Trust builds credit. For a lender to allow you to borrow money, they need some sort of guarantee that you will repay what you borrow. That guarantee is a credit score. The higher the score, the more you are considered a trustworthy borrower.

Building credit will not happen overnight, but there are well-known strategies that can help if you want to build your credit quickly.

How long does it take to establish credit?

So, how long does it take to build credit? Well, it depends. If you’re new to building credit, you can generally expect it to take at least six months to establish your first score.¹ If you’re rebuilding credit or need to improve a damaged score, you should be prepared for it to take longer.

With a stronger credit score, you’ll gain access to better interest rates and loan terms for new credit accounts. Good credit helps you reach important milestones, like getting your first apartment or buying a car.

But if you have a low score or even no credit at all, establishing a good credit score can feel daunting. Luckily, there are simple steps you can take toward establishing your credit score or improving your credit history.

How long does it take to build credit from nothing?

Lenders look at your payment history to determine how dependable a borrower you may be. If you have no credit history to show, lenders can’t anticipate your ability to use credit responsibly and pay your bills on time. That’s why getting approval for new accounts is more challenging for first-time credit users.

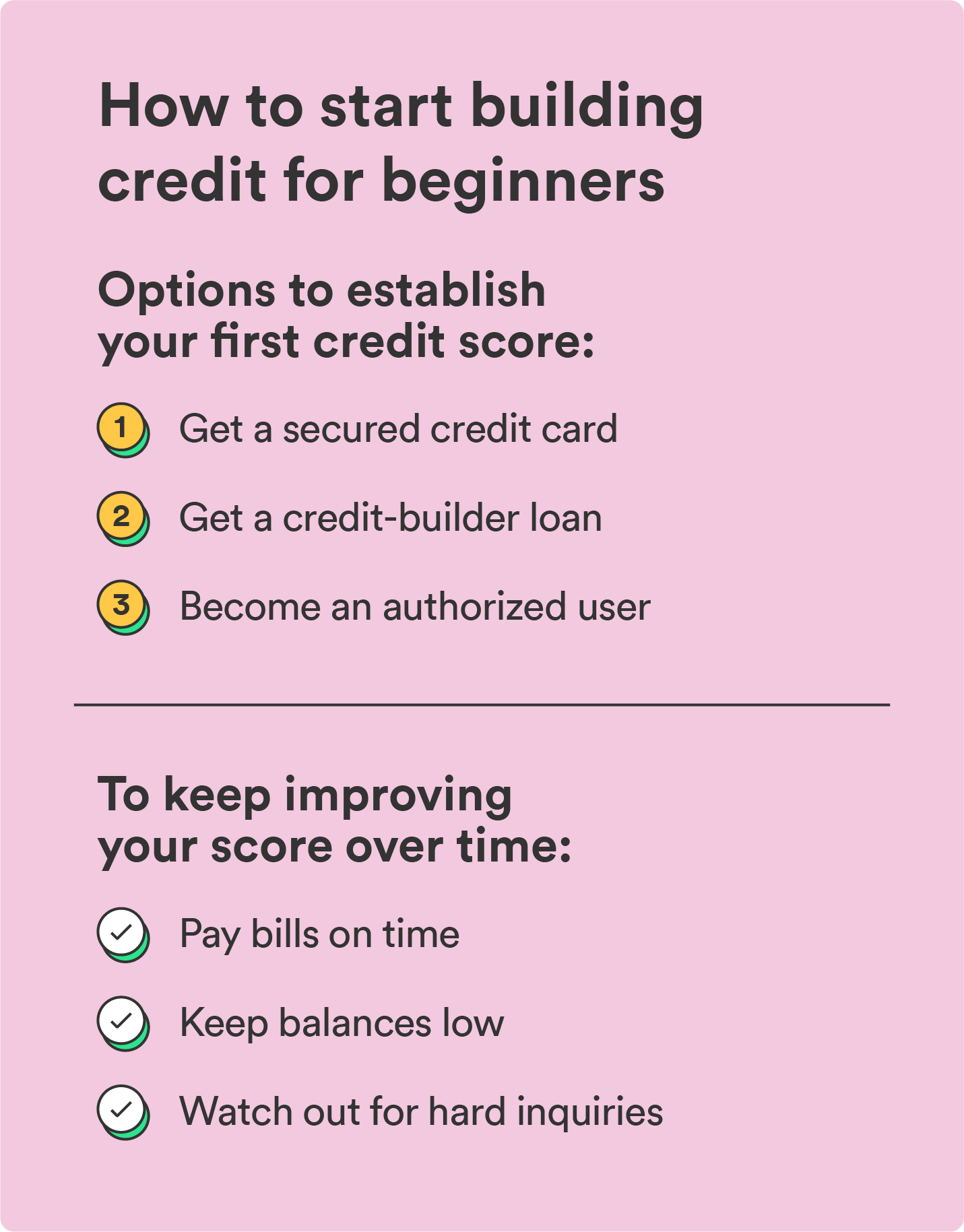

You’ll need some sort of credit account to get started. Applying for an unsecured credit card often requires having a good credit score first. If you’re starting from scratch, it’s better to build credit with a few alternatives:

- Get a secured credit card: Secured credit cards act just like regular credit cards, but you pay a security deposit upfront. This deposit is collateral for your card and sets your credit limit. These cards often come with more lenient requirements and are more accessible to first-time credit builders. To avoid the fees associated with their often higher APR, pay your bill on time and in full every month.

- Get a credit-builder loan: If you want to build credit without a credit card, you can use a credit-builder loan to create a history of on-time payments. They’re different from traditional loans because you’re essentially repaying a loan to build credit. You don’t get the loan’s proceeds until you repay it in full. Check out your local credit unions and community banks for these loans.

- Become an authorized user: To build credit without a history, ask a trusted friend or family member with good credit to add you as an authorized user on their account.

- Boost your credit with rent and utility payments: Some property managers and utility companies report your on-time payments to credit agencies. Check with yours to see if you can use a positive payment history to improve your credit.

How long does it take to improve your credit score?

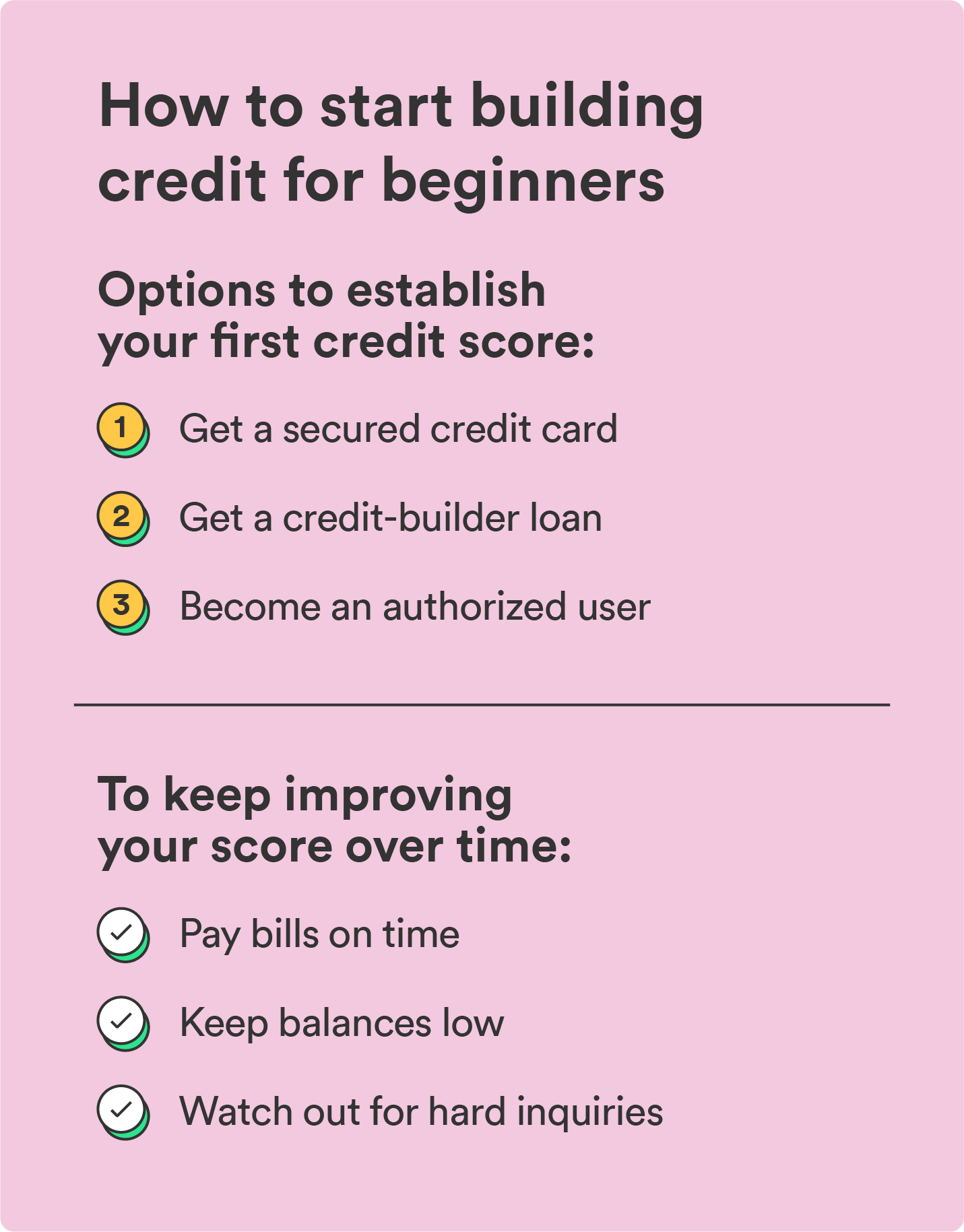

Your financial habits directly influence how long it takes to improve your score. You can improve your credit score by paying bills on time, reducing your overall debt, and keeping balances low. While huge changes can’t happen overnight, continued effort will result in steady growth. You could start to see changes in as little as 30 to 45 days.²

To boost your score, be proactive and maintain consistency. Focus on what actions will have the greatest impact on your score while reducing the factors that lower your score.

Once you have better credit, your financial options open up. You can borrow money when you need to and secure great rates.

How long does it take to rebuild a damaged credit score?

Depending on the severity, repairing a damaged score can take anywhere from a few months to a couple of years. Make sure to halt the behaviors that led to the damaged score and start new habits that will increase it.

To rebuild your credit faster, focus on clearing high-interest debt and making payments on time. These are two of the biggest factors that can hurt your score. Doing this can help you build your credit in around a month. Both positive and negative credit information often takes 30 days to hit your credit report.

That said, don’t expect your credit score to jump 100 points in a single month. Building good credit is a long game – you’ll need to use credit responsibly for three to six months before seeing significant changes to your score.¹,²

Key factors that affect your credit score

Building credit takes time, but the good news is that you can speed up the process by practicing a few smart habits. Here are some key factors that impact your credit score:

- Payment history: Paying bills on time is the most important factor for your credit score. The longer you make on-time payments, the faster your score will improve. Missed payments can slow down your progress. Set up automatic payment plans to stay on top of due dates.

- Credit utilization: Try to keep your credit usage under 30% of your limit. A poor credit utilization ratio can hurt your score and slow your progress, but keeping it low can help your score grow more quickly.

- Credit age: The longer your account is in your credit file, the better it is for your score. While you can’t speed up the aging process, keeping old accounts open will help your score improve over time. Closing accounts unnecessarily can delay your progress. Cut up the card if you have to, to avoid racking up more debt, but leave those accounts open.

- Hard inquiries: Hard inquiries can lower your score. Applying for many new credit accounts in a short time can slow your progress. Space out hard credit inquiries to avoid this issue.

- Credit limits: You can improve your score by requesting periodic credit limit increases. This can lower your overall credit utilization, as long as you don’t overspend. Space these requests out as well, as they are often a hard “pull” on your credit. Sometimes, lenders will automatically reward you by offering a limit increase, which is often only a soft pull.

Stay consistent with these habits, and your score will steadily improve over time.

How your credit score is calculated

Knowing how credit scores are calculated helps you understand why it takes about six months to build your first score. If you’re rebuilding your credit, it might take even longer.

Most lenders use your FICO® Score, which is based on five key factors:³,⁴

- Payment history (35%): your history of paying bills on time or not

- Credit utilization (30%): how much available credit you’re using

- Length of credit history (15%): how long you’ve been building credit

- Credit mix (10%): the mix of different types of credit accounts you have

- New credit (10%): the number of credit accounts you have recently opened

Your payment history and credit utilization are the most important factors that make up your credit score. Consistently paying bills on time and using credit sparingly can help you improve your score.

Credit scoring companies like FICO® Scores and the VantageScore, have credit scores ranging from 300 to 850. Major credit bureaus (and lenders) consider a score of 579 or below as poor credit, while they see 800 and above as excellent credit.

Keep your credit-building journey on track

How fast you can build credit depends on where you’re starting from and your ability to maintain smart credit habits. Whether starting from zero or rebuilding a score, with the right moves, you can start seeing noticeable improvements.

Monitor your progress, be consistent, and celebrate every small score increase along the way. Ready to take the next step in your credit journey? Learn how to build credit fast for beginners.

Frequently Asked Questions

What does your credit score start at?

There’s no starting credit score – you either have open credit accounts or you don’t. Your score is generated based on your credit and payment activity once you open an account.

How do I build credit faster?

To speed up credit building, pay your bills on time, keep credit use low, and avoid applying for too many accounts at once. Learn more about how to build credit faster as a beginner.

Can you build credit in three months?

You could raise your credit score within one to three months. But it depends on your current score, financial situation, and what you’re willing to do to raise it. For those rebuilding damaged credit, it could take much longer. To boost your credit fast, pay bills on time, limit hard inquiries, and keep balances low.

Log in

Log in