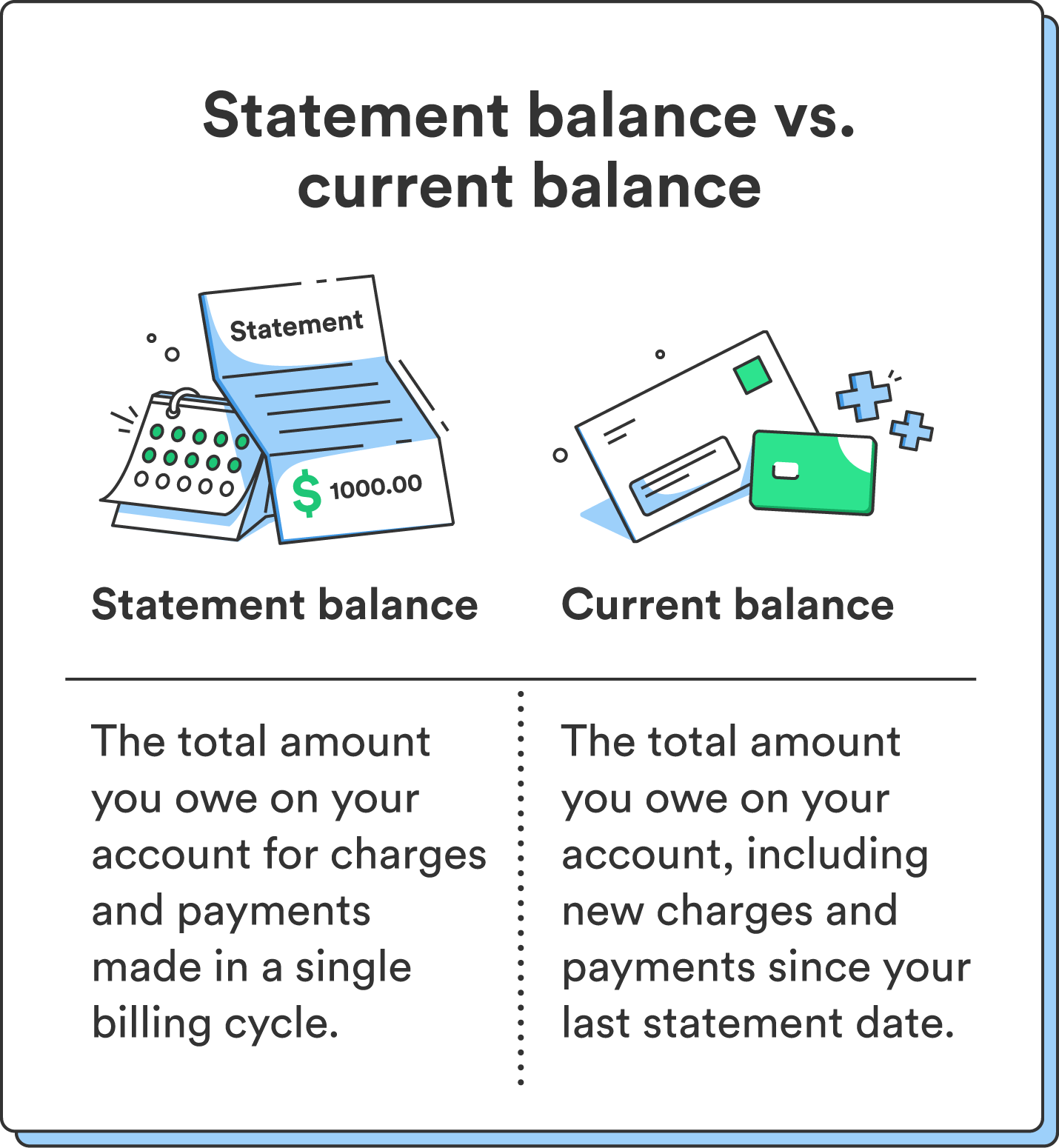

Your statement balance represents what you owed at the end of your last billing cycle. Your current balance reflects the total amount you owe on your credit account at the time you check it, including any recent transactions you made outside of your last billing cycle.

Both your current balance and statement balance can impact your credit score. If you’re using a credit card, keeping both balances in check is essential. We’ll cover what you need to know.

What is a statement balance?

Your statement balance is the total amount you owe on your account at the end of a single billing cycle. Since it doesn’t account for any purchases you’ve made after that cycle ends, it’s like a financial time capsule – it captures your debt only for a set period.

Your statement balance stays the same until your next billing cycle ends. But that doesn’t mean you have stopped using your credit card. As you continue using your card, you’ll generate new charges and payments for the next billing cycle. Those charges will show up in your current balance.

Chime tip: To avoid interest charges on your credit card, always pay your statement balance in full by the due date each month.

What is a current balance?

Your current balance is the total amount you owe on your account, including new charges and payments since your last statement date.

Unlike the statement balance, which only reports charges up to the end of your billing cycle, the current balance is updated every time you make a purchase or receive a credit. It’s a real-time reflection of the full amount you owe on your account, regardless of the statement date or billing period.

Why is my statement balance different from my current balance?

Your statement balance and current balance may not always match up depending on how you use your credit cards.

That’s because your statement balance doesn’t consider any transactions you make after the cycle ends – but those transactions would appear on your current balance. Your current balance includes all your recent spending and payments, whether your billing cycle recently ended or not.

Because of this, your statement balance can either be lower or higher than your current balance.

Here’s an example of when your current balance may be higher than your statement balance:

Say you spent $1,000 during one billing cycle, and your billing cycle ends on the 30th of each month. Your statement balance on the 30th would be $1,000. If you make a $250 purchase on the 31st, your statement balance would remain the same ($1,000), but your current balance would be $1,250. In this case, your current balance is higher than your statement balance.

Alternatively, your current balance may be lower than your statement balance:

Let’s say you spent the same $1,000 during your billing cycle that ends on the 30th of each month. Then, you made a $500 payment toward your account balance on the 31st. In this case, your statement balance would still be $1,000, but your current balance would be $500.

How to use statement and current balances wisely

Follow the tips below to learn how to use your statement and current balances to your advantage (and help you read your next credit card statement.)

Know how balances can impact your credit score

Both your statement balance and current balance can affect your credit score.

Each month, your credit card company shares information about your account with the credit bureaus. They use your statement balance and current balance to calculate your credit utilization rate. That’s a measure of how much of your available credit you use compared to your credit limit, accounting for 30% of your credit score.

If your statement balance is high compared to your credit limit, it could increase your credit utilization rate, which may lower your credit score. Pay attention to both balances, making sure to pay your statement balance on time while also keeping an eye on how close your current balance is to your credit limit. This way, you can manage your credit wisely and maintain a good credit score.

Chime tip: Most creditors report your statement balance to credit bureaus rather than your current balance, but contact your card issuer to confirm which one it uses.

Budget with statement balance

Use your statement balance as a practical budgeting tool. Using this fixed snapshot of how much you owe at the end of your billing cycle, you can plan your monthly budget effectively. This way, you can be ready to allocate funds for upcoming expenses and manage your money without overspending.

Monitor spending with current balance

To stay in control of your spending, keep an eye on your current balance. It provides a real-time overview of your finances, including recent purchases and payments. Monitoring your current balance can help you keep track of day-to-day account activity and avoid excessive spending (or overdraft fees).

Should I pay my statement balance or current balance?

Which balance you pay is ultimately a personal preference. But you should pay your statement balance in full by the due date each month to avoid interest charges or late fees. If you can’t pay the entire statement balance, you’ll need to pay at least the minimum to keep your account in good standing (but you may wind up with interest charges).

If you want to pay down your credit card debt more proactively, you can always pay your current balance. This covers all recent transactions and helps you reduce your overall debt more swiftly.

Knowledge is power on your credit journey

Understanding your statement balance and current balance is essential, whether you’re aiming to stay on top of your spending, pay off credit card debt, or build a better credit score.

Now that you understand statement balances and current balances, learn more about how to increase your credit limit.

Log in

Log in