Whether you’re new to Chime or haven’t had the chance to fully explore the app, you might be wondering: “How do I deposit money into Chime?” or “How do I transfer money into Chime?”

We’ve made the process as simple as possible. Here’s what you need to know!

How do I set up direct deposit?

If you set up direct deposit with Chime, you’ll start unlocking more exciting features in the app.

You can start the process in the Chime app under Move Money and then Set up direct deposit. You can set up direct deposit in a few ways:

- Do it in the app. You can find your employer or payroll provider right in the Chime app if they are supported. Search among more than 30,000 employers, payroll providers, and unemployment agencies at the bottom of Set up direct deposit. Just tap Find employer to get started.

- Sign up through your employer or benefits portal. Log directly into your payroll provider portal or government portal to update your payment method. Enter your Chime account information into the portal and choose the amount of your paycheck you’d like to deposit. Confirm with your Human Resources department, payroll provider, or manager that the change has been implemented.

- Get a completed form. Navigate to Move money, then Set up direct deposit. Tap Get completed form and we’ll email you a completed direct deposit form as a PDF, along with a voided check should your employer require it. On the form, you can say whether you want your entire paycheck direct deposited into your account or a specific amount or percentage deposited. Email this form to your manager or HR department, and you should be all set.

If you’d like a little more guidance, this article dives deeper into the details of setting up direct deposit with Chime.

Benefits of setting up direct deposit with Chime

Not only is direct deposit a simple and hassle-free way to get paid, but when you do it with Chime, you’ll be eligible for key Chime features like:

- Get paid early¹: Gain access to your paycheck up to two days early.

- SpotMe®²: Overdraft up to $200 on purchases and cash withdrawals³ (as long as you’re receiving at least $200 per month in qualifying direct deposits).

- The Secured Chime Credit Builder Visa® Credit Card: Increase your credit score by an average of 30 points⁴ with everyday purchases and on-time payments.

- Save When I Get Paid⁵: Automatically save a portion of each paycheck, and watch your emergency fund grow!

- Mobile check deposit⁶: Easily deposit checks via the Chime mobile app.

More ways to move money into Chime

Not eligible or interested in setting up direct deposit with Chime? No problem. Here are some other ways to move money into Chime.

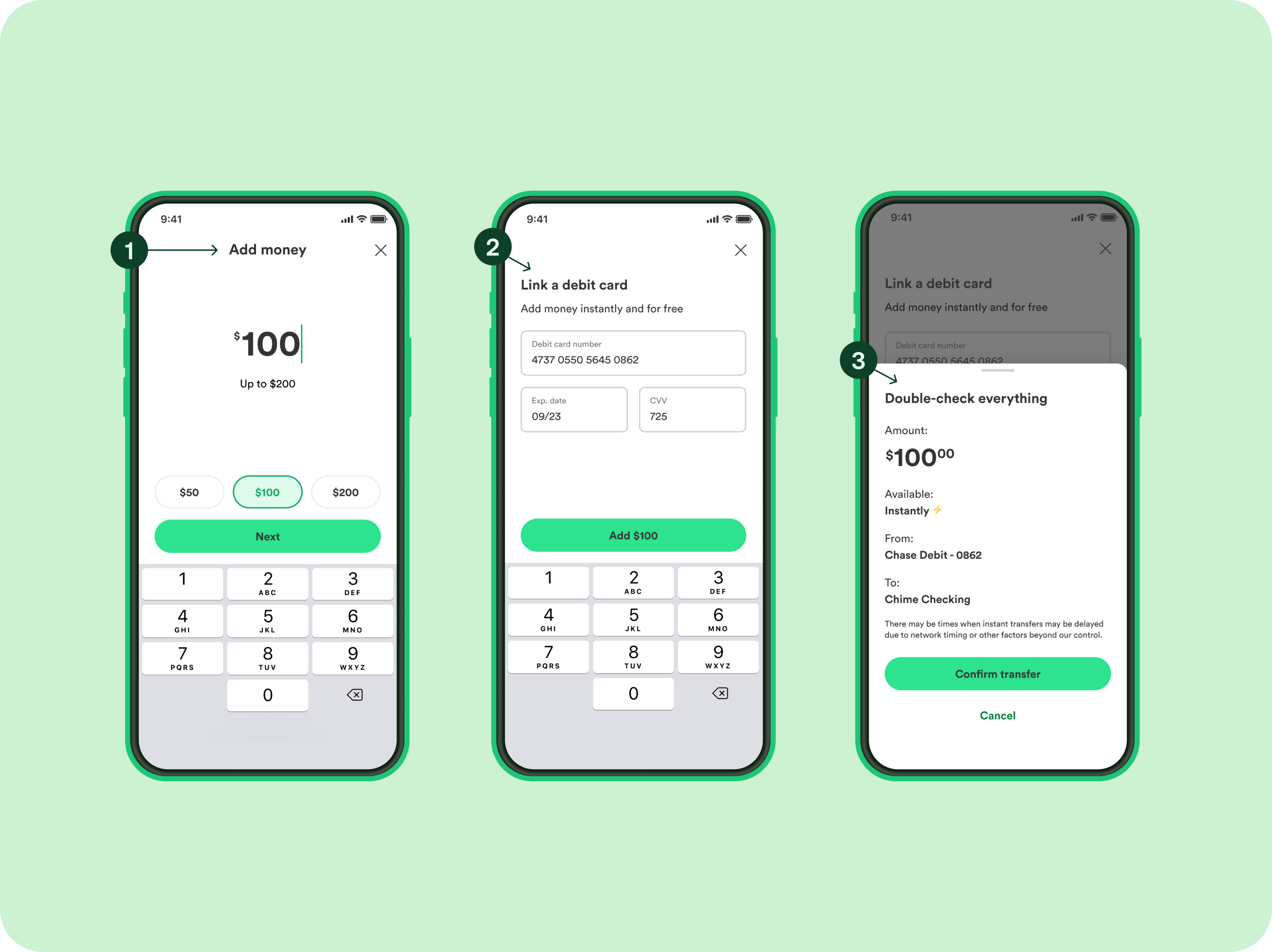

1. Make an instant transfer

Link a debit card by adding a debit card number, and you’ll be able to move money into Chime – instantly. Head to Move Money in the app to get started.

2. Transfer from another account in the Chime app

Here’s how to transfer money from another financial institution:

- Log into the Chime app and tap Transfers under Move Money.

- Enter the username and password for your other bank (don’t worry; it’s encrypted!).

- Transfer your money. You’ll have access to the funds within five business days.

3. Transfer from another account’s app or website

You can also move money from your previous bank from their app or website.

Here’s how:

- Log into your previous financial institution’s website or app.

- Look for a menu item that says something like “transfer funds” or “add external account.”

- When prompted, add your Chime Checking Account number and bank routing number (which you’ll find under Settings → Account info in the Chime app).

While the transfer time will depend on your old bank’s policies, you’ll usually see the money in your Chime Checking Account within a few business days.

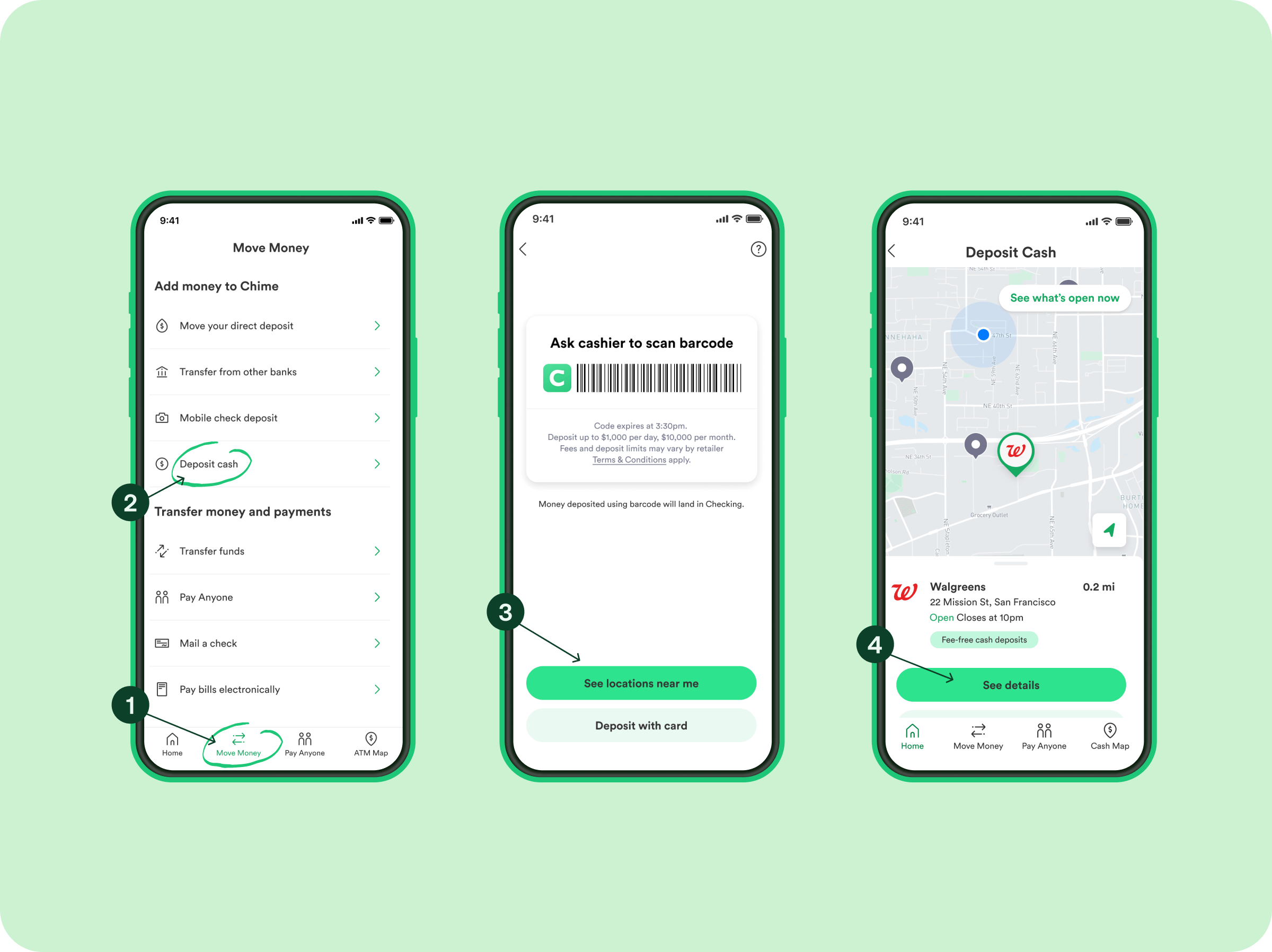

4. Deposit cash

We make it easy to add cash to your account at 8,000+ Walgreens® locations for free.⁷ You can also deposit money through other retail partners in over 75,000 locations, which is more than you would have using any walk-in bank in the US. Keep in mind that retailers other than Walgreens might impose their own fees or transaction limits, so be sure to ask before you start your transaction.

Here’s how to deposit cash:

- Log into the Chime app, tap Move Money, and then select Deposit cash.

- Tap see locations near me to find the nearest walk-in retail location.

- Hand the cashier your cash and have them scan the barcode on the Deposit cash screen. You can also have them swipe your Chime Visa® Debit Card or Credit Builder card. Some retailers may set their own deposit limits, so check with the cashier on the maximum amount you can deposit per transaction.

Wondering about wire transfers? While we don’t allow those yet, we hope to add them in the near future.

Welcome to Chime 💚

However you choose to move money into your Chime account, we’re just happy to have you join the community! And no matter where you’re at in your money journey, we’re here to help you unlock your financial progress.

Ready to put your savings to work? Find out how to grow your money faster.

Log in

Log in