At Chime, we keep trust and safety top of mind. Our members come first, which is why we offer them features like two-factor authentication and real-time transaction alerts – so they can manage their finances with peace of mind.

Even though we work tirelessly to protect our members, scammers are common and use old-fashioned tactics to try to access information that isn’t theirs. Being proactive, safeguarding your accounts, and understanding common Chime money scams will help you steer clear of threats and be your own strongest line of defense.

Social media scams

Scammers love to use social media for their own gain. Here are types of scams you might see across social platforms.

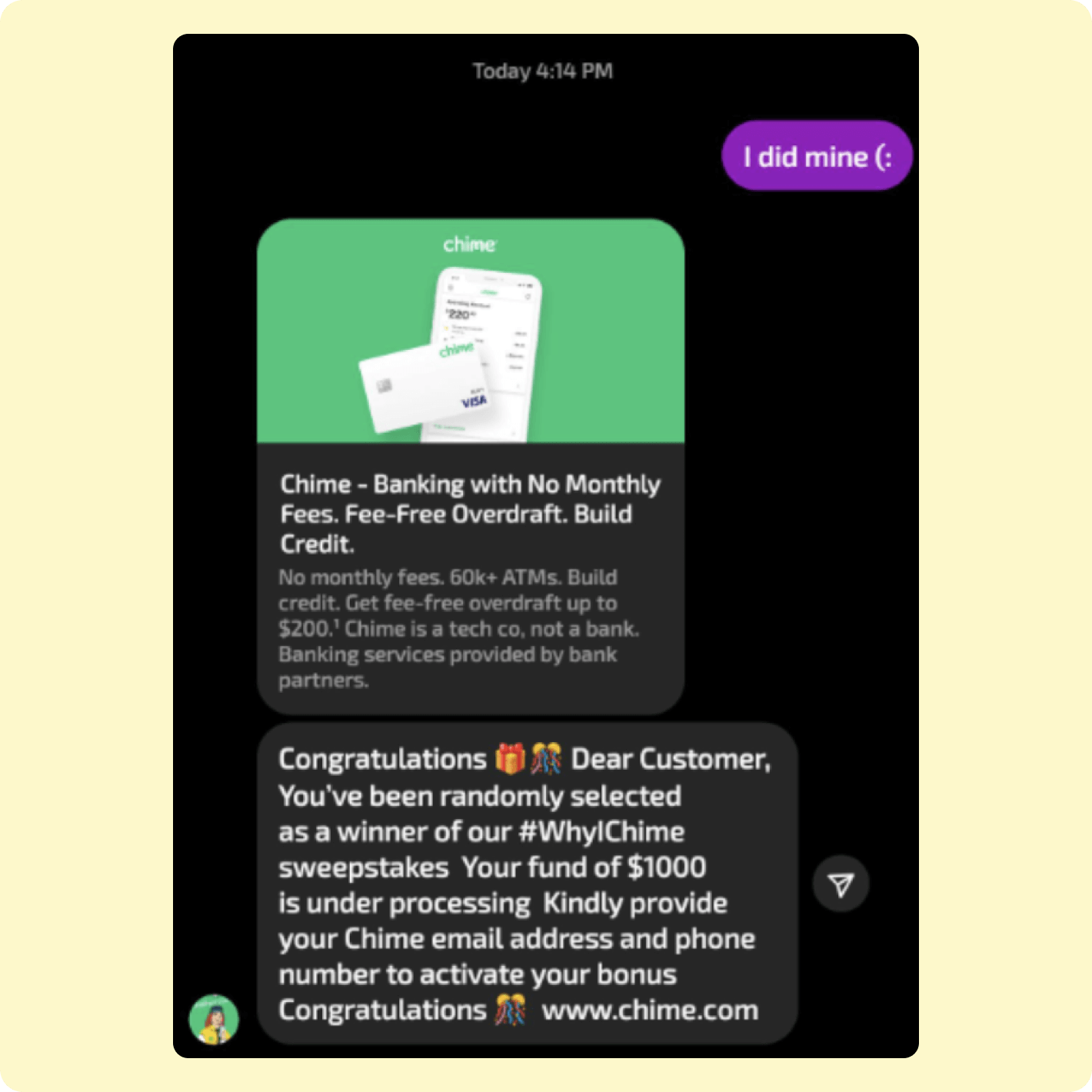

Sweepstakes scams

Who doesn’t love winning freebies? It’s a universal joy. Fraudsters know this, often exploiting people’s love for free prizes to gain personal information in return.

If you win a Chime sweepstakes, you’ll automatically see your winnings in your Chime account if you’re a Chime member. Non-members can still win, but we will ask you to take additional steps like opening a Chime account. Some Chime sweepstakes have non-monetary prizes that require email or other verification, and some of our sweepstakes require you to enter through 3rd-party apps like TikTok.

Be suspicious of any “You’ve won!” notifications received via social media that prompt you to verify your email, log into third-party platforms, or disclose sensitive details like your address or password. Always make sure you are speaking to official Chime accounts and email addresses.

Also, watch out for claims of a “Chime glitch” where scammers falsely claim that Chime is giving away money – that’s another red flag!

Remember: Chime’s social media handles are all verified. You can identify us by the handle @Chime or @ChimeHelps. Authentic Chime sweepstakes or promotions are exclusively advertised across our official social media platforms.

Second-party fraud

Second-party fraud is another scam method to watch out for. Unlike traditional identity theft, second-party fraud involves willing participation, where individuals provide personal financial information (PII) to fraudsters for illegal activities.

That could include selling personal details for account access, money laundering, or fraudulent loans, with criminals often enticing victims with promises of easy money through social media platforms.

Participation in second-party fraud can lead to legal and financial consequences, which is why it’s so important to know the most common scam tactics and immediately report suspicious messages.

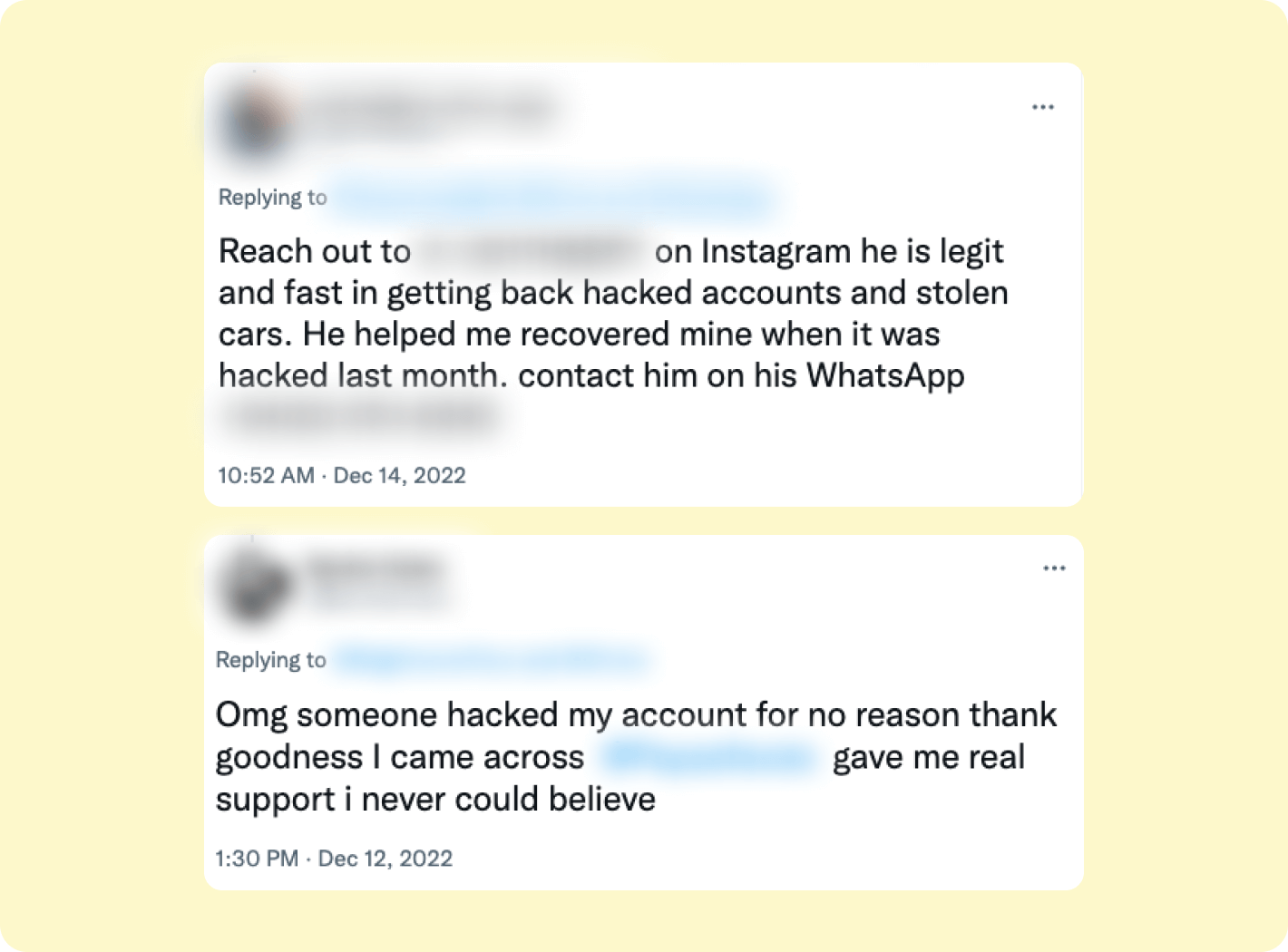

Fake customer support scams

We wish scammers would stop mimicking Chime online through fake profiles, websites, and emails, often soliciting personal information from unsuspecting followers under the guise of customer support. But, they persist – the more you know, the better!

These scammers redirect users to scam accounts, asking for sensitive details like usernames, passwords, and Social Security numbers. Again, only trust our verified social accounts with the @Chime handle or @ChimeHelps handle and our customer support team, available 24/7 through live chat or phone for assistance. Visit our homepage and click the social media icons at the bottom to be sure.

Most of the time, email communication from Chime will come from an email address ending in @chime.com. Avoid clicking on non-Chime links, and contact us through official channels to steer clear of scams. And just to note, we do not have Chime customer service “ambassadors” or “representatives” on social media who speak on our behalf.

Chime tip: contact @ChimeHelps to avoid customer support scams

Our @ChimeHelps handle on X (formerly Twitter) gives our members a centralized and trustworthy spot to get customer service questions answered. With our verified handle, you can trust that you’re speaking to a real Chime team member.

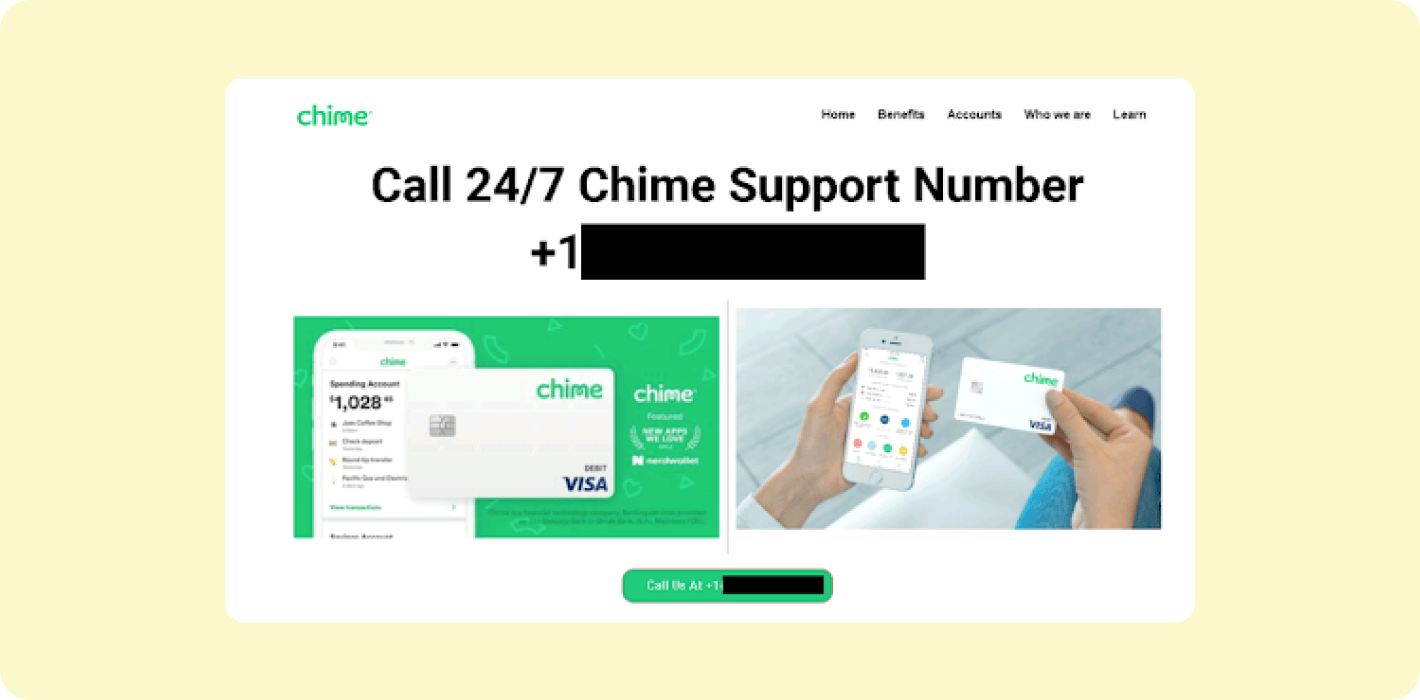

Search engine ad scams

Yes, even ads are a part of the scammer’s playbook. When you search for Chime – or other financial services-related information online, you might see sponsored ads that look like Chime ads. In reality, these could be sponsored ads that impersonate Chime and other brands, often sending users to sites asking for sensitive data, offering fake contact information, or even infecting visitors’ devices with malware.

But you can spot them! Just channel your inner Sherlock Holmes when searching Chime-related information online and know that the real Chime service phone number is 1-844-244-6363. Keep in mind, Chime team members will never ask you to download apps or send money through Pay Anyone, so watch out for any ads suggesting this.

If you’re still unsure, just call the contact number provided on the back of your Chime card or hop into the Chime app for questions.

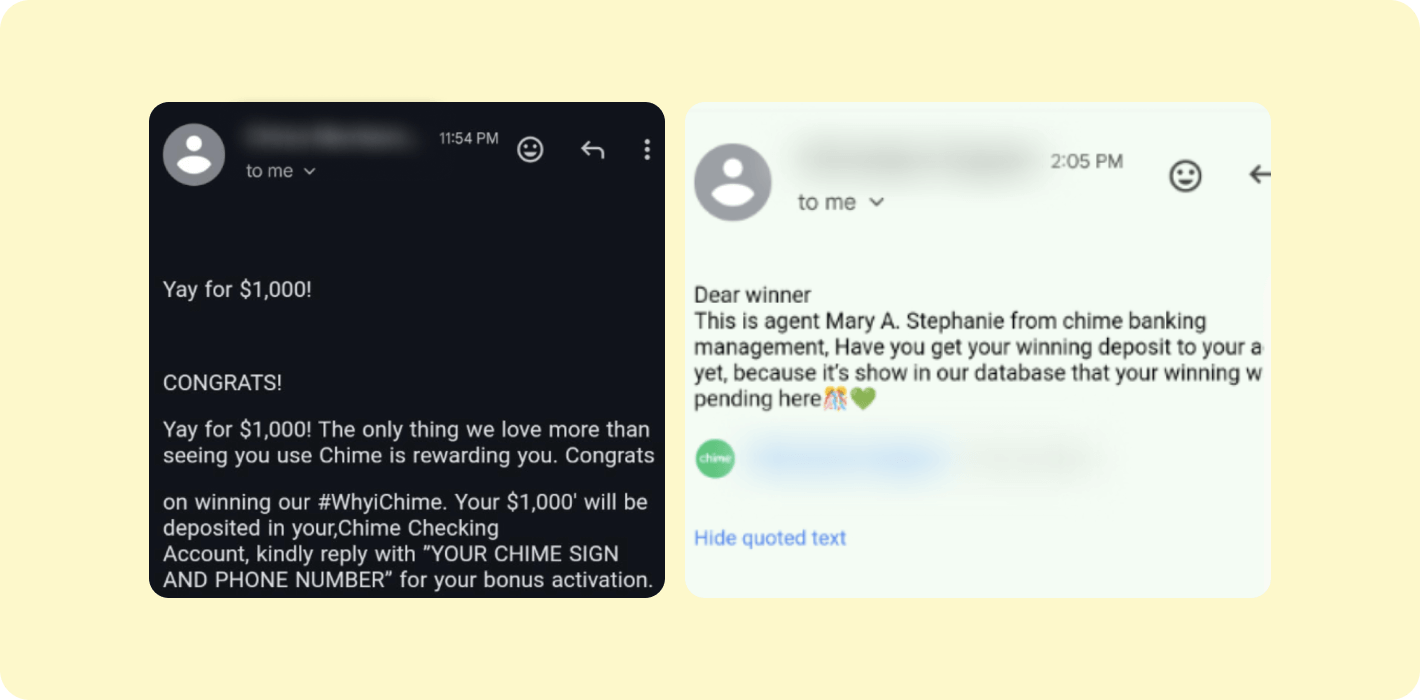

Email scams

Scammers love email. Much like social media scams, they’ll reach out to Chime members from a highly suspicious email about anything from “late” payments to fake prizes or rewards you need to claim.

You may receive the run-of-the-mill phishing scam email, in which the criminal claims something is wrong with your account and asks for personal and sensitive information to resolve it.

But we know how to recognize what’s real and what isn’t. Always check the sender’s email address for any inconsistencies or unfamiliar domains. Typically, the email address will have an odd series of letters or numbers, and the sender will express urgent requests for personal information or financial transactions. They may even get pushy, threatening repercussions for non-compliance. Push back – by blocking and reporting it as phishing.

Remember, Chime will never ask for sensitive information via email. If you are completing an action like updating your name, we might ask for documents verifying certain information through email, and you would upload these via protected cloud links.

When in doubt, verify the authenticity of the email through official channels (like our verified social or through the app), or directly contact Chime’s support team.

Phone and text scams

Another classic: phone scams. Scammers still pick up the phone to call or text Chime members and might claim there’s been fishy or unauthorized transactions on their account. In order to get your “new card,” they have to verify your account details.

Whether over the phone or via text, scammers may pose as a Chime member services agent and request personal information or try to have you download an app that gives them access. Well, not this time! You’ll be ready to block, report, and move on.

If some form of fraud or risk is suspected on a Chime member’s account, here’s what really happens:

- The transaction might be declined.

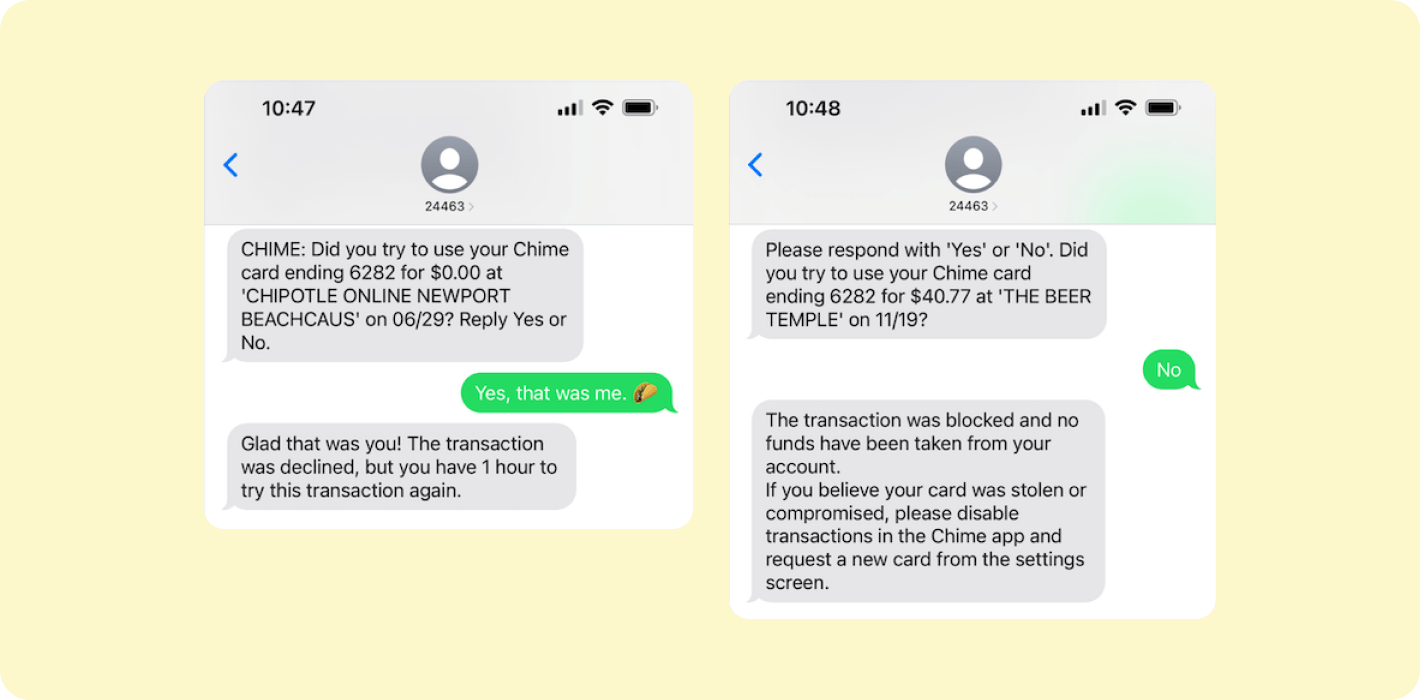

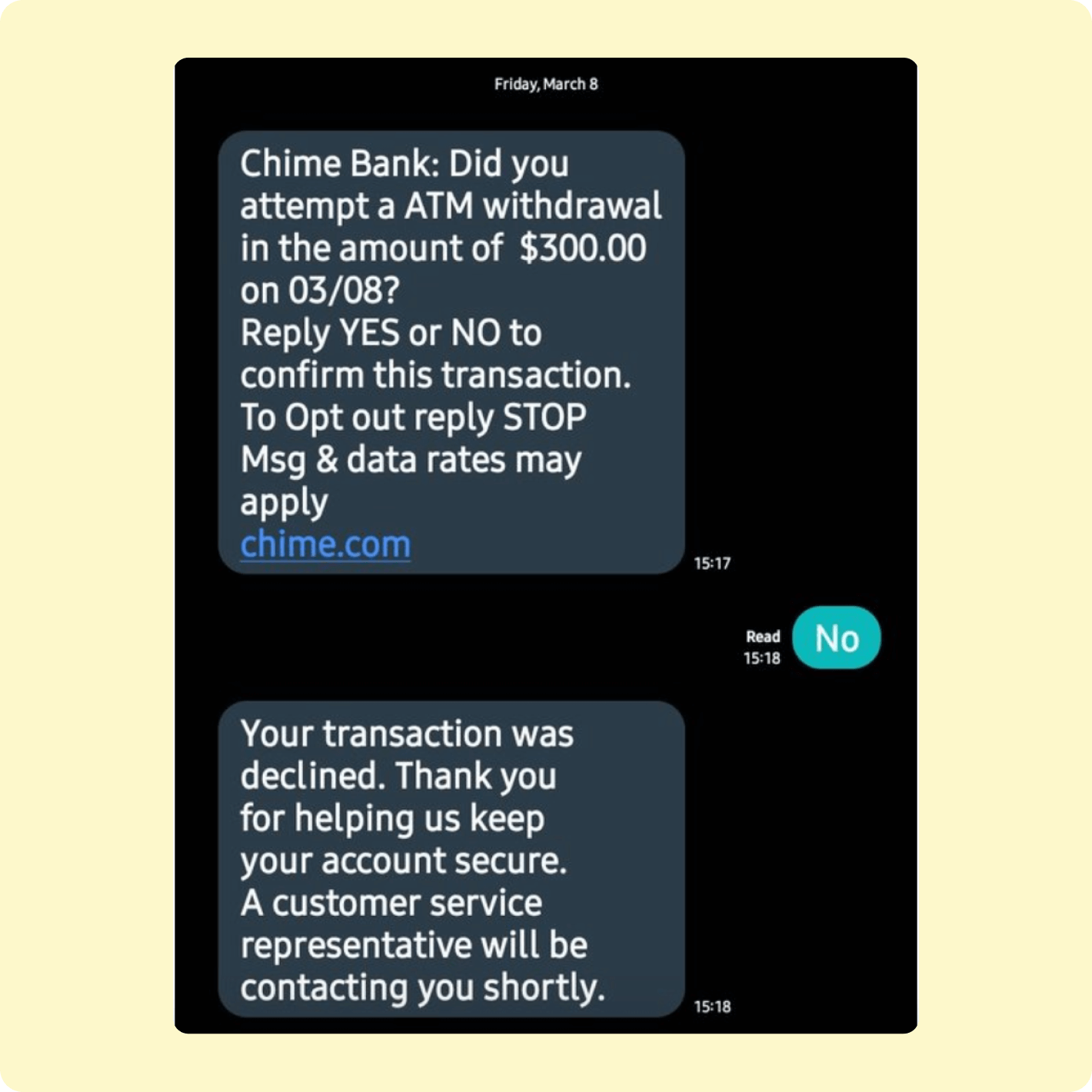

- Chime might send an SMS text to the member to confirm the transaction, but it will read something like this: “Did you try to use your Chime card ending [LAST 4] for $[AMOUNT] at [MERCHANT] on [DATE]? Reply Yes or No.”

- If you reply “YES”, Chime asks you to retry the transaction and unlocks your card for one hour. If you reply “NO”, or don’t reply at all, Chime continues to decline transactions, and you are told to reach out to Chime to replace your card. Not the other way around.

- If your card is declined due to insufficient funds or another reason, you’ll receive an official Chime push notification or email (depending on your settings) about why your card was declined.

Keep an eye out for SMS messages using fake names like “Chime Bank” or “Chime Bancorp” and scammy follow-up calls too, pretending to be from “Chime Banking.” See examples below. Remember, Chime is not a bank, so the word “bank” is a big red flag.

You could very rarely receive a call from Chime. We do have options to schedule a call back when receiving support in-app. However, you won’t receive surprise phone calls from Chime urging you to send funds through a service like Pay Anyone or share sensitive information like your Social Security number.

Payment service scams

Payment services and digital wallets are often the go-to method of payment for many people today – and scammers see them as a new avenue to exploit.

Common peer-to-peer (P2P) scam tactics include requesting information or even money transfers through mobile payment apps like Venmo, Zelle, or Chime’s Pay Anyone. You may see other attempts that claim you’ve won a prize and need to pay a fee to claim your earnings, or that you owe taxes to the IRS. They might claim they’re from IT support and need money to “fix your computer.”

Then, there are romance scams, in which someone tries to lure you into a fake relationship online and starts requesting money transfers through one of these apps.

Only use mobile payment apps like Chime’s Pay Anyone to send money to trusted friends and family members. These apps are meant to make it easier for you to send money to people you already know and trust – not strangers.

And lastly, Chime will never request that members send us funds through Pay Anyone under any circumstances, including to fund a new account. End of story, case closed!

Chime’s scam prevention list

- Never write any identifying information, especially your PIN, on your debit card.

- Never share your personal information, including your account number, username, password, or Social Security number (including the last 4 digits), or the last 4 digits of your payment card with strangers or on unsecured websites.

- Enable additional security features, like a PIN or passcode, biometric authentication (thumbprint or facial recognition), or other multi-factor authentication on your smartphone and/or P2P payment apps.

- Enable push notifications in the Chime app so you’re immediately alerted of suspicious activity.

- When you’re not planning to use your card, you can even block all debit and Credit Builder card transactions; all it takes is a quick toggle in the Chime app.

- Watch out for increased scammer activity during the holidays and tax season.

- If you think your information has been compromised, change your password immediately.

- If you think you’ve been a victim of a scam, we’ve outlined a few steps you should take to protect yourself.

How to report suspected scams and fraud to Chime

Although we strive to shut down fake accounts as quickly as possible, new ones continue to appear. We encourage you to guard your personal information carefully – and if you see a scam, let us know ASAP.

You can report suspected scams by contacting us directly through live chat, phone, or social media with the @Chime or @ChimeHelps handle.

Stay informed, stay sharp, stay protected!

While we do everything we can to combat scammers and uphold security measures for our members, always remain vigilant. Rest assured that Chime will never proactively reach out to you via phone, email, or text to request personal information or passwords. If any questions or concerns come up, reach out to Chime directly for assistance. Together, let’s stay several steps ahead of fraudsters and keep your finances protected!

Gain more peace of mind about the safety of the money in your account by taking a deep dive into deposit security.

FAQs

How do you know if a sweepstakes is real?

If you win legitimate sweepstakes from a sponsor, you’ll likely be notified by the company directly and should never be asked to pay service fees to participate or win a prize. Charges of any kind are sure signs of a scam. Also important to note: government agencies are not involved in sweepstakes of any kind.

Why did I get a message from Chime?

Chime might send you an SMS text to authenticate you or in the case of suspected fraud. You may text messages to authenticate you if you already reached out to support yourself. We will only ever ask you to provide this code to an agent when you reach out to us. We will never proactively reach out to members and ask you for a code, and such messages could be scams.

Is Chime.com a scam?

No! Chime.com is not a scam. You can visit our official website at www.chime.com. However, you should always check the URL when online, and only trust the verified Chime social accounts with the @Chime or @ChimeHelps handle.

Log in

Log in