Learn everything you need to know about how to void a check, including why you should never give someone a blank check. With step-by-step instructions and tips for avoiding common mistakes, you can confidently manage your finances and keep your money safe.

What is a voided check?

A voided check is a paper check with the word “VOID” written across it. Voiding a check helps to ensure no one can use it to make a payment or withdraw money from your checking account.

There are several reasons you may need a void check, including setting up direct deposit or an online bill.

Since checks contain important banking information, you want to make sure you void them correctly to prevent misuse.

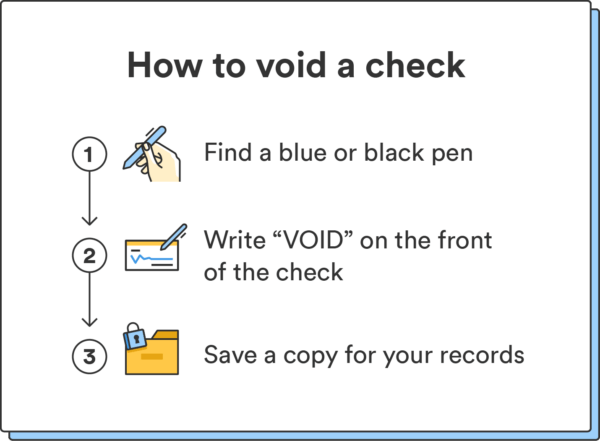

How to void a check

Wondering how to write a void check? It’s simple. All you need is a pen and the check that you want to void. Here’s how to do it.

1. Find a blue or black pen

Find a blue or black pen to write with.

2. Write “VOID” on the front of the check

Write “VOID” in large, capital letters across the front of the check. It’s okay if it covers up the different text boxes on the check. But you want to avoid covering up the routing number and bank account number as you need these numbers to send or receive payments to your account.

You can also write “VOID” in a smaller font on the payee line, date line, amount line, signature line, and in the amount box.

3. Don’t sign the check

When voiding a check, leave the signature line blank to avoid confusion or misuse.

4. Save a copy of the voided check

Make a note of the checking number and make a physical copy of the voided check to keep for your records.

Tip: Never give someone a blank check; they can fill it out with a higher amount or even use it fraudulently.

Why would I void a check?

There are several reasons you may need to void a check. For instance, you may want to ensure no one else uses it, or you may need to provide a void check for someone to access and confirm your banking information.

Here are the most common reasons for voiding a check:

- To set up direct deposit: Setting up direct deposit requires giving your employer your bank account information, which you can quickly do by providing a voided check.

- To set up automatic bill pay: You can set up your car payment, mortgage, or other online bills for automatic payment. One autopay method includes submitting a voided check tied to your checking account.

- To complete Automated Clearing House (ACH) transfers: ACH transfers are often used by businesses to send payments to vendors or to send online payments to the IRS, and may require a void check.

- To verify banking information: If you’re trying to rent an apartment, a landlord might ask to see proof you have a valid bank account. You can provide this information by giving a void check.

- When you made a mistake on a check: If you wrote the wrong amount, addressed it to the wrong person, or dated it incorrectly, voiding keeps others from using it.

Voiding a check makes it useless for payment or withdrawing money. By voiding a check you help to ensure that no one else can use it if they were to find it.

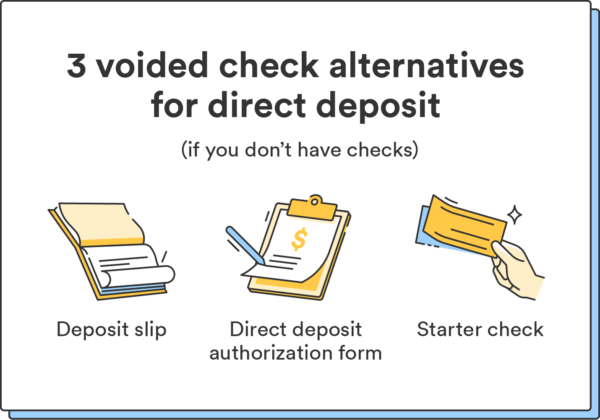

How to void a check for direct deposit if you don't have checks

If your checking account doesn’t offer checks, you may be able to set up direct deposit in other ways.

- Use a deposit slip: If your bank offers deposit slips (these also contain your routing and bank account numbers), see if your employer would accept one instead of a check.

- Use a direct deposit authorization form: Your employer may offer a direct deposit authorization form. You can fill in your routing and bank account numbers on this form instead of a voided check.

- Request a starter check from your bank: Some financial institutions can print a starter check containing your account and routing numbers. If yours does, you can use this and fill it in like a regular voided check.

While some companies offer alternative ways to set up direct deposit if you don’t have access to checks, not all do. Be sure to speak with your employer to review your options.

Common mistakes when voiding a check

Being aware of common mistakes that can occur when voiding a check can help you avoid them. Some examples include:

- Writing too small or light: Writing “VOID” in small letters or in ink that’s difficult to read could result in confusion or potential misuse of your check.

- Failing to record: If you forget to record that you voided a check, this can lead to mistakes when you go to balance your checkbook or check register.

- Improper disposal: Forgetting to properly destroy and dispose of your check can make you vulnerable to identity theft or other fraudulent activity. To protect your personal and banking information you can shred the void check so it’s no longer legible.

Now you know how to void a check

While paper checks are becoming a thing of the past, there are instances when you need them. It’s useful to know what a voided check is and how to write a void check. To learn more about checks and how to fill them out, check out our step-by-step guide.

FAQs

Can you go to the bank and get a voided check?

Yes, if your bank has a physical branch, you can speak with a teller and request a voided check. The bank can void the check by stamping or writing “VOID” on it.

How do you get a voided check online?

You can often get a voided check online by logging into your bank’s website or mobile banking app and selecting an option to request a voided check. Some banks also offer the ability to print a voided check directly from their website.

Why would you void a check?

You may need a voided check to set up a bank account, direct deposit, or automatic bill payment. You may also decide to void a check if you filled it out wrong or completed a mobile deposit and want to prevent others from using it.

What can someone do with a voided check?

A voided check still shows information about you and your bank account. It will likely have your name, address, bank name, account number, and routing number. If someone has your voided check, they can see and use all of this information.

Why do employers ask for voided checks?

Employers might ask for a voided check to set up direct deposit. They can use your void check to get account information and confirm that your paycheck is going into the correct account.

Do you sign a voided check?

No, you do not sign a voided check. Instead, just write “VOID” on it in large letters. When you void a check, it becomes invalid and unusable.

Can you cash a voided check?

No, you cannot cash a voided check. The purpose of a voided check is to certify your bank account information. Once you void a check, it becomes invalid and useless for payment.