When payday hits, you’re probably most excited to see that hard-earned cash land in your checking account.

The direct deposit (or paper check) itself is certainly the most exciting part of getting paid, but there’s something else that’s worth reviewing now and then: your pay stub. This document details how much money you make vs. how much you actually get to keep after taxes and other deductions.

Not sure how to read a pay stub or why it’s useful to review yours? Let’s dive in.

What is a pay stub?

A pay stub is a physical or digital document that accompanies your paycheck and includes details like your gross pay, tax withholdings and deductions, year-to-date (YTD) earnings, and how much money you’re actually being paid when all is said and done. In this way, a pay stub serves as a summary of your earnings.

Before the rising popularity of direct deposit, employers typically paid employees with a paper check. The pay stub would be attached to the check; you’d remove the check from the stub along a perforated line, deposit the paycheck into your checking account, and keep the pay stub for your records.

Today, 93% of Americans get paid via direct deposit,1 which means there’s no paper stub to file away. You can typically access a digital version of your pay stub (just ask your manager or payroll department), and it’ll have the same information.

How to read a pay stub

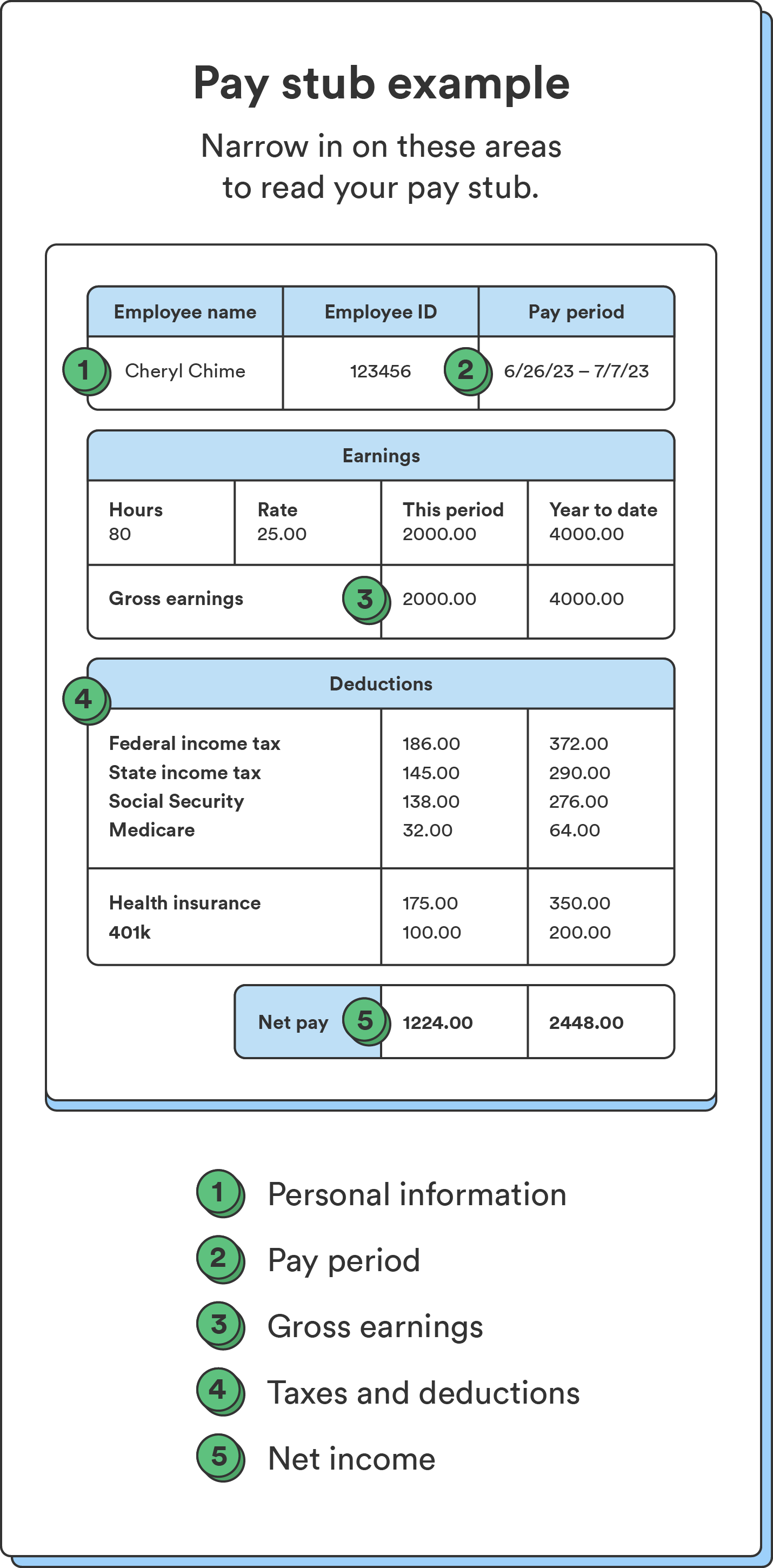

So you’ve got your pay stub in hand (or on your screen), but how do you read it? There are five main sections to a typical pay stub:

- Personal information

- Pay period

- Gross earnings

- Taxes and deductions

- Net income

Let’s take a look at each of these pay stub elements for a better understanding:

1. Personal information

The top of your pay stub will include your legal name, Social Security number, home address, and usually your filing status and exemptions.

The pay stub may also include work details, like the amount of paid time off you’ve accrued and taken, your employee ID, and how you’re paid (hourly vs. salary).

The company’s name and address will also usually be printed at the top.

Chime Tip: Verify that your filing status is correct for tax season, as your employer uses this status to predict your tax withholdings (how much money to withhold from your paycheck for taxes). If they withhold too little because your filing status is wrong, you could end up owing money in April.

2. Pay period

Before the actual payment information, pay stubs also typically list the pay period (the date range for which your employer is issuing payment) and the date the payment was issued.

3. Gross earnings

Here’s where pay stubs get exciting: This portion details how much money you earned during the pay period.

If you’re salaried, the number will look consistent from pay stub to pay stub – until you get a raise, take unpaid time off, or earn a bonus. If you’re an hourly worker, the pay stub will indicate the number of hours you worked during the pay period, your hourly rate, and the resulting earnings.

Additional earnings, like reimbursement for an expense or overtime pay (and the rate), will also appear in this section.

This section typically shows gross earnings for the current pay period and the year-to-date.

4. Taxes and deductions

Don’t get too attached to that attractive number in the gross earnings section. It’s not what you’ll actually take home. The next section of your pay stub is dedicated to the money you owe.

First, you’ve got to pay Uncle Sam his fair share in federal taxes, and your state – and maybe even your city and/or school district – may also take a portion. You’ll also see Social Security and Medicare deductions here.

If you receive health insurance through your employer, you likely pay the premium out of your paycheck, so that’ll show up in the deductions as well. Other common deductions include 401(k) contributions, FSA contributions, and HSA contributions.

As with gross pay, your pay stub usually shows you deductions for the current pay period and YTD.

5. Net income

Finally, your net income represents how much money you’re actually being paid. It’s your gross income minus your taxes and deductions. This amount should match what lands in your bank account.

You can usually see net income for the current pay period and YTD.

Excited for payday? Find out what time direct deposit hits.

What are the deductions on your pay stub?

Seeing how much money is being taken out of your paycheck each pay period can be frustrating, but taxes are unavoidable, health insurance is crucial, and contributing to retirement and a Health Savings Account can establish a better future for yourself.

Let’s take a look at these common deductions:

- Federal taxes: First and foremost, you’ll have to pay federal taxes out of your paycheck. How much depends on which tax bracket you’re in. Because the U.S. uses a progressive tax system, the more money you earn, the higher percentage of earnings you’ll owe in taxes. This tax applies to your gross income, minus any pre-tax deductions, such as HSA and certain 401(k) contributions.

- State and local taxes: Depending on where you live, you may also owe state and local taxes.

- Social Security and Medicare Tax: You’ll usually see this on your pay stub as FICA (Federal Insurance Contributions Act). By law, you’re required to contribute to Social Security and Medicare from your earnings.

- Retirement contributions: If you contribute to a 401(k) through your employer, your contributions will show as a deduction from your paycheck.

- HSA and FSA: Similarly, you might have a Health Savings Account or Flexible Spending Account through your employer, in which case contributions would be deducted from your paycheck.

- Child support and alimony: If you pay court-ordered child support or alimony, expect to see these deducted from your paycheck.

- Garnished wages: You can also have money taken out of your paycheck for unpaid taxes, medical bills, credit card debt, defaulted student loans, and more.

Pay stub deduction codes

Pay stubs use a lot of shorthand, particularly when it comes to your various deductions. If you’re just learning how to read a pay stub, it’s easy to get confused. Here’s a reference list for some of the abbreviations commonly used.2,3

| Pay stub deduction code | What it means |

|---|---|

| FED, FIT, FWT, or FITW | Federal income tax withholding |

| STATE, SIT, SWT, or SITW | State income tax withholding |

| FICA | Federal Insurance Contributions Act, usually accompanied by Social Security or Medicare code |

| SOC, SS, SOCSEC | Social Security tax |

| MED | Medicare tax |

| 401(K) or RET | Retirement contributions |

| INS | Health insurance premium |

| GARN | Garnished wages |

| CHSPPRT | Child support |

Why you should read your pay stub

So now you know how to read your pay stub – but why read it in the first place? There are a few reasons to check your pay stub occasionally, like to:

- Make sure you’re getting paid correctly. Check your pay stub to ensure the payment info is correct and up to date. If you’re salaried, check the pay stub after getting a raise or a bonus. If you’re hourly, make sure the hours logged on the pay stub match what you actually worked.

- Verify your filing status and exemptions. Your employer uses your reported filing status and exemptions to calculate how much federal and state taxes to withhold from your paycheck. Major life changes – like marriage, divorce, death of a spouse, or birth of a child – can impact how much you should have withheld. After filing a W-4 with your employer to reflect your life change, check your pay stub to ensure it took effect.

- Send it to a lender. Sometimes, lenders want to see recent copies of your pay stubs before approving you for a loan. This is common for big purchases, like buying a house or car, and also when taking out a personal loan.

- Build your budget. If you’re making a budget for the first time, you don’t want to build it based on your gross salary. Instead, you want to use the amount you actually take home after deductions. If you’re not sure how much that is, you can check your bank account for your most recent direct deposit – or just look at your pay stub for net pay.

It pays to check your pay stub

When payday hits, it’s natural to skip the paperwork and just celebrate the money that hits your bank account. But every now and then, double-check your pay stub to ensure you’re getting paid the right amount.

Of course, you don’t have to wait until payday to get your money. If you have a Chime Checking Account and get paid via direct deposit, it’s possible to access your paycheck up to two days in advance. Here’s how Chime gets you paid early.

FAQs

What's on a pay stub?

A pay stub includes personal and payment information, including:

- Your name, Social Security number, address, tax withholding information, and employee ID

- The pay date and the pay period

- Your gross earnings, including any bonuses, overtime, and expense reimbursements

- Taxes withheld from your paycheck

- Other deductions, including health insurance premiums, retirement contributions, and garnished wages

- Your net pay

What is the gross pay income on a pay stub?

Gross pay income on a pay stub refers to how much your employer pays you. This is not how much you’ll actually receive, however, as your employer will take out taxes, insurance premiums, and other deductions from your paycheck before issuing your payment. How much you end up with is referred to as your net income.

Log in

Log in

Deductions on your paycheck depend on your unique situation but may include: