When it comes to saving money, there’s always room to improve. But have you ever felt that no matter how hard you try, you still can’t seem to find ways to save?

While there are plenty of creative ways to save money, the best money-saving hack is the one you can stick to.

So, if you’ve been searching for new ways to make progress toward your financial goals, you’re in the right place. From the simple and effective to the more out-of-the-box, peruse our favorite money-saving hacks and take what works for you.

1. Try the cash envelope method

If you tend to overspend, consider the cash envelope method. It’s a budgeting system that only uses cash, making it easy to know exactly how much you can spend in different categories each week or month.

Start by choosing the spending categories you want to include, such as grocery money, money to dine out, or “fun” money. You could also keep it simple with categories like “spend,” “save,” and “give.”

Each time you get paid, allocate a portion of your paycheck to each envelope in cash. This is now your budget for that category for your pay period. The idea is to avoid spending more than what you put in each envelope.

While this method doesn’t work for everyone, it makes overspending more visceral when you want to buy something but don’t have enough cash in your envelope to cover it. There are also alternative approaches to the envelope method, such as the 100 Envelope Challenge to save money.

2. Eliminate unused subscriptions

One of the easiest ways to put extra cash in your wallet? Review any subscriptions you’re paying for that you’re no longer using. You might be surprised to find you’re still paying a monthly fee for an old account you no longer use or for a streaming service you forgot you signed up for.

3. Be savvy about seasonal sales

Did you know that seasonal sales follow a predictable schedule in the retail world? If you know when to expect the best deals on certain items, you can avoid paying a higher premium by shopping during the offseason.

Typically, spring and summer items go on sale in June and July, and fall and winter items tend to go on sale in January after the holiday season has passed. If you’ve ever seen someone buying winter gear or snow shovels in the summer, they don’t have their seasons mixed up – they’re just savvy bargain shoppers.

4. Autosave a portion of every paycheck

For this money hack, the saying “out of sight, out of mind” rings true. Instead of remembering to transfer a portion of each paycheck to your savings account each time you get paid, set up automatic savings.

Using your bank’s auto-save feature online or in the app, choose how much of each paycheck you want to save (20% of your monthly income is a smart goal) and adjust the settings accordingly. Not only are you off the hook for remembering to do this each month, but it reduces the friction of paying your future self when you’d rather spend it elsewhere at the moment.

If you use Chime, the Save When I Get Paid feature makes it simple to save money from your paychecks every month. Just sign up for direct deposit with Chime and turn on Save When I Get Paid in your settings. When you get paid, Chime automatically transfers 10% of your deposit of $500 or more into your Savings Account.

5. Get cash back on groceries

If you’re looking to save on groceries, take advantage of any smartphone apps to get cash back on your groceries. Some popular options are apps like Ibotta, Fetch Rewards, and Receipt Hog.

On many cash-back apps, you just search for offers you’re interested in, then upload a photo of your receipt after you shop to redeem the offer. If you want to take it a step further and are a responsible credit card holder, you could even look for credit cards with cash-back rewards programs for groceries and potentially save even more.

Chime member tip: “Match what (you) spend on unnecessary items and put it into savings.” — Ariana

6. Switch to a high-yield savings account

If you’re currently keeping your savings in a standard savings account instead of a high-yield savings account (HYSA), you might be leaving money on the table. An HYSA can pay interest rates many times the national average of a standard savings account, allowing you to grow your money faster.¹

7. Have an emergency fund

While not the most glamorous money-saving hack, having an emergency fund isn’t something you’ll regret. When unexpected expenses come up, having an emergency fund to lean on can save you time, money, and stress.

It could be the difference between opening a high-interest credit card to pay for an emergency expense and not. Proactively building an emergency fund may not feel all that gratifying – until you need to use it!

8. Buy generic over name-brand

Swapping out your usual name-brand purchases for the generic version can amount to serious savings. Most big-box stores also have their own store brands, which are often just as good as the name brand.

Example swaps could include anything from your over-the-counter allergy meds, contact solution, and toothpaste to food items like cereal, canned goods, and baking staples like flour and sugar.

Chime member tip: “Live with parents/roommates, buy in bulk, use rewards apps and cash-back apps for everything.” — Marina

9. Buy in bulk

If you tend to avoid buying items in bulk, consider the cost savings over time. Yes, you’ll pay a higher price for bulk items up front, but you’ll often save money.

Why? Because bulk items are almost always less expensive per unit than non-bulk versions. For example, a single grapefruit may cost 75 cents, while a three-pound bag of six grapefruits is $3. With the bulk option, you’re paying 50 cents per grapefruit instead of 75 cents. Instant savings!

10. Pack your lunch for work

Maybe you simply can’t give up your morning Starbucks run before work, but what about swapping out your daily takeout during lunch break for a packed lunch?

Even if you don’t pack your lunch every single workday (big kudos if you do), working it in two or three times a week will save you some cash. Just think – if you usually buy your lunch two or three times a week for $10 to $12, that’s $20 to $24 a week or $80 to $96 every month! Try packing your lunch when you can and see how much you can save.

11. Have a weekly or monthly budget check-in

You wouldn’t hike in an unfamiliar area without a map, right? In the same way, you’ll have difficulty reaching your savings goals without checking where you are and how far you have to go. Creating a budget is the first step, but instead of setting it and forgetting it, commit to having a weekly or monthly budget check-in to keep you on track.

Your check-in may include:

- Tracking last week’s expenses

- Noting any upcoming expenses

- Reviewing your top financial priorities

- Adjusting your spending categories if you’ve gone over in one area

- Finding room to increase how much you save each month

- Celebrating your progress

Keeping an eye on your spending while also keeping bigger, long-term goals in view regularly ensures you’re making progress – and seeing those small wins build up over time can motivate you to keep going.

12. Prioritize paying off high-interest debt

If you’re carrying any high-interest debt, make it your priority to pay it off as soon as possible – even ahead of any lower-interest debt you may have. Continue to pay the minimum on any other cards or accounts, but put as much money as you reasonably can afford towards the highest-interest debt.

Prioritizing your highest-interest debt is crucial if you want to save money in the long term since the quicker you pay the full debt, the less time you have to keep paying the interest rate.

13. Set up price-drop alerts

How do you make sure you get the best deals? Start tracking prices online.

Instead of impulsively buying something as soon as you remember you need or want it, set up a price tracking tool to monitor the price and alert you when prices drop. You can do this on Amazon by adding items to your watchlist or cart or using a tool like Google Shopping to monitor and compare prices online.

Chime member tip: “(Put) 10% of your direct deposit (in your) savings account.” — Robert

14. Let items sit in your cart for at least a week before purchasing

At the end of the day, spending less money is the surefire way to put extra dollars in your pocket. If you’re an avid online shopper and are prone to impulse buying, try implementing this simple trick to help you avoid spending money on things you don’t need.

It takes a bit of willpower, but make it a rule to let any item you’re considering buying sit in the cart for at least a week. Once that time is up, decide if it’s still worth buying. More often than not, you’ll find it was more of an impulse purchase than an actual need.

15. Shop local at farmers' markets

Shopping at the farmers market not only supports local farmers but also gives you access to fresher, less-processed, and often organic foods – generally for less than what you’d pay at the grocery store. Items on sale at the farmers market are also already in-season, and shopping seasonally is already a great way to save on food.

Items like fresh herbs that might cost you $3 to $5+ at the grocery store can often be found far less at the farmers’ market. Other items that tend to be cheaper, fresher, and tastier at local farmers’ markets include berries, lettuce and greens, and sweet corn. Search for local markets in your area and take advantage of them!

16. Do a home energy audit

A home energy audit is a thoughtful way to slash your monthly energy bills. If your home isn’t as energy efficient as it could be, it could wreak havoc on your utility bills.

While buying more energy-efficient appliances and updating your windows for better insulation are great ways to improve your energy efficiency, these updates aren’t cheap.

Instead, perform a simple DIY measure: EnergyStar.gov offers the Home Energy Yardstick. This online program compares your home’s annual energy consumption to other homes in your area and provides ways to improve it.

Chime member tip: “Put all (your) dimes in a 2-liter pop bottle until it’s full and use it for vacation spending money.”—Nicole

17. Try a no-spend challenge

Shake things up as you work towards your savings goals with a no-spend challenge. It’s a fun way to “gamify” those healthy saving habits you’re trying to build and help make things feel less like a chore.

The idea is to spend only on necessities and cut out anything else you don’t truly need. So you’ll still pay for things like your rent or mortgage, monthly bills, groceries, and gas but eliminate spending on non-necessities like:

- Eating out

- Coffee and drinks

- Clothes

- Furniture and home decor

- Gifts

- Beauty appointments

There’s no denying a no-spend challenge will get uncomfortable, but it’s only for a designated amount of time. You could start with three days, your work week, or a full week. The key is to make it manageable but still challenging. To help you get started, download our printable spending tracker below and keep track of your progress!

18. Consider a balance-transfer credit card

Carrying debt can make reaching your savings goals feel like an uphill battle. If you’re dealing with significant high-interest debt, you might consider a balance-transfer credit card.

A balance transfer credit card is a debt management method that transfers your debts to a new card with a lower interest rate. You can pay down your balance faster and save more money in the long run. It also allows you to consolidate multiple lines of credit, leaving you with a single lower-interest monthly payment.

19. Share streaming accounts

Do you and your friends have any of the same streaming services? If so, a simple money-saving hack is to go in on one account and split the bill each month. If you can find more than a few friends to go in with you, you could considerably cut that monthly streaming bill!

20. Don't accumulate credit card debt

Credit card debt can be one of the biggest roadblocks to reaching your savings goals. If you don’t currently have any debt, congratulations – that might be one of the best money-saving hacks we can think of!

You’re certainly not in the minority if you carry debt. If growing your savings and achieving greater financial freedom is your goal, adjusting your spending habits to ensure you don’t accumulate more debt is the priority. If you’re struggling with a high debt load, consider methods like debt consolidation to make it more manageable.

Chime member tip: “Instead of racking up credit card (debt) or getting loans, sell things you don’t need to pay for things you do need. I specifically use my online seller shops to pay for Christmas every year.” — Joan

21. Keep your car tires inflated

You don’t need to be an auto-wiz for this one – by making a point to keep your tires inflated, you’ll stretch the longevity of your tires (and contribute to a safer ride). Considering the cost of a new tire can range anywhere from $137 to $187 on average, this simple habit could keep you from having to shell out the cost unexpectedly.²

For a DIY approach, get a pressure gauge from your local hardware store and refer to your car’s manual to find your tire’s pressure specifications. Otherwise, most car mechanics and tire shops are happy to check your tire pressure for you for free – just call a local shop in your area to inquire (you might ask them to teach you how to do this yourself if you want to take care of it on your own in the future!). Staying on top of car maintenance ahead of time will ultimately save you money in the long run.

22. Take advantage of happy hours

If you’re not already taking advantage of happy hours, you’re missing out on some sweet deals at your favorite bars and restaurants. If possible, plan meals out and trips to the bar around happy hour times. This way, you can get the food and drinks you love for a fraction of the price.

23. Repurpose food scraps

If you usually toss those residual bones, peels, and scraps from your weekly meals, try repurposing them instead. In addition to reducing your food waste, it’s also a way to stretch your dollars further.

Fruit scraps like apple cores or apricot peels are great for jams, while orange, lemon, and lime peels are perfect for a DIY garbage disposal cleaner that makes your sink smell fresh. You can use veggie scraps like onion peels, broccoli trunks, and carrot tips for homemade vegetable stock. Or, toss those leftover rotisserie chicken bones in for chicken stock.

Chime member tip: “Skip the fast food and coffee shops daily. The savings add up quickly. Get rid of cable and utilize your wifi for streaming. Prepaid phones allow you to skip contracts that cost a lot. Skip brand name items and shop more for quality (rather) than making a fashion statement. Reuse what you already have if you can. (This) saves you money and saves the environment too.” — Lisa

24. Negotiate a lower credit card rate

Did you know it’s possible to negotiate lower rates with your creditor? While there’s no guarantee your rate will decrease, it’s worth a shot if it means getting a reduced annual percentage rate (APR) – and saving tons in the process.

Even a small reduction in your annual percentage rate (APR) can shorten how long it takes to pay off credit card debt. If you’re willing to spend some time on the phone, call the customer service number on the back of your card and make your pitch to a real representative.

If they tell you a lower rate isn’t possible, ask to speak with a supervisor and give it another shot. The effort may pay off, and you could pocket some serious savings in the long run.

25. Find cheaper car insurance

You already compare prices for things like flights, new clothes, and restaurants, so why not do the same for your car insurance? If you haven’t revisited your monthly car insurance premium in a while, take a minute to compare it to a handful of other car insurers and see how they stack up.

If you’re paying more than you need to, it might be time to switch car insurance. For something you pay every month, this could add up to significant savings in just a year. Even if you find a rate for $50 less than what you’re currently paying, that’s $600 in your pocket after one year.

26. Change your own oil

If you’re willing to learn (or maybe you just enjoy working with your hands), one way to save on that annual oil change is to do it yourself. Changing your car’s oil is one of the simpler auto maintenance tasks, and if you’re committed, anyone can learn how to do it – be sure to lean on online resources like YouTube for helpful tutorials.

Changing your oil yourself means pocketing that $25 to $75³ you usually have to pay. Once you get the hang of it, you’ll wonder why you didn’t learn sooner!

27. Only use your bank's ATM

When you withdraw cash at an ATM outside of your bank’s network, there’s usually an ATM fee. This fee depends on the ATM operator, but it’s usually around $2.50 to $5, and those fees add up.

An easy way to avoid this is to use ATMs you know are in your financial institution’s network. Chime has over 50,000 fee-free ATMs in our network.4

28. Clean your dryer vent

Did you know this simple household task can also save you money? Your washer and dryer contribute to your monthly utility bill, and failing to clean your dryer vent means your dryer has to work harder than it should. That extra energy it’s using amounts to extra dollars on that utility bill. Keep that dryer vent unclogged to avoid reducing your energy efficiency!

29. Get a cash-back credit card

If you’re already a disciplined credit card owner, take advantage of a credit card that offers cash-back. If you can find one that offers cash-back on even just 1 to 2% of what you spend, that can add up to a couple of hundred bucks back in your wallet after some time.

Chime tip: In addition to comparing the cash-back rate for different credit cards, be sure to check for sign-up bonuses or annual fees, if any — ideally, you’ll choose one without an annual fee.

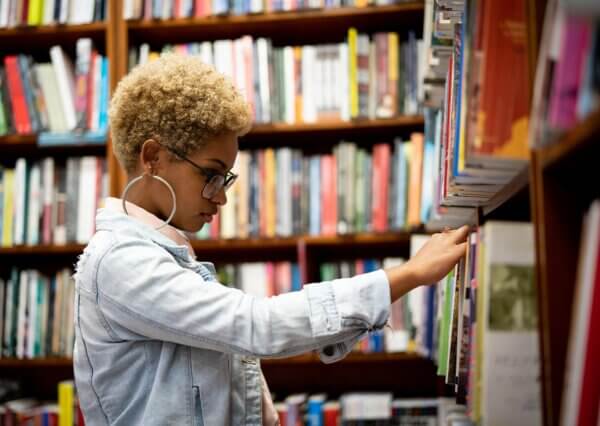

30. Stop buying new books — hit the local library instead

If you’re looking for a new book, don’t buy it brand new – find it at your local library and read it for free instead. Check for libraries in your area and sign up for a library card to gain access to thousands of books for free.

This doesn’t just apply to physical books – your library will also have a digital catalog of e-books available to read online. Also take advantage of digital libraries like Libby and Hoopla, where you’ll find even more books, movies, audiobooks, and more – all for free!

31. Learn new skills for free

Instead of shelling out hundreds to take a course you’re interested in, take advantage of free courses online. With platforms like Coursera, Alison, SkillShare, CreativeLive, and Duolingo, it’s never been easier to learn just about anything you want, whether it’s an obscure skill related to a new hobby or something you’ll use to further your education and career.

32. Find free events around town

If your typical weekend plans include going to bars, restaurants, and other places that require money, consider penciling in some free weekend activities instead. Challenge yourself to make plans that don’t cost a dime – you might be surprised by how much you can do for free!

Start by looking up local free events happening around town. There are bound to be free concerts, markets, and other events.

Chime member tip: “Budget! Only spend on necessities and put a certain amount in savings and a certain amount in a rainy day fund you cannot withdraw from.” — Staci

33. Finish skincare products before buying more

When it comes to your skincare products and toiletries, use an entire bottle of product before purchasing more.

It can be tempting to buy new personal care products before finishing what you already have, but wait until you’ve truly run out of a product before buying more. You could cut a bottle in half to make sure you use every last drop to make products last longer.

It might seem minuscule, but this can prevent you from suddenly having six half-opened bottles of a product you don’t need.

34. Check return shipping costs before you buy online

While many stores today offer free returns for purchases bought online, not all do. A $6 return fee may not seem like much, but pay it often enough, and those small amounts add up. If you don’t keep the item, you’re only losing money.

Pay extra attention to shipping costs for larger items like furniture or rugs – shipping costs are calculated by weight, and if it’s a large item, that could be upwards of $60 (or more, depending on the item). If you’re not 100% sure you’ll want to keep the item, try to buy in-store instead to avoid being hit with a hefty shipping charge.

Use the money-saving hacks that work for you

Remember, at the end of the day, the best money-saving hack is the one that sticks. Pick whichever of the above will inspire you to save more, live on less, pay down debt, and put more money in your wallet.

Log in

Log in