Refinancing a loan, whether a personal loan or mortgage loan, is when you replace your current loan with a new one that ideally has better terms. It’s a way to secure a lower interest rate and make loan payments more manageable. Here’s everything to know about how to refinance a loan and whether or not you should.

What does it mean to refinance a loan?

Refinancing a loan is just replacing your current loan with a different one. Depending on your situation, it may allow you to make your loan payments more manageable or provide a more flexible repayment timeline. Ideally, your new loan pays off your old one and leaves you with a better rate.

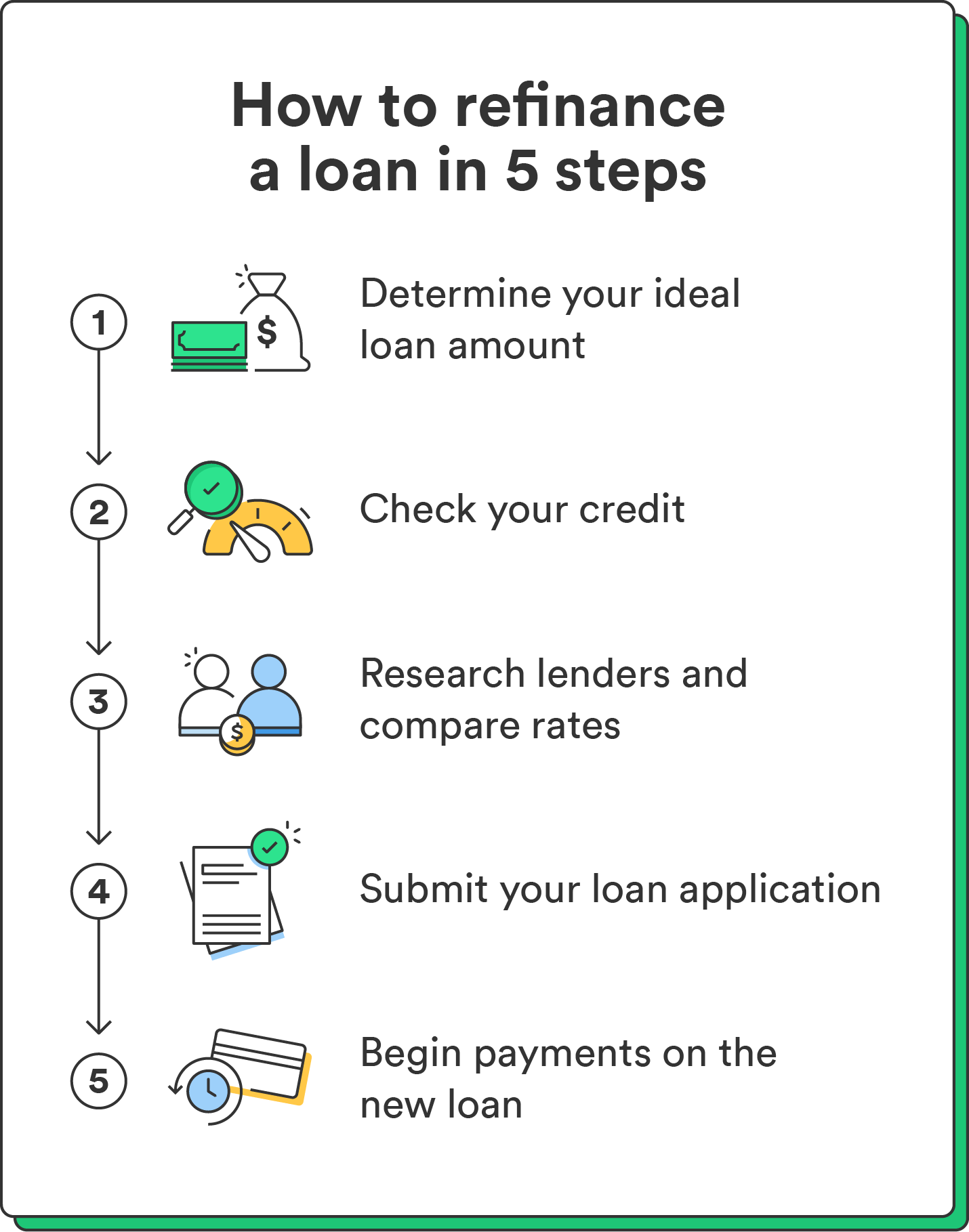

5 steps to refinance a loan

Here’s how to refinance a loan in five steps.

1. Determine your ideal loan amount

First, to refinance a loan, determine how much it’ll cost to pay off the existing one. View your loan account online or call your current lender to request a settlement figure. This settlement amount is usually valid for a set period, often 28 days.

Ask your lender if they charge early prepayment penalties, and weigh them against the benefits of refinancing.

Chime tip: Use our loan payoff calculator to find out how long it will take to pay off a loan.

2. Check your credit

Refinancing a loan only makes sense if it gives you a lower rate than you’re currently paying. Checking your credit score can help you gauge this. You can request a free copy of your credit report from each of the three major credit bureaus (Equifax®, Experian®, and TransUnion®) once per year at AnnualCreditReport.com.

Knowing your credit score will help you determine what loans and rates you qualify for, which we’ll cover in the next step.

Consider improving your credit score with something like a secured credit card before you refinance your loan. While this might delay your refinancing plans, the payoff of a better rate can be substantial.

3. Research lenders and compare rates

Not all lenders are created equal, and the same goes for their loan terms. Take the time to shop around and compare rates from different lenders. It’s like finding the best deal on a new car or laptop – except it’s your loan. Prioritize for low interest rates, favorable repayment terms, and low monthly payment costs.

Review all additional fees associated with the loans you’re comparing. Fees can cancel out any savings even if a potential loan has a lower interest rate.

4. Submit your loan application

Once you find one that fits your needs, you can apply for the loan. Your new lender can walk you through the application process and tell you what documents you must provide. This will likely include your Social Security number and proof of income via pay stubs or bank statements.

When you submit your application, your lender will run a credit check. A credit check usually involves a hard inquiry on your credit, which may cause your credit score to drop by a few points.

5. Start making payments on the new loan

Once your loan application is approved, you can start paying for your new, refinanced loan. Ask your lender if you can set up automatic payments from your checking account so you never miss a payment.

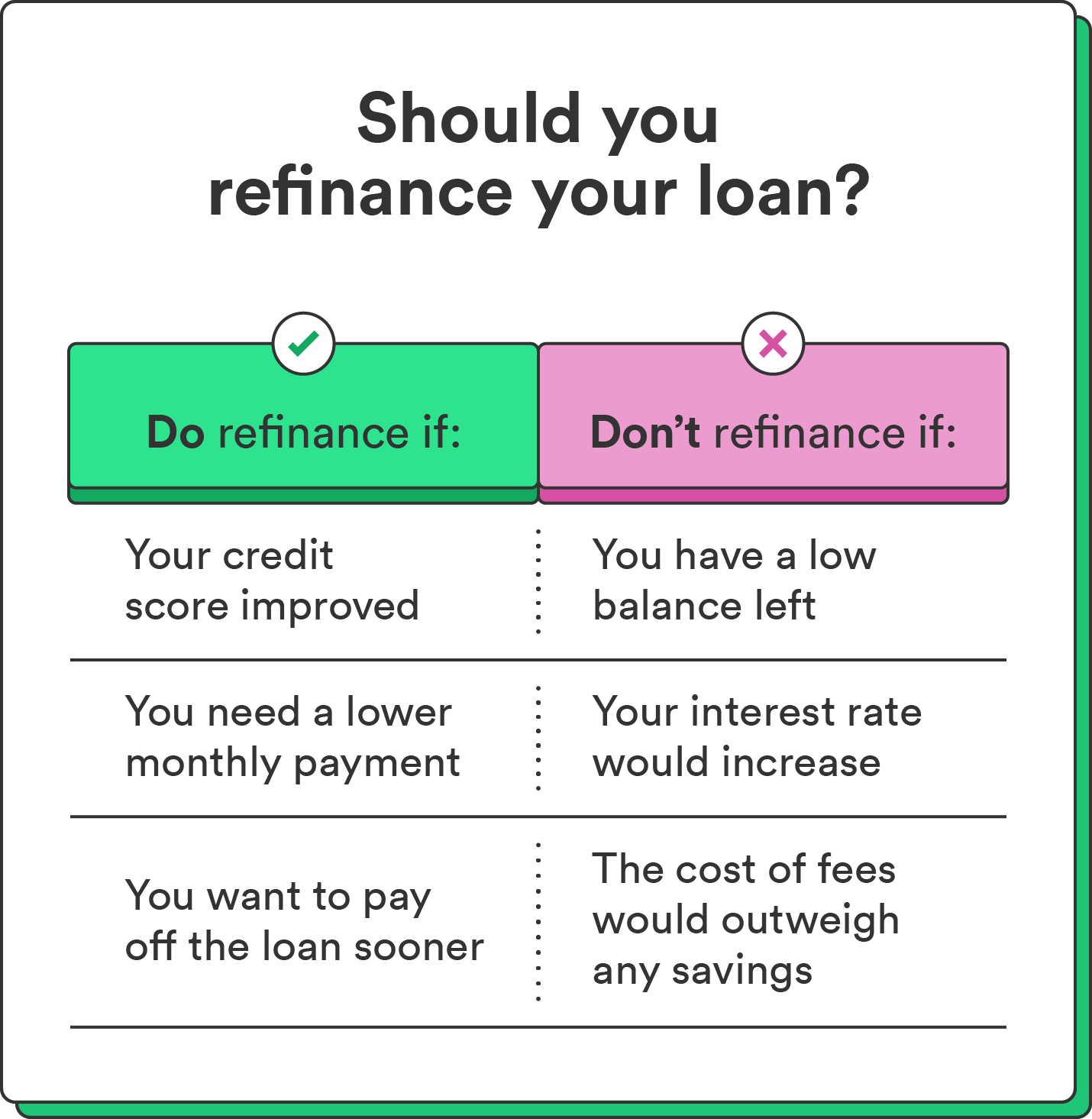

When to refinance your loans

There are a handful of situations where it would make sense to refinance a loan:

- Your credit score improved: If you’ve recently improved your credit score, you’ll have a better chance of securing a lower interest rate on a new, refinanced loan.

- You want to lower your monthly payment: If your income decreases, you may need a lower monthly payment on an existing loan. Sometimes, you can refinance your loan to secure a longer repayment period, but it might not be cost-effective in the long run.

- You want to pay off your loan quicker: If you want to repay your loan sooner, you can refinance your loan to secure a short repayment period and start paying a higher monthly payment.

- You can afford the fees: Refinancing a loan comes with certain fees, like origination fees and application fees. There may also be a fee for paying off your current loan ahead of the repayment period, known as a prepayment fee. Add up the total cost of any fees required to refinance a loan.

When not to refinance your loans

Refinancing a loan may not make sense for everyone. Here’s when it may not be worth refinancing:

- You have a low balance left on the loan: If you’re close to paying off your full balance on your existing loan, refinancing may not make sense when you factor in the cost of fees or potential prepayment penalties. Instead, consider paying off your balance.

- Your interest rate would increase: Usually, refinancing a loan doesn’t make sense if it results in a higher interest rate. Only consider refinancing if you need to stretch out your repayment timeline to avoid falling behind on payments.

- The refinancing fees outweigh potential savings: If the refinancing fees would cancel out any potential savings on interest, refinancing may not make the most sense.

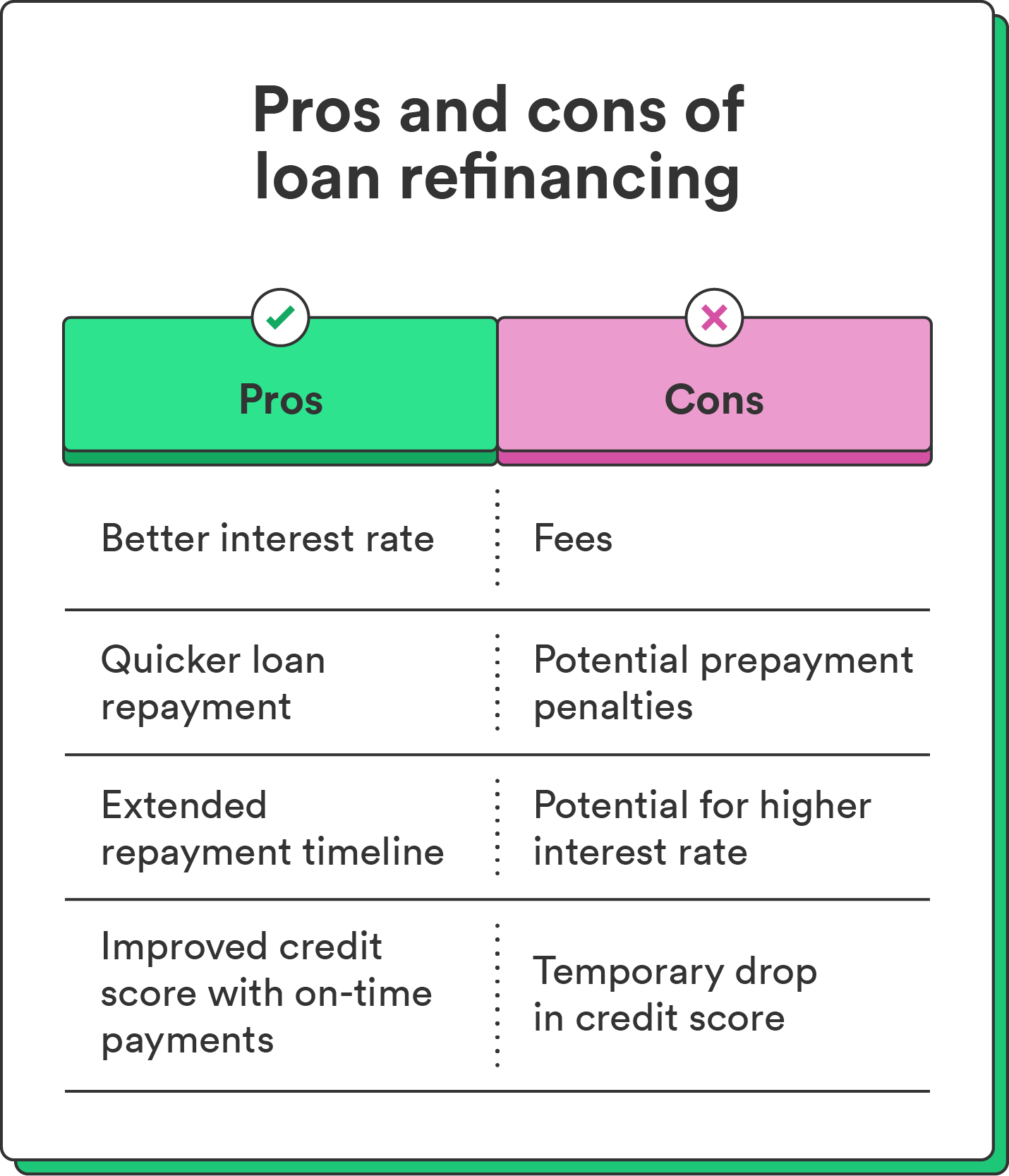

Pros and cons of refinancing your loans

Refinancing your loans has different pros and cons, depending on your goals and financial situation.

Pros:

Here are the advantages of refinancing a loan:

- Better interest rate: Refinancing allows you to secure a lower interest rate, potentially saving you money over the life of the loan.

- Quicker loan repayment: Opting for a shorter loan term by refinancing can give you a quicker repayment schedule. While this often means higher monthly payments, it can save interest over time.

- More time to repay the loan: Refinancing can also extend the loan repayment term, reducing your monthly payment.

- Improved credit score: Consistently making on-time payments on your refinanced loan can help you build your credit. A higher credit score can open up more favorable loan terms and rates down the line.

Cons:

Here are the potential disadvantages of refinancing a loan:

- Closing costs and fees: Refinancing often involves closing costs and fees, which you should weigh against the potential savings from a lower interest rate.

- Prepayment penalties: Some existing loans may come with prepayment penalties. Check your current loan agreement to see if that applies to you, and consider this before you refinance.

- Potential for higher interest charges: Extending the repayment terms can lead to paying more interest over the life of the loan, even if the monthly payments are more manageable.

- May lower credit score: Refinancing a loan may lead to a hard inquiry on your credit report, lowering your credit score. This is the case for any type of new credit inquiry – the impact is typically minor.

Is loan refinancing right for you?

Loan refinancing can be a helpful tool for securing a better interest rate or adjusting your repayment terms. Just be sure to weigh the pros and cons by considering fees, prepayment penalties, and whether it will help you secure a lower rate and save money.

Do you need a loan but have a poor credit score? Learn how to get a loan with no credit.

FAQs about how to refinance a loan

Still have questions about how to refinance a loan? Find answers below.

Is loan refinancing the same as loan consolidation?

No, loan refinancing and loan consolidation are different. Refinancing involves replacing an existing loan with a new one to secure better terms. In contrast, loan consolidation combines multiple loans into a single loan, simplifying payments but not necessarily improving terms. Learn more about how to consolidate debt.

Does refinancing a loan hurt your credit?

Loan refinancing may lower your credit score due to a hard inquiry during the application process. However, your credit score could improve over time if you make timely payments on the new loan.

What do you need to refinance a loan?

To refinance a loan, you need financial documents, like pay stubs, tax returns, and proof of income. An excellent credit score, details about your existing loan, employment information, and mortgage loans may require a property appraisal. Be prepared to show your ability to manage additional debt, compare offers from different lenders, and clearly define the purpose of the new loan to increase your approval odds.

Log in

Log in