Already got a Chime Credit Builder Visa® Credit Card? Ready to level up your knowledge?

Here’s the scoop on how your Credit Builder balance and statements work — so you’ll have the best shot at improving your credit score over time.

What is your Credit Builder balance? 🤑

First off, a little dictionary sesh Here are two must-know terms when it comes to understanding your Credit Builder account:

- Available to Spend: This is the number you’ll see in the app, and it’s how much you have left to spend on your card.

- Balance: The total amount you’ve spent on your card since your last statement.

Put another way, when you move money into your Credit Builder’s secured account, it’ll increase your “Available to Spend.” So, if you have $400 under “Available to Spend,” and you move another $100 into your secured account, you’ll then see a total of $500. As the name suggests, this is the maximum amount you can spend on the card before you’d need to add more money or make a payment.

Throughout the month, you can put everyday purchases on your Credit Builder card: anything from groceries to gas and HBO to IHOP. Each time you swipe your card, the amount from your “Available to Spend” will instantly decrease, so you’ll know exactly how much you have left.

However — and this is important! — that doesn’t mean your card is paid off. It simply means there’s a hold on that money, preventing you from spending more than you’ve deposited into the secured account. You can use that money later, to pay your statement when it arrives.

Understanding your Credit Builder statement 🗓

At the end of every month (around the 28th or 29th), you’ll receive an email with your Credit Builder statement. It’ll include your current balance: the amount you spent during the previous month.

At first, you might be confused — like didn’t I pay this already?

But remember: Though that money was deducted from your Available to Spend, it didn’t pay off your card. There’s merely a hold on it so you couldn’t spend more than you have.

Why the extra steps? To better help you build your credit history. If you paid off your Credit Builder balance with every transaction, it’d be no different than your Chime Visa® Debit Card. By putting a hold on your money, and then using it to pay your bill at the end of the month, you’re contributing to a history of regular on-time payments — one of the keys to improving credit scores!

How to pay off your Credit Builder balance 💰

Once your statement arrives, it’s time to pay it off. You have two options.

1 – Safer Credit Building

This is the most popular way to pay among Chime members.

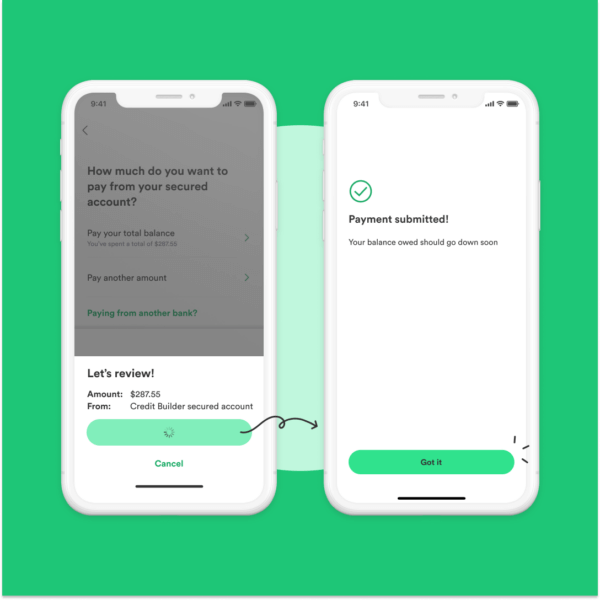

It’s a handy feature we built to help you pay on time. When you turn on Safer Credit Building, your payments will be automatic. The day after your monthly statement is issued, the hold on the money you’ve spent will be released, and the money is used to pay off your balance.

In the meantime, you can sit back and relax knowing your balance will be paid on time. And since regular on-time payments are one of the most important components of credit scores, turning this feature on is an effortless way to help build your credit history over time.

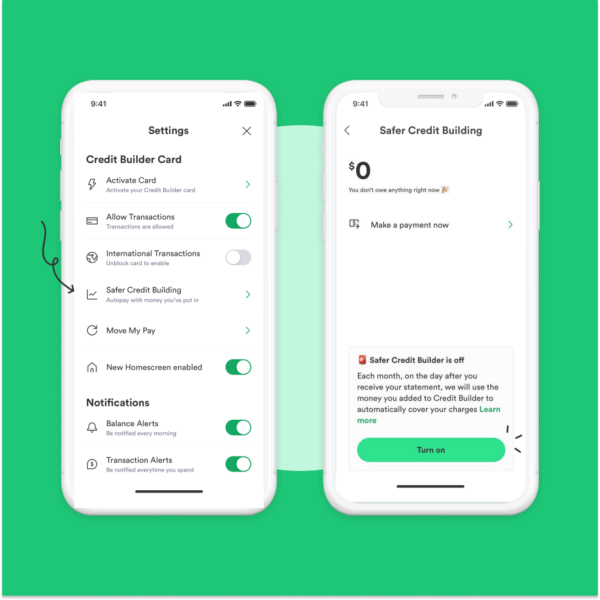

To turn on Safer Credit Building in the Chime app, select Settings → Credit Builder → Safer Credit Building → and then tap on “Turn on” at the bottom of your screen.

2 – Manually

You also have the option to pay your bill manually—with money from your Chime Checking Account or another bank account.

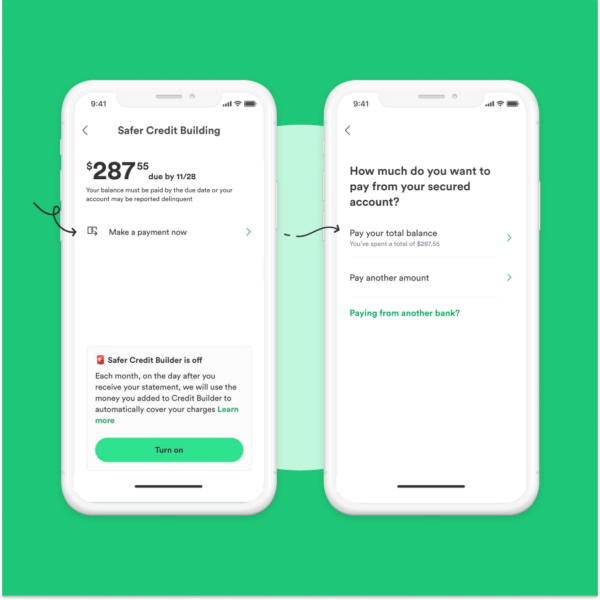

To manually make a Credit Builder payment, select Settings → Credit Builder → Safer Credit Building → and then tap on “Make a payment now.”

The downside? If you choose to make manual payments, and one or more payments are not made on time, it could negatively impact your credit score.

We all know that life happens, and payments get missed. So, for peace of mind and a good shot at building your credit history, we recommend taking the Safer Credit Building route!

Your 30-second recap of Credit Builder statements and balances ⏰

Since that was a lot of info, let’s do a quick review:

- Every time you swipe your Credit Builder card, a hold is placed on the purchase amount and the amount is deducted from your “Available to Spend.”

- Around the 28th or 29th of each month, we send you a statement with your balance: the total amount you spent during the previous month.

- If you’ve turned on Safer Credit Building (which you really should!), you don’t have to do a thing. You’ll automatically use the money on hold in your Secured Account — your money — to pay your bill on time and help you build your credit history.

- If you’ve opted for manual payments instead, you’ll have to sign into the Chime app and make a payment from your secured account or pay via ACH. As long as the payment is on time and in full, it should help you build your credit history, as well.

We hope this has helped you better understand all things Credit Builder. Keep an eye out for more blog content to help you get the most out of Chime!