Budgeting, tackling debt, or planning for your retirement might feel like a puzzle without all the pieces, but having an expert to guide you can make these processes less daunting. A financial planner could help, but their expertise often comes with a considerable price tag.

Enter financial podcasts as affordable mentors for building a stronger financial future. The best ones aren’t just chitchat; they’re packed with actionable advice to make your money journey smoother.

Whether you’re looking to understand investing, debt management, or even the psychology behind financial decision-making, we rounded up the best financial podcasts to help you flex your personal finance muscles, whatever stage of your journey.

| Podcast | Best for | Release schedule | Episode length | Topics covered |

|---|---|---|---|---|

| How to Money | Beginners, personal finance basics | Every 2-3 days | 40-60 minutes | Budgeting, saving, investing, paying off debt |

| Afford Anything | Achieving financial independence | 1-2 episodes per week | 30-60 minutes | Investing, psychology of money, financial independence |

| Journey to Launch | Millennials and Gen Z | Weekly | 30-60 minutes | Budgeting, saving, financial independence, side hustles |

| The Ramsey Show | Becoming debt-free | Weekdays, 2-4 p.m. ET | 30-45 minutes | Budgeting, saving, debt management, basic money management |

| Money for the Rest of Us | Beginner-friendly investing advice | Wednesdays at 12 p.m. ET | 30-45 minutes | Investment strategies, asset allocation, risk management, macroeconomic trends |

| Millionaires Unveiled | Learning to build wealth | Weekly | 45-60 minutes | Investment strategies, real estate, financial independence |

| Millennial Investing | Investors, specifically millennials | Every 3-4 days | 60 minutes | Stock investing, real estate, financial markets, Bitcoin |

| BiggerPockets Money | Real estate basics | Every Monday and Friday | 45 minutes | Investing, debt reduction, retirement planning, real estate investing |

| Stacking Benjamins | Investing advice with a touch of humor | 1-2 episodes per week | 60-90 minutes | Personal finance, saving, investing, money trends |

| Planet Money | Economics basics | Every 2-3 days | 0 minutes | Macroeconomic trends, financial markets |

| Retirement Man Answer Show | Holistic retirement planning | Weekly | 5-60 minutes | Retirement planning, investing strategies, lifestyle design |

| ChooseFi | Learning F.I.R.E. (financial independence, retire early) | Sundays | 40-60 minutes | Retirement planning, investing, debt management, tax strategies |

| Your Money, Your Wealth | Retirement planning and tax reduction | Tuesdays | 30-45 minutes | Wealth management, retirement planning, tax-efficient planning, Social Security |

| More Money | Financial literacy basics | Mondays | 60 minutes | Financial independence, early retirement, budgeting, debt and credit, side hustles, entrepreneurship |

| Marriage Kids and Money | Young families and married couples | Weekly | 30-45 minutes | Financial independence, generational wealth, raising financially literate children |

| I Will Teach You to Be Rich | Couples | Weekly | 60 minutes | Personal finance, joint money management, investing, entrepreneurship |

| So Money | Couples seeking personal and professional financial growth | Every 2-3 days | 0-40 minutes | Budgeting, saving, investing, managing family finances, work-life balance |

| Couple Money | Couples navigating shared finances | Weekly | 20-30 minutes | Budgeting as a team, opening joint accounts, managing debt collaboratively, joint investments, finance for blended families |

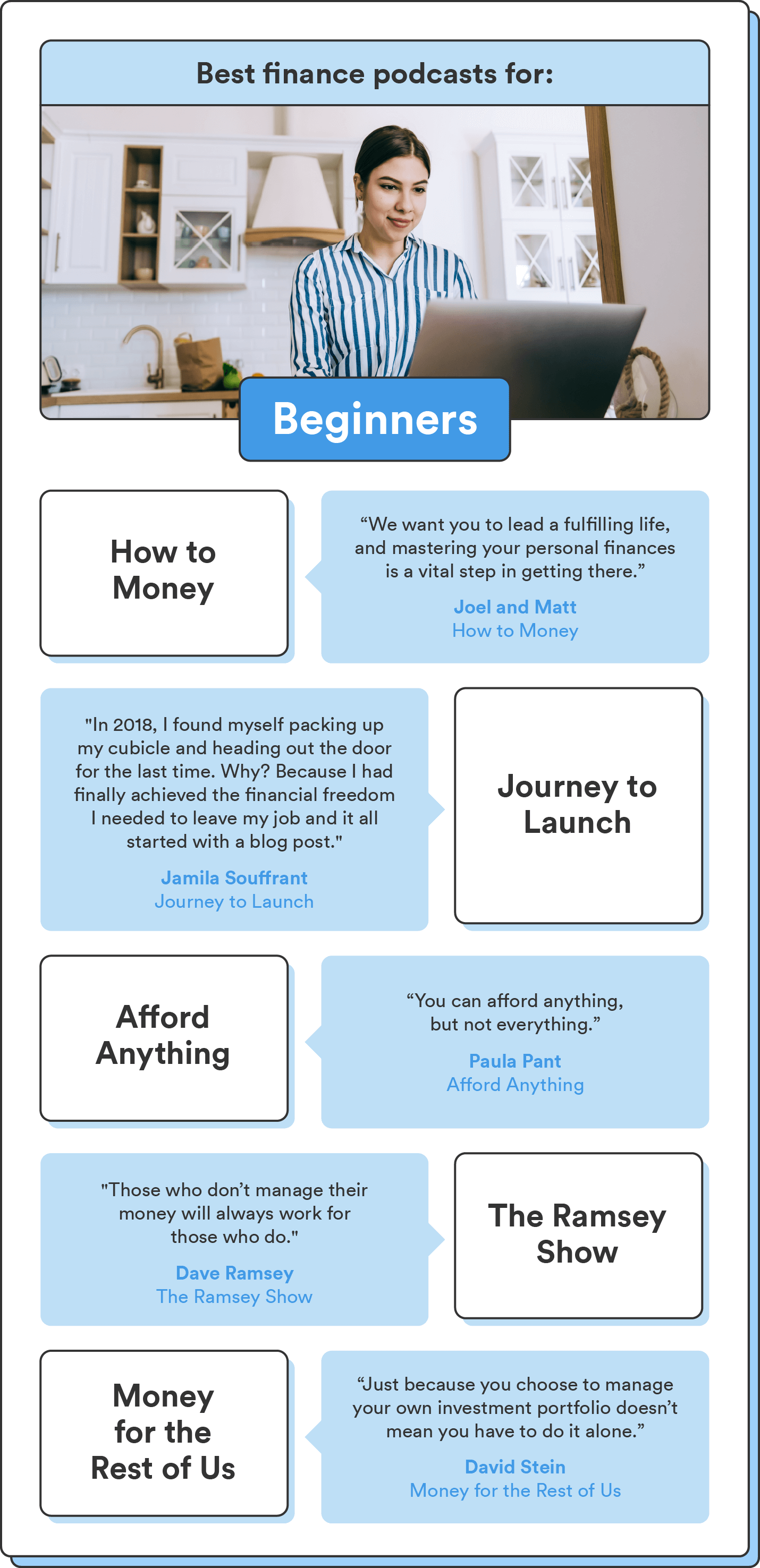

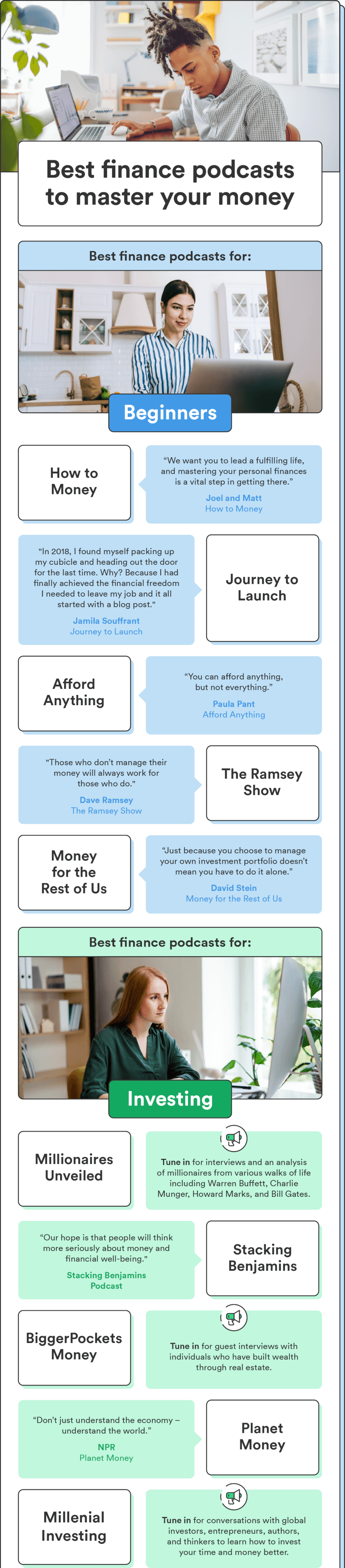

1. How to Money

Best for: Beginners; personal finance basics

Episode schedule: Every 2-3 days

Average episode length: 40-60 minutes

How to Money is a podcast hosted by Joel and Matt, two friends who love nothing more than talking about money. Their mission is to make money more approachable for the masses, “providing the knowledge that normal folks need to thrive in areas like debt payoff, DIY investing, and crucial money tricks that provide continuous help along your journey.”¹

Sharing their practical expertise with a touch of humor, Joel and Matt cover topics like budgeting, saving, investing, and debt management, breaking down complex topics into easy-to-grasp discussions. Expect to learn how to build a solid financial foundation, make informed decisions with your money, and set achievable goals.

2. Afford Anything

Best for: Achieving financial independence

Episode schedule: 1-2 episodes per week

Average episode length: 30-60 minutes

In the Afford Anything podcast, host Paula Pant explores the idea that you can “afford anything, but not everything” – not only for your money, but also your time, energy, and attention.² The show emphasizes the importance of intentional money choices and explores how to align daily habits and behaviors with the lifestyle we want to live.

While Afford Anything is primarily about money and investing, Paula frames these topics through the lens of psychology and critical thinking. Topics include financial independence and entrepreneurship to travel, productivity, and personal development.

If you want to understand how your thought patterns and cognitive biases inform your financial decisions, or as Paula says, “thinking about how to think,” this podcast is for you. Whether you’re a beginner or well-versed in finance, this podcast caters to anyone interested in leveling up their decision-making skills and financial literacy.

3. Journey to Launch

Best for: Millennials and Gen Z

Episode schedule: Weekly

Average episode length: 30-60 minutes

Journey to Launch is a finance podcast hosted by Jamila Souffrant, a Certified Financial Education Instructor (CFEI) dedicated to empowering others to achieve financial freedom. Its focus is millennials and Gen Zers who know what they want to achieve with their money but don’t necessarily know how to get there.

The podcast provides practical insights for achieving financial goals through solo episodes and expert guest interviews. It covers everything from budgeting and saving to debt management techniques, side hustle ideas, and even the psychological aspects of money management.

If you appreciate real-life success stories and want to learn from someone who has walked the path to financial freedom, you’re sure to enjoy Jamila’s point of view.

4. The Ramsey Show

Best for: Learning how to become debt-free

Episode schedule: Weekdays, 2-4 p.m. ET

Average episode length: 30-45 minutes

Once a one-hour radio segment at a struggling local station in 1992, The Ramsey Show is now a nationally syndicated radio show, podcast and YouTube channel hosted by personal finance expert Dave Ramsey.³ After battling his way out of bankruptcy and millions of dollars of debt, Dave uses his podcast to empower others to learn from his mistakes and turn even the worst financial situations around.

Best known for his no-nonsense approach to helping people take control of their finances, a primary focus of The Ramsey Show is becoming and remaining debt-free. You’ll also find many topics covered, including budgeting, tax basics, saving for emergencies, investing, and retirement planning.

The Ramsey show is formatted as a live call-in show, where Dave takes questions live from listeners to answer their questions about life and money. If you want to learn how to become debt-free and don’t know where to start, Dave’s simple, actionable steps can help you lay a solid foundation for money management.

5. Money For the Rest of Us

Best for: Beginner-friendly investing advice

Episode schedule: Wednesdays at noon ET

Average episode length: 30-45 minutes

If your goal is to become a more confident investor (or how to get started investing at all), Money for the Rest of Us is worth a listen. The host and former chief investment strategist, David Stein, believes no one should go about their investing journey alone. He created his podcast to be a community to share successes, failures, and lessons learned.

Money for the Rest of Us mainly covers investing topics, including investment strategies, asset allocation, risk management, and macroeconomic trends. David focuses on making investing approachable for anyone, simplifying the complex concepts he learned as an institutional investment advisor so you can take action.

If you want to better understand investing, economics, and personal finance without needing specialized knowledge or background in the field, this show is for you.

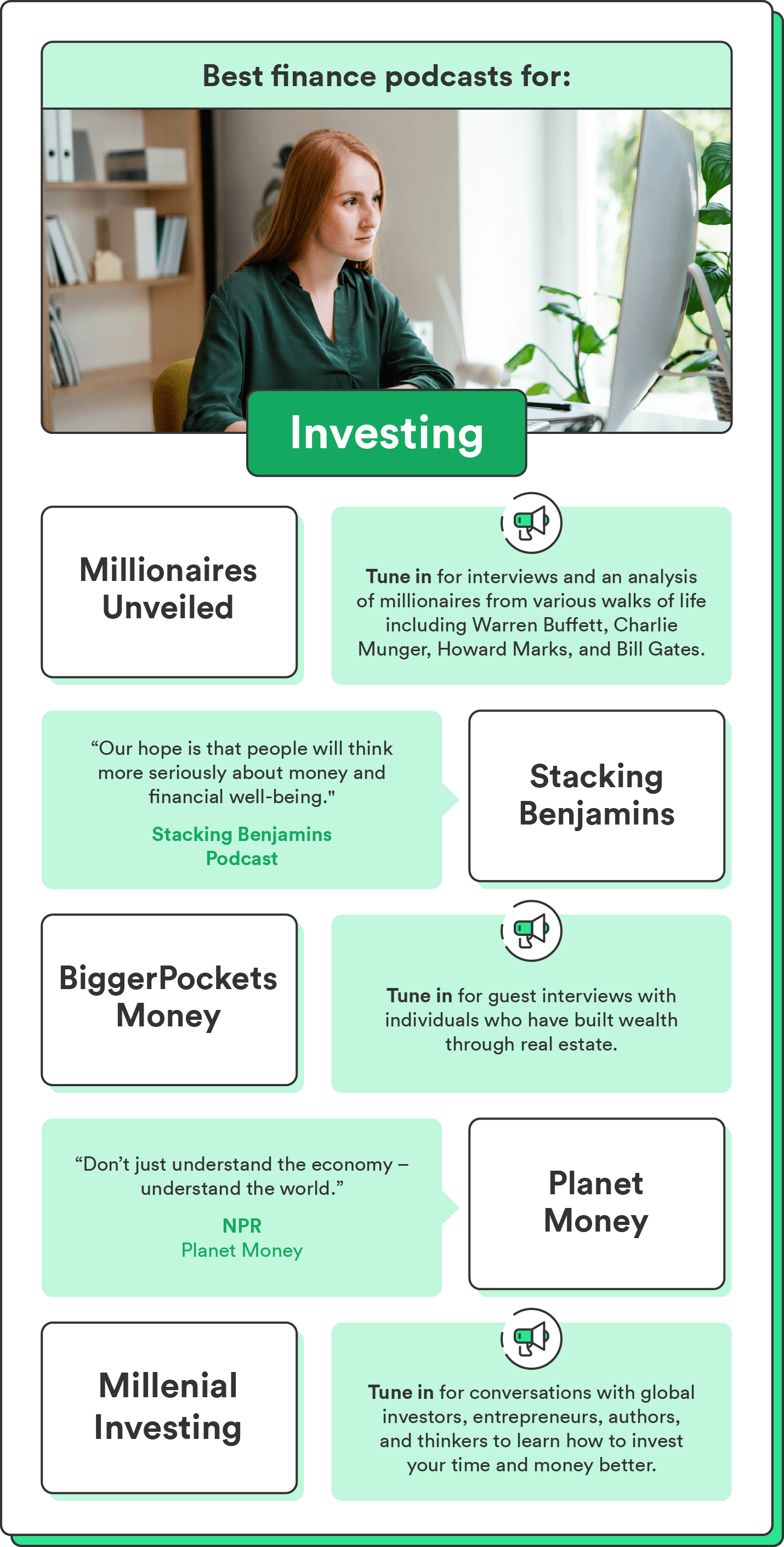

6. Millionaires Unveiled

Best for: Learning to build wealth

Episode schedule: Weekly

Average episode length: 45-60 minutes

Hosted by Jace Mattinson, CPA, Millionaires Unveiled was created out of the desire to learn how wealthy people invest. The podcast interviews millionaires from various walks of life and delves into their stories, strategies, and perspectives on building wealth. The podcast aims to uncover successful investors’ habits, decisions, and mindsets to help inform your financial decisions.

The podcast covers a wide range of financial topics, including strategies for saving, investing, entrepreneurship, real estate, and more. Each episode features a millionaire guest who shares their journey to achieving financial success. The podcast offers practical insights, inspiration, and advice for individuals aspiring to build wealth, whether just starting their journey or looking to refine their financial strategies.

7. Millennial Investing

Best for: Investors, specifically millennials

Episode schedule: Every 3-4 days

Average episode length: 60 minutes

Millennial Investing is hosted by Robert Leonard, Patrick Donley, and Kyle Grieve. On the show, they have conversations with global investors, entrepreneurs, authors, and thinkers to discover their ideas, strategies, and personal experiences about investing so listeners can learn how to invest their time and money better.

The podcast is a practical resource for budding investors venturing into wealth building and is tailored for millennials. Millennial Investing spans various topics, including an entrepreneur’s investment criteria and a business owner’s insights on navigating inflation.

8. BiggerPockets Money

Best for: Real estate basics

Episode schedule: Every Monday and Friday

Average episode length: 45 minutes

BiggerPockets Money is a podcast focused on personal finance and achieving financial independence through real estate investing. It’s a spinoff of the popular real estate investing podcast BiggerPockets, but BiggerPockets Money specifically delves into the financial aspects of real estate investment and other money-related topics. The hosts, Mindy Jensen and Scott Trench, have extensive experience in real estate and personal finance.

The podcast covers budgeting, saving, investing, debt reduction, retirement planning, and, most prominently, real estate investing. Episodes often feature guest interviews with individuals who have successfully built wealth through real estate and other investment strategies. If you want to learn the basics of personal finance and real estate, this show can help you get there.

9. Stacking Benjamins

Best for: Investing advice with a touch of humor

Episode schedule: 1-2 episodes per week

Average episode length: 60-90 minutes

Stacking Benjamins is hosted by Joe Saul-Sehy, a former financial advisor, and his co-host who goes by the moniker “OG,” short for “Other Guy.” With nearly 700 episodes, this fun podcast is about money for people who want to build generational wealth.

In each episode, the hosts dive into various financial subjects, including budgeting, investing strategies, retirement planning, managing debt, and understanding complex financial concepts. The podcast often features guest experts and industry professionals who share their expertise and insights. The hosts incorporate entertaining segments, listener questions, and quirky anecdotes, making the show informative and enjoyable.

10. Planet Money

Best for: Economics basics

Episode schedule: Every 2-3 days

Average episode length: 30 minutes

Planet Money is a podcast and blog produced by National Public Radio (NPR) that focuses on making economics and financial concepts accessible and engaging to a broad audience. The podcast hosts various speakers and contributors to help explain what’s going on in the economy, often delving into how these concepts shape our everyday lives and the world around us.

The podcast first launched in response to the 2008 financial crisis to explain the economy’s current status in a more digestible way. Today, the podcast addresses and clarifies the evolving economy in bite-sized episodes. Whether you’re interested in financial markets, the impact of policies, or the quirky stories behind how the economy impacts daily life, Planet Money is a valuable resource for economic education and exploration.

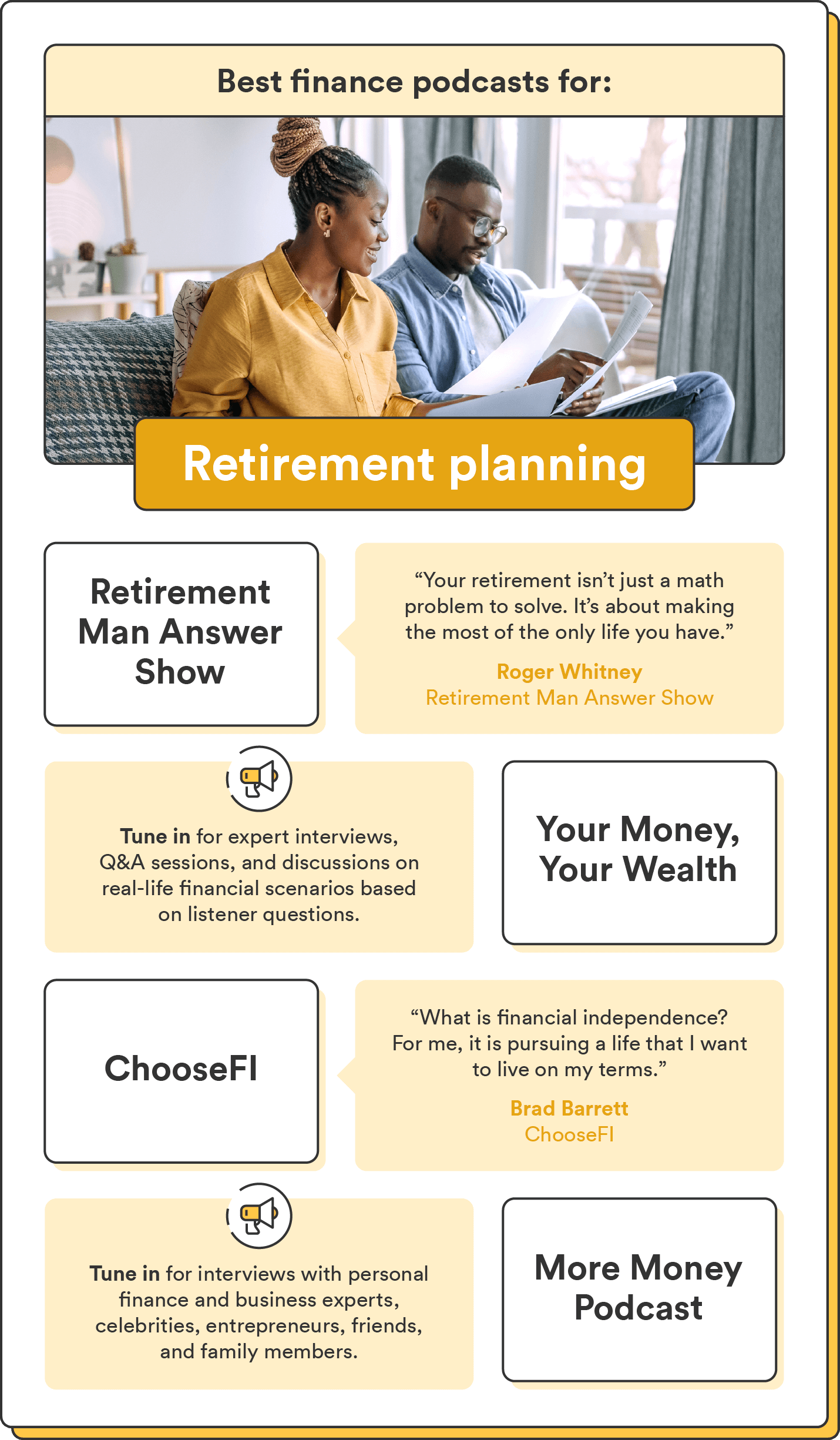

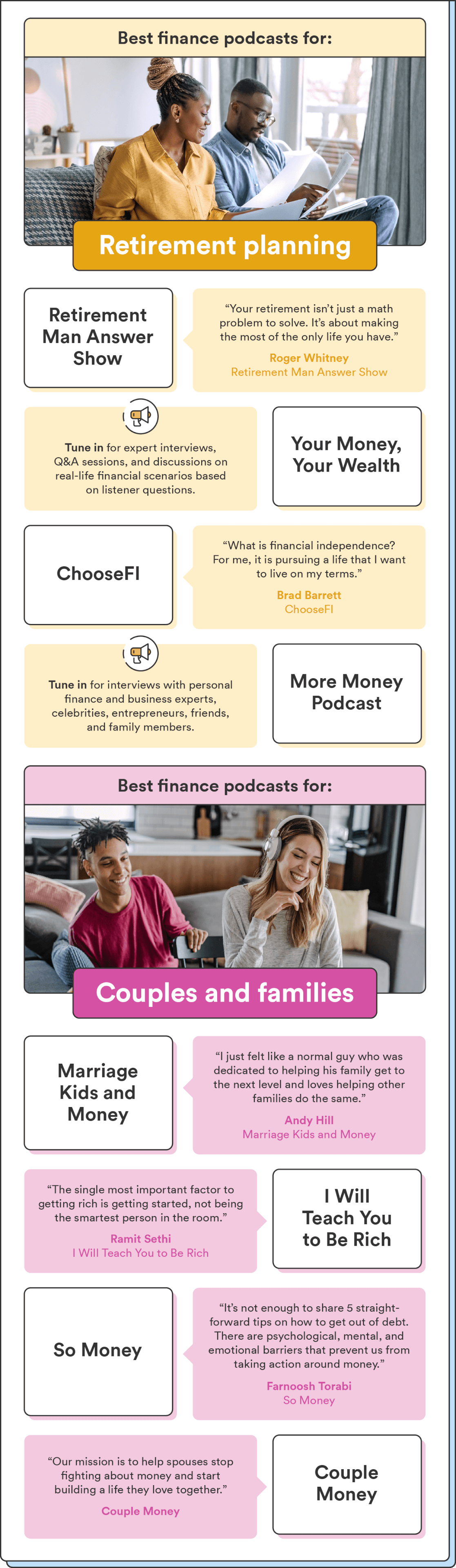

11. Retirement Man Answer Show

Best for: Holistic retirement planning

Episode schedule: Weekly

Average episode length: 45-60 minutes

The Retirement Man Answer Show is a podcast hosted by Roger Whitney, a certified financial planner dedicated to helping others build an enjoyable retirement. In his show, Roger offers a holistic approach to retirement planning – he explains how things like investment options, insurance, IRAs, Social Security, and taxes work and emphasizes aligning retirement strategies with the context of your life and goals.

Each episode includes a “listener questions” segment where Roger answers real-life questions from listeners about various retirement planning topics, from optimizing your income taxes to understanding retirement withdrawal strategies. If you’re after actionable guidance on creating a solid retirement plan, The Retirement Man Answer Show has you covered.

12. ChooseFI

Best for: Learning F.I.R.E (financial independence, retire early)

Episode schedule: Every Sunday

Average episode length: 40-60 minutes

ChooseFi is a popular finance podcast hosted by Brad Barrett and Jonathan Mendonsa and is dedicated to helping listeners achieve financial independence. The podcast explores the concept of “financial independence, retire early” (F.I.R.E) and provides practical strategies for reducing expenses, increasing income, and building wealth to achieve early retirement or greater financial flexibility.

On the show, Jonathan and Brad share their own experiences and invite guests to discuss various topics related to personal finance, from frugality and lifestyle design to building passive income streams through online businesses or real estate. While the show covers a broad range of topics, each discussion is rooted in teaching strategies to speed up financial independence.

13. Your Money, Your Wealth

Best for: Retirement planning and tax reduction

Episode schedule: Every Tuesday

Average episode length: 30-45 minutes

Hosted by Financial advisor Joe Anderson, CFP® and certified public accountant Alan Clopine, CPA, Your Money, Your Wealth teaches you practical insights and strategies to help you retire successfully. The show is a mix of expert interviews, Q&A sessions, and discussions on real-life financial scenarios based on listener questions.

Your Money, Your Wealth covers all things retirement planning, investing, and tax reduction with a touch of fun and humor. Expect to learn about retirement income and wealth management, investment portfolio diversification, and tax-efficient planning. The podcast emphasizes the importance of making financial decisions based on long-term goals and provides practical tips for achieving financial security.

14. More Money Podcast

Best for: Financial literacy basics

Episode schedule: Every Monday

Average episode length: 60 minutes

Jessica Moorhouse is a financial counselor who takes a fresh approach to personal finance. In the More Money Podcast, Moorhouse interviews personal finance and business experts, celebrities, entrepreneurs, friends, and even family members.

Episodes focus on better managing your money, becoming debt-free, and building wealth. While these are the primary topics covered on the show, there are also episodes discussing things like no-spending challenges, how to work abroad, and how to turn your side hustle into a main hustle.

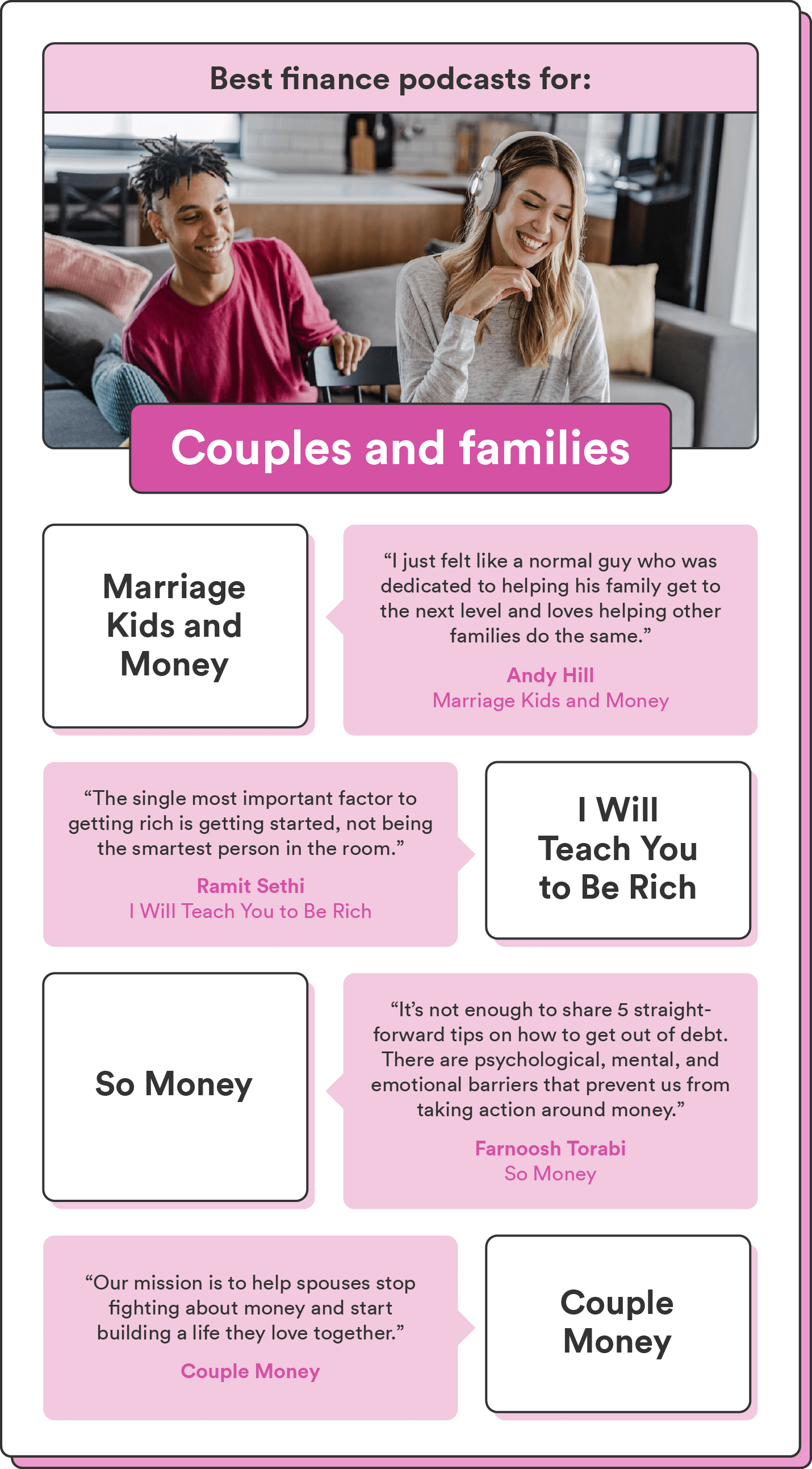

15. Marriage Kids and Money

Best for: Young families and married couples

Episode schedule: Weekly

Average episode length: 30-45 minutes

Hosted by Andy Hill, Marriage Kids and Money explores the intersection of family, marriage, and personal finance. With a focus on helping couples and parents navigate financial challenges, the podcast covers various money-related topics to support families in achieving their financial goals. The show provides practical insights, relatable stories, and expert interviews to guide listeners on their journey to financial success while managing family life.

Andy interviews various guests, from personal finance experts to financially independent couples, to discuss how they achieved their success. Then, he breaks down their answers into key takeaways that you can apply to your own life. The podcast addresses common financial dilemmas that parents and couples face and offers tips for open communication about money, aligning financial goals, and planning for a secure future.

16. I Will Teach You to Be Rich

Best for: Couples

Episode schedule: Weekly

Average episode length: 60 minutes

Hosted by renowned personal finance expert Ramit Sethi, I Will Teach You to Be Rich is a podcast that focuses on providing couples with practical strategies for achieving financial success and living a rich life. The podcast aims to empower listeners with the knowledge and tools they need to take control of their finances and build a life they love.

Ramit’s approach is grounded in actionable advice that covers various aspects of personal finance, from automating finances and negotiating salary increases to investing and entrepreneurship. Each week, Ramit interviews real couples who share their honest financial struggles. He aims to get to the heart of the matter by going beyond the numbers and exploring the psychology behind finances.

Above all, Ramit emphasizes the importance of living a rich life beyond financial success, encouraging listeners to invest in experiences, travel, and personal growth.

17. So Money

Best for: Couples seeking personal and professional financial growth

Episode schedule: Every 2-3 days

Average episode length: 20-40 minutes

Hosted by financial strategist, TV host, and bestselling author Farnoosh Torabi, So Money is a dynamic podcast that delves into the realm of personal finance, career growth, and finances in marriage or relationships.

Farnoosh interviews a diverse range of guests, from personal finance thought leaders and to bestselling authors and entrepreneurs. She covers topics like budgeting and saving, investing, managing family finances, and achieving work-life balance to avoid burnout. Her engaging interview style presents complex financial concepts in an approachable way.

18. Couple Money

Best for: Couples navigating shared finances

Episode schedule: Weekly

Average episode length: 20-30 minutes

Elle Martinez created the Couple Money Podcast to help couples navigate the intricacies of co-managing finances. The podcast addresses the unique challenges and opportunities when combining financial lives as a couple. The podcast provides practical strategies for achieving financial harmony and shared goals through insightful discussions, expert interviews, and relatable stories.

Elle covers various financial topics specifically for couples, including budgeting as a team, opening joint accounts, managing debt collaboratively, and optimizing joint investments. Expect to learn how to openly communicate about money, address financial disagreements, and find common ground in financial decision-making.

Fuel financial growth with the best finance podcasts

Listening to your favorite top finance podcasts can help you feel more confident about your finances and the decisions you make with your money. The right tools and budgeting apps can also help you gain financial confidence.

Mastering your money is a marathon, not a sprint, so be patient with yourself, work with what you have, and watch your success slowly but surely compound over time!

Read our deep dive on financial literacy to learn more about mastering your finances.

Log in

Log in