The deadline to file 2024 taxes is April 15, 2025.¹ There’s no time like the present to get organized and make some decisions regarding your 2024 taxes. This way, you can avoid filing your taxes online at the last minute.

Learn how to file taxes online quickly and easily and take the headache out of tax season.

How to do taxes: Best tips

Taxes are no one’s idea of fun. A recent Chime survey about financial literacy found that 25% of respondents would rather do homework than file taxes, while others would rather dissect a frog or take a calculus exam.

It’s no secret that filing taxes may be something you’re putting off or not looking forward to. But filing your taxes late can get you in hot water with the IRS. These tips will prepare you to file your taxes on time and accurately.

Gather your tax forms and documents

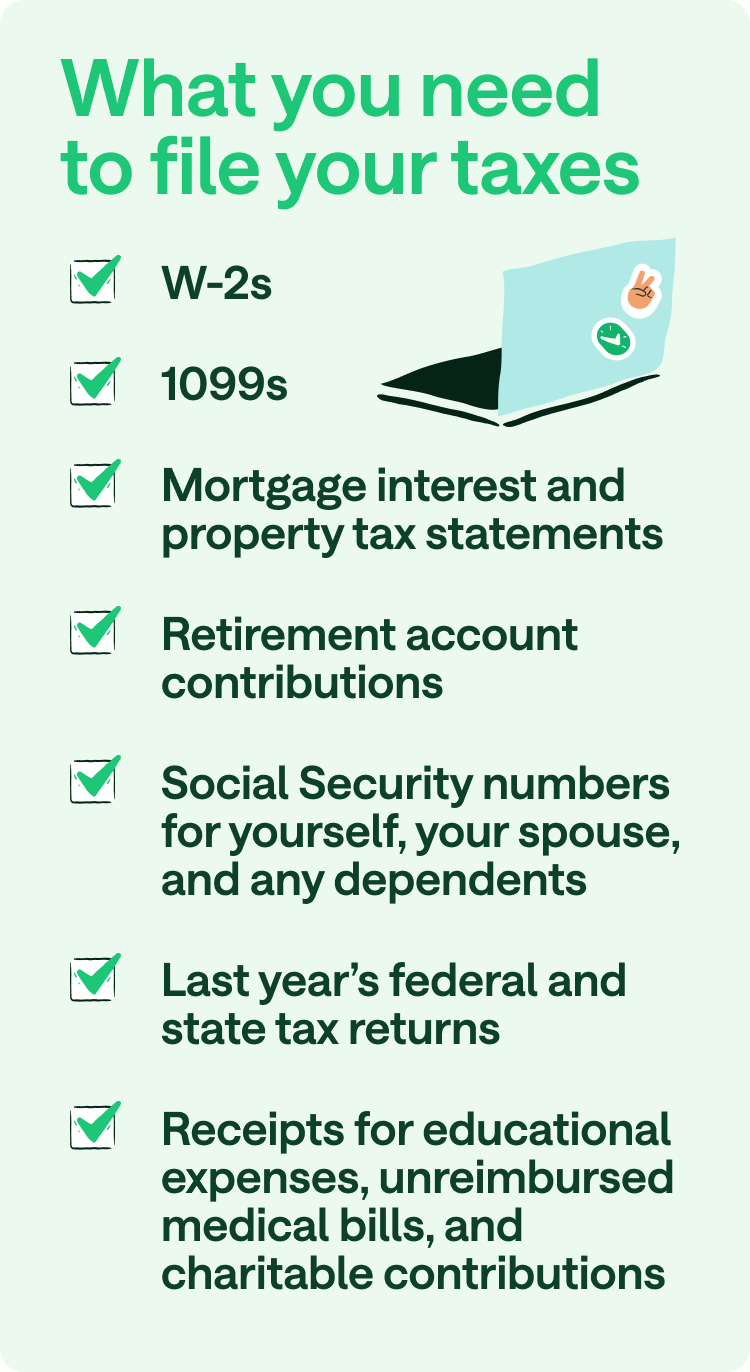

There are several tax documents you’ll need to fill out to file your taxes. While the exact documents and forms required can vary depending on your situation, you’ll generally need at least the following:

- W-2s for any job you worked as an employee.

- 1099s for other income, like money earned as an independent contractor, interest from a bank account, or capital gains from a house sale.

- Mortgage interest and property tax statements.

- Retirement account contributions.

- Social Security numbers for yourself, your spouse, and any dependents.

- Last year’s federal and state tax returns.

- Receipts for educational expenses, unreimbursed medical bills, and charitable contributions, if applicable.

Write down 2025 tax dates

When filing your 2024 taxes in 2025, pay attention to two key dates: January 31, 2025 (the due date for your employer to send your tax forms) and April 15, 2025 (the filing deadline).¹

| Jan. 31, 2025 | The due date for employers to send out W-2 forms and for certain 1099 forms to be sent to you (like if you’re an independent contractor or are self-employed). |

|---|---|

| April 15, 2025 | The deadline for filing 2024 taxes for individuals. |

| April 15, 2025 | The deadline for individuals to request a tax extension. |

| June 16, 2025 | The deadline for filing 2024 taxes for U.S. citizens or residents living abroad.¹ |

Choose between standard and itemized deductions

Take time to understand how tax deductions work since they can lower your taxable income and potentially give you a larger refund or a lower tax bill. When you file your taxes, you’ll have two options: Take the standard deduction or itemize your deductions.

- Standard deduction: If you have a 9-to-5 job and receive a W-2, you may be able to take the standard deduction. For filing 2024 taxes, the standard deduction for individuals is $14,600 and $29,200 for married people filing jointly.²

- Itemized deductions: If itemizing all the deductions you qualify for allows you to deduct above $14,600 (filing single) or $29,200 (filing jointly), you should itemize. Most tax preparation software and accountants can find the better option for you.

In general, you might want to consider itemizing deductions if you own property, run a small business, have major out-of-pocket medical expenses, or made considerable contributions to charity in 2024.

Chime tip: If you are married, both you and your spouse will need to take either the standard deduction or itemize deductions, even if you choose married, filing separately.³

File early and sign up for direct deposit

The sooner you file your taxes, the sooner you’ll get your refund – which could mean more money in your savings account. If you want your cash as fast as possible, set up direct deposit – it’s a safe and easy way to get your funds.

When filing electronically, you can set up direct deposit with the IRS to have your tax refund deposited directly to your account.

Tax return online vs. traditional methods

In the past, filing taxes involved filling out forms by hand and mailing your return to the IRS. However, the internet makes filing much quicker and more accessible, and you may find it the more convenient option. E-filing also removes the risk of your tax return getting lost in the mail since the forms are delivered electronically to the IRS.

Filing online is a more sustainable option since you won’t need to use paper and mailing envelopes to file. It also reduces the need for physical storage systems to organize paper tax documents.

Filing your taxes online may cost you money if you file through a tax preparer or use tax software, making paper filing more attractive for some.

Chime members will be able to file their taxes for free through the Chime app – there’s no fee for state or federal tax return filing.† You will be able to file your taxes through Chime starting in January 2025.

Common tax mistakes to avoid

Several common tax mistakes can lead to issues with your tax return. You can avoid most of them by slowing down and double-checking your inputs as you go.

Forgetting to sign and date

One common error is forgetting to sign and date your tax return. Without a valid signature, your return may not be considered filed.

To avoid this mistake, double-check that you’ve signed and dated where required before submitting your return.

Incorrect information

When you file your tax return, your name must be spelled the same way it’s spelled on your Social Security card.

Your Social Security number must be entered correctly, as must information on your wages and other income received. If any of the information on your return is inaccurate, you may face delays and other issues.

Missing deductions and credits

Another frequent mistake is missing out on eligible deductions and credits that could reduce your tax liability. To avoid this, review the IRS’s tax deductions and credits list.

Keep records of your expenses, and consider consulting a tax professional who can identify all potential deductions and credits that apply to your situation.

Missing write-offs

If you itemize your deductions, make sure you include all write-offs that you’re eligible for. Missing write-offs can lead to paying more taxes to the IRS than you need to.

Faulty math

If you don’t calculate your tax liability correctly, you may owe the IRS more than you pay. This, in turn, can lead to penalties if you don’t realize your mistake until after the filing deadline.

Before submitting, double- and triple-check your math.

Selecting the wrong filing status

Selecting the wrong filing status can affect your tax liability. To avoid this mistake, review the IRS guidelines on filing status and choose the one that best matches your circumstances.

Filing late

Filing your taxes late can result in penalties and interest charges. Note the tax filing deadline and ensure you file your return on time. If you need more time, consider requesting an extension. Just remember that this extends the time you have to file, not the amount of time you have to pay any taxes owed.

Not reporting all income

Failing to report all your sources of income is a significant error that can lead to IRS inquiries or a tax audit. Make sure you keep accurate records of all income sources. This includes income earned from freelance or gig work, investments, and bank accounts that earn interest (like a high-yield savings account).

When you’re ready to file, double-check that you’ve included all income on your tax return before submitting it.

File your taxes through Chime

Starting in January 2025, you can file your federal and state taxes through the Chime app completely free.~ Direct deposit your federal tax refund with Chime and you can receive your refund up to six days early.^ Maximum refund is guaranteed,* so you won’t need to worry about settling for less than what you are owed.

Learn the definitions of 25 tax terms to demystify the tax-filing process.

FAQs

Is it hard to file your own taxes?

Filing your own taxes online can be straightforward, especially if you use a free online option to complete the forms. However, if you have investments, own a home, or have complex finances, consider seeking the advice of a tax professional who can help you get the correct credits and deductions.

What if I made a mistake on my online tax return?

If you realize you made an error on your online tax return after filing, you can usually amend it by filing an amended return (Form 1040-X). Correcting the mistake as soon as possible can help avoid any potential issues with the IRS.

How do I check the status of my online tax return?

To check the status of your online tax return and refund, you can use the “Where’s My Refund?” tool on the IRS website. You’ll need your Social Security number, filing status, and the exact refund amount to access this information.

How long does it take to receive my tax refund when filing online?

The processing time for tax refunds can vary, but if you file your return online and request direct deposit, you can often expect to receive your refund within 21 days.⁴ However, this timeline may change depending on the IRS’s workload and any issues with your return.

What happens if I miss the tax filing deadline when filing online?

Missing the tax filing deadline can lead to penalties and interest charges on any taxes owed. If you can’t file by the deadline, you should file an extension through the IRS. This gives you additional time to file your return without any late penalties.

Log in

Log in