Credit cards offer a convenient way to shop, manage bills, earn rewards, and build your credit score. They can be a helpful addition to your financial toolkit – with responsible use.

While credit cards may appear no different from debit cards, they have different uses. So how do credit cards work exactly? Keep reading to learn how to use a credit card and why having at least one in your wallet can be a smart move.

What is a credit card?

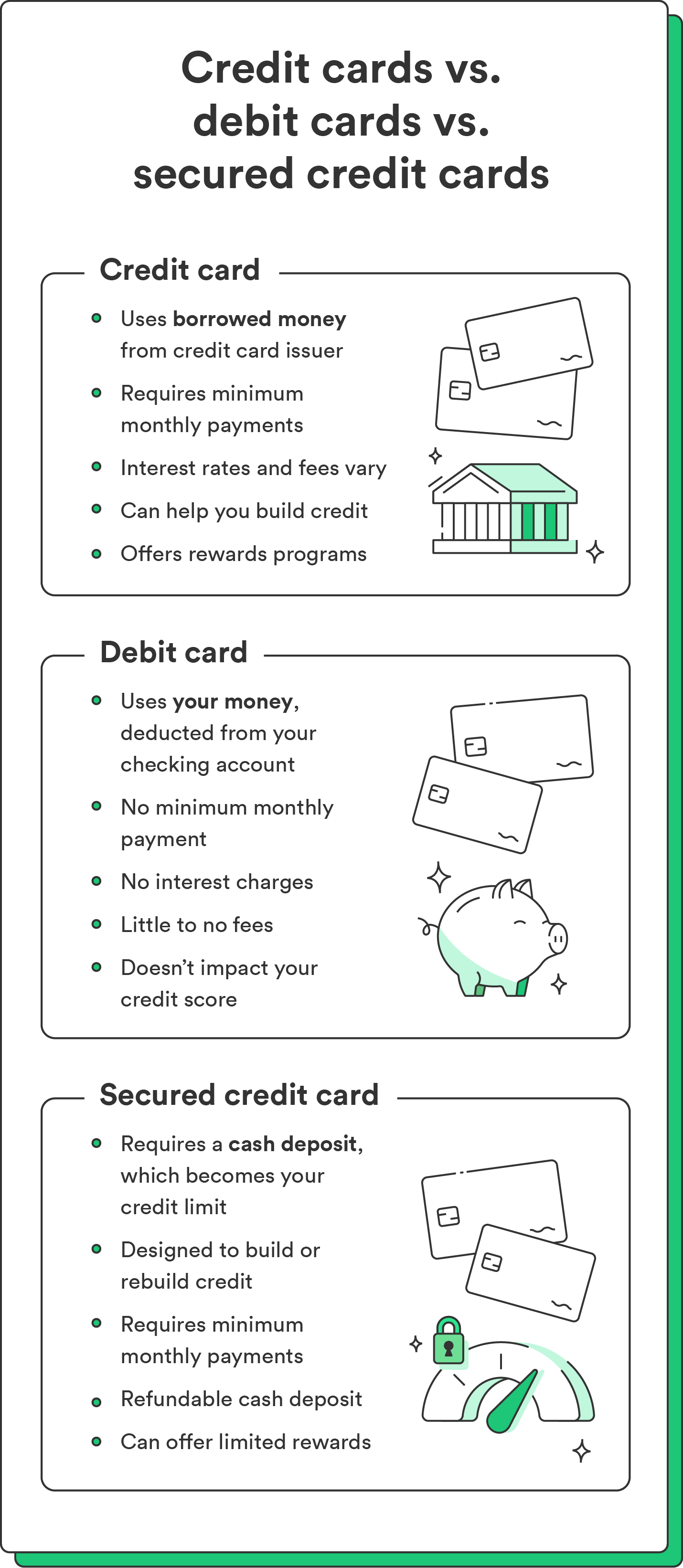

A credit card is a financial tool that allows you to borrow money from a bank or a credit card issuer to make purchases in stores and online. You repay the borrowed amount along with any interest or fees charged.

How a credit card works

A credit card is a type of revolving credit that lets you borrow money up to a certain limit, known as your credit limit. Unlike debit card purchases, which are covered by the money in your bank account, credit card purchases are made with borrowed funds from a credit card company. So, using your credit card means borrowing money you pay back later. As you make purchases, your available credit shrinks.

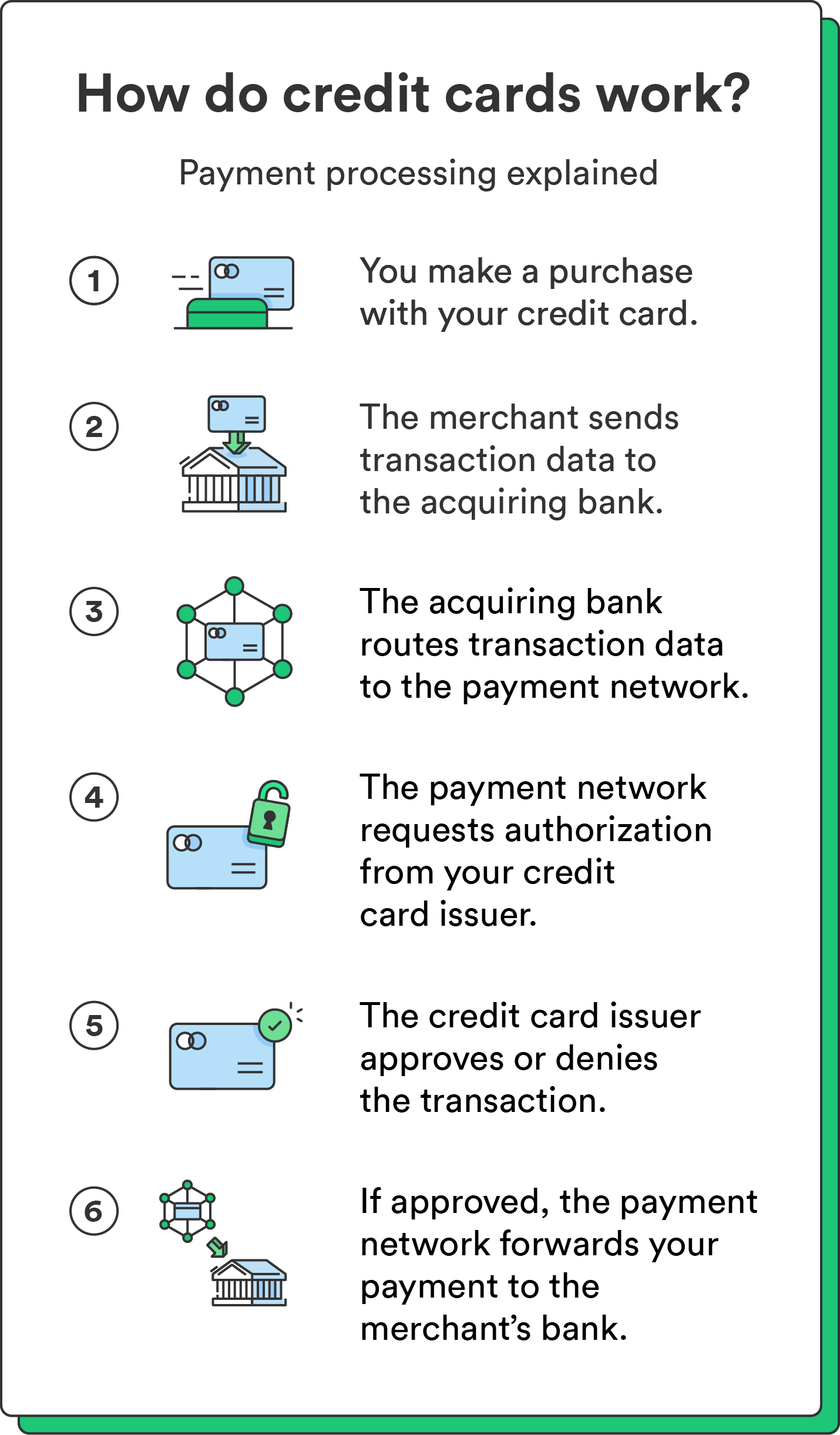

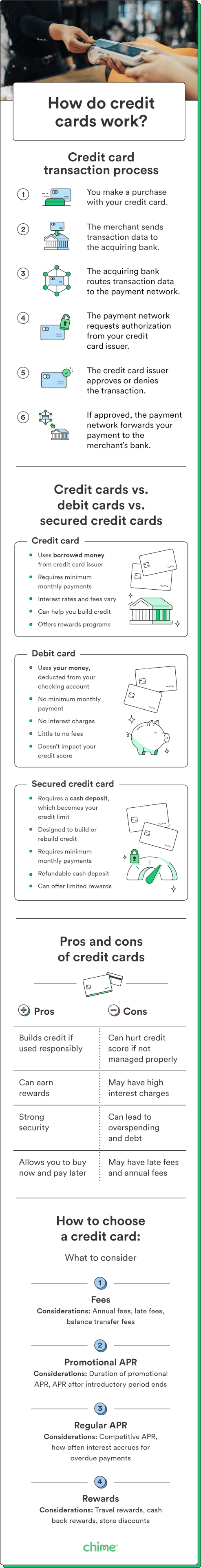

Here’s a breakdown of how a credit card works:

- Card swipe or insertion: You use your credit card to make a purchase.

- Data encryption: The payment terminal encrypts your credit card information to protect it from unauthorized access during transmission.

- Transmission to acquiring bank: The payment terminal sends your encrypted data, including your credit card number, transaction amount, and merchant details, to the acquiring bank. The acquiring bank is the bank that has a relationship with the merchant to handle their credit card transactions.

- Acquiring bank to payment network: The acquiring bank routes the transaction data to the appropriate payment network, such as Visa, Mastercard, or American Express.

- Payment network to credit card issuer: The payment network sends the transaction details to your credit card issuer, who verifies whether to authorize it or decline it based on factors like available credit, account status, and fraud detection systems.

- Payment network to acquiring bank: If your issuer approves the transaction, the payment network sends the authorized transaction to the acquiring bank.

These steps occur within seconds when you use your credit card to make purchases. Once the purchase is complete, the transaction amount is deducted from your total available credit.

How to pay off your credit card

Each month, your credit card issuer will send you a credit card statement that outlines your transactions, payments, previous balance and new balance, minimum payment amount, and your due date.

Credit cards typically offer a grace period, which is the time between the end of the billing cycle and your payment due date. You won’t be charged any interest if you pay your bill in full during this time.

If you carry a balance month to month, interest charges will apply. Interest charges are calculated based on how much you owe and your annual percentage rate (APR). The APR is the annualized rate of interest you’ll pay if you carry a balance on a credit card. In other words, you pay the price to borrow the credit card company’s money. The higher the APR, the more you’ll pay.

Chime tip: Avoid credit card interest by paying your balance in full before the due date. If you pay late, your credit card company could impose a penalty APR, which might be higher than your regular APR.

How to read your credit card statement

To fully understand how credit card payments work, you’ll want to review the key elements listed on your credit card statement. Your billing statement will include your transactions, payments, previous and new balance, minimum payment amount, and due date.

Minimum payment

The minimum payment is the smallest amount you must pay by the due date to keep your credit card account in good standing. It’s usually a percentage of your total outstanding balance. Paying only the minimum payment may help you avoid late fees, but it will also result in carrying a balance and accumulating interest charges over time.

Available credit

Available credit is the difference between your credit limit (the maximum amount you can spend on your credit card) and your current balance. Whenever you make a purchase, your available credit decreases, and it goes back up when you make a payment.

Statement balance

The statement balance is the total amount you owe on your credit card at the end of the billing cycle. It includes all purchases, cash advances, balance transfers, fees, and any interest charges applied during that period. Paying off the statement balance in full by the due date allows you to avoid interest charges and demonstrates responsible credit card management.

Current balance

The current balance is the total amount you owe on your credit card, including the statement balance and any new purchases you made after the billing cycle ended. It reflects the real-time balance on your credit card and may change throughout the month as you make additional purchases or payments.

Credit card fees

Credit cards can come with various fees in addition to the interest rate. Learn what fees come with any credit card you apply to so you can manage your credit card responsibly and avoid unexpected costs.

Below are some common credit card fees to be mindful of:

| Fee type | Description |

|---|---|

| Interest fees | Fee for carrying an unpaid balance |

| Annual fees | Yearly fee for being a cardholder |

| Balance transfer fees | Fee for transferring your balance to another credit card |

| Over-limit fees | Fee for spending more than your available credit limit |

| Late fees | Fee for failing to make the minimum payment by the due date |

| Cash advance fees | Fee for withdrawing cash against your credit limit |

| Foreign transaction fees | Fee for using your credit card in another country |

Most credit card fees will be clearly marked on your credit card statement. Different credit cards have different types of fees, so carefully review the agreement guidelines to avoid unexpected charges.

Types of credit cards

There are various types of credit cards available. Below are some of the most common:

- Secured credit cards: Secured credit cards require a cash deposit as collateral, which becomes the credit limit. They are designed for those with a limited or poor credit history, offering an opportunity to build or rebuild credit.

- Rewards cards: Rewards cards offer incentives in the form of points, miles, or cash back. These rewards can be earned based on your spending in specific categories such as travel, dining, or groceries, providing potential savings and perks for regular card usage.

- Cash back cards: Cash back cards provide a percentage of your purchases as cash-back rewards. These cards allow individuals to earn money back on their everyday spending, providing a straightforward way to save or redeem rewards.

- Student credit cards: Student credit cards are tailored specifically for students who are new to credit. They often have lower credit limits and may come with benefits like rewards or educational resources to help students establish credit responsibly.

While all credit cards share certain features, like a credit limit, minimum payment, and APR, there are many types of credit cards available depending on your financial situation and goals.

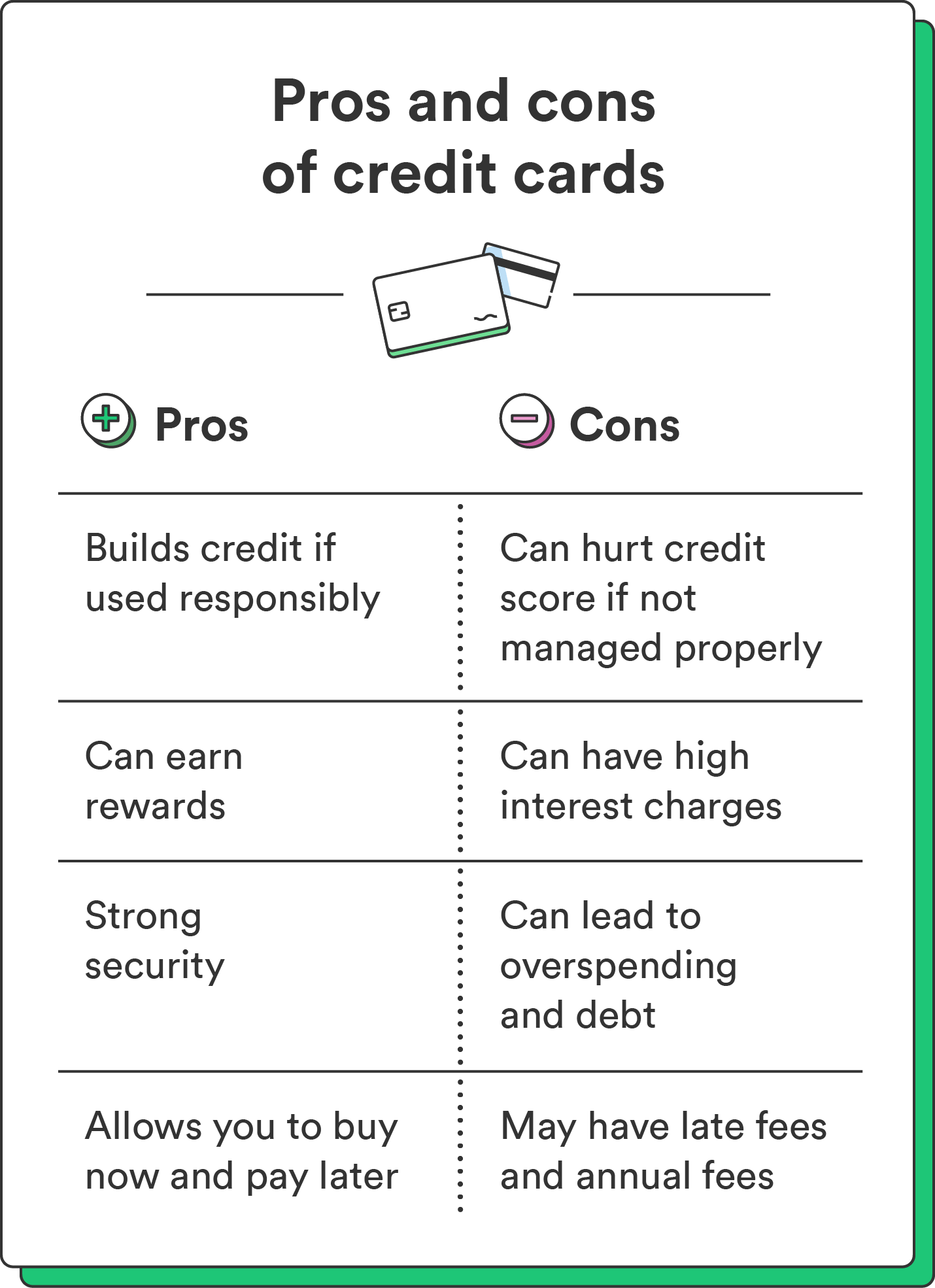

Pros and cons of credit cards

Credit cards can offer convenience, perks like cash-back rewards, and the potential to build credit, but they also carry the risk of debt, fees, and negatively impacting your credit score if not managed properly.

Here are the pros of credit cards:

- Builds credit if used responsibly: Credit cards can be a valuable tool for building your credit. Good credit can make you eligible for car loans, mortgages, and even rental agreements.

- Can earn rewards: Various credit cards offer rewards programs, from travel discounts and airline miles to cash-back for spending in a certain category.

- Strong security: Credit cards can come with built-in security protections that you don’t always get with debit cards. And if your card is lost or stolen, your liability for those losses is limited since the funds are coming from your credit card issuer (versus funds from your checking account).

To maximize the benefits of credit cards, pay off your balance in full each month, be mindful of potential fees and interest charges, and understand the terms of any rewards programs.

On the other hand, credit cards can potentially come with some disadvantages:

- Can hurt your credit score: Missing payments or carrying high balances can hurt your credit score, affecting your ability to borrow in the future.

- High interest charges: Some credit cards come with high-interest charges if you don’t pay off your balance in full each month.

- Can lead to overspending and debt: You’re not on the hook for repaying what you spend until your payment due date. This can lead to considerable credit card debt.

While credit cards have significant advantages, they can lead to financial strain if you spend beyond your means. To avoid these cons and make the most of your credit card, use it responsibly and keep tabs on your credit score.

What to look for in a credit card

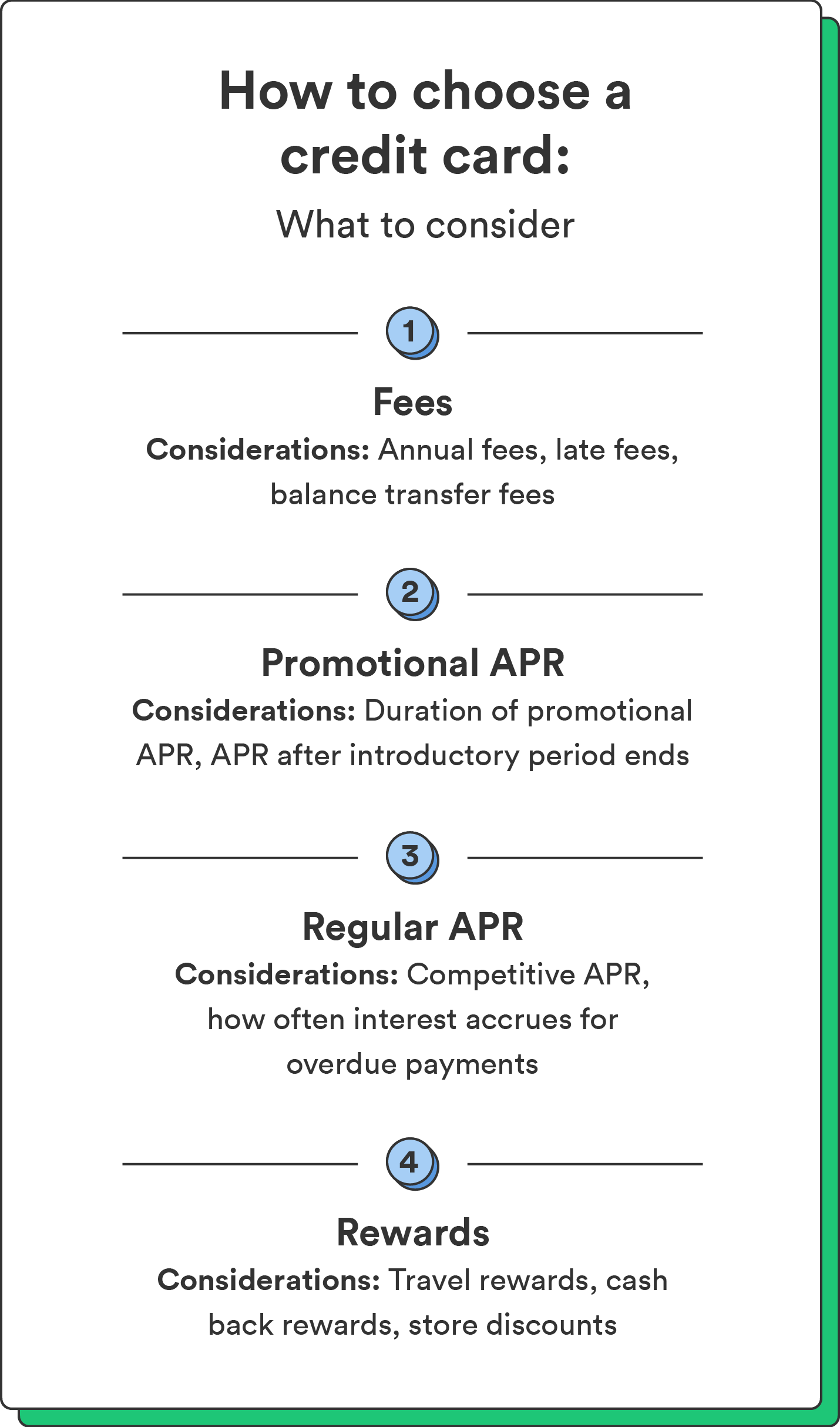

There are thousands of credit cards on the market. You’ll need to shop around and compare credit cards to find the best one for you. Look for these factors:

- Low APR: To minimize interest costs, shop for credit cards with a low APR on outstanding balances.

- Promotional APR terms and conditions: Many credit cards offer an introductory period with a 0% APR, but only for a limited time. Check the promotional APR rate terms so you know how long it lasts.

- APR for balance transfers and cash advances: If you intend to transfer balances from other credit cards or use your credit card for cash advances, be aware of the associated interest rates and fees.

- Terms and fees: Review any annual fees, late payment fees, foreign transaction fees, or other charges that may impact the cost of using the card.

- Rewards programs: Different cards can provide cash back, points, or miles based on your spending in specific categories. Consider how you’ll use your credit card and find a rewards program that aligns with your goals.

It’s also advantageous to check your credit score to know what credit cards you qualify for. A premium travel rewards card might be out of reach if you’re new to using credit. It might be easier to get approved for a secured card or a credit builder card.

Is a credit card right for you?

With responsible use, credit cards can help you build a strong credit history, leading to lower interest rates on other loans like mortgages and car loans. Rewards offered by credit cards are also appealing, particularly if you have significant spending in specific categories like dining out or travel.

For most people, the benefits of using a credit card outweigh the drawbacks. With knowledge and self-discipline, credit cards can serve as valuable financial tools.

Compare some of the best credit cards for building credit.

FAQs about how credit cards work

Still have questions about how credit cards work? Find answers below.

How do credit cards impact your credit score?

Responsible credit card use, like making timely payments and keeping credit utilization low, can help build a strong credit history. However, late payments, high balances, and a high balance can negatively affect your credit score.

What is the best way to use a credit card?

The best way to use a credit card is to make purchases you can afford and pay off the full balance each month. This can help you avoid high-interest debt and prevent overspending. Know your card’s fees, rewards, and terms to maximize your card’s benefits.

When should you get a credit card?

You should consider getting a credit card when you have a stable source of income and the discipline to manage credit responsibly. If you understand how credit cards work and can commit to paying off your balances in full each month, a credit card can be a useful financial tool to build credit and enjoy benefits like rewards programs.

When do credit cards charge interest?

Credit cards charge interest when you carry a balance from one billing cycle to the next. If you don’t pay off the full balance by the due date, interest charges will apply to the outstanding amount, increasing the overall cost of your purchases.

What is the minimum payment on a credit card?

The minimum payment on a credit card represents the amount you must pay by your statement due date. Your minimum payment might be a percentage of your balance or a flat dollar amount, whichever is greater.

How do you get a credit card?

You can get a credit card by applying online or in person with a bank or credit card issuer. They will review your credit history and income to determine whether you qualify for the card. If approved, you’ll receive the card and a credit limit, which is the maximum amount you can borrow on the card.

How long does it take for a credit card payment to process?

Credit card payments typically process within a few business days, although the exact timing can vary depending on the credit card issuer and the payment method used. Make payments before the due date to avoid late fees or negative impacts on your credit score.

Do you only have to pay what you spend on a credit card?

You only have to pay what you spend on a credit card if you pay in full by your statement due date. You might also have to pay interest if you’re carrying a monthly balance. Credit card companies can also charge various annual and late payment fees.

Log in

Log in