If you’re like many American pet owners, you think of Fido as your “fur child.” And given that vet bills have soared by 60% over the past decade – far outpacing inflation – having a dog may feel closer to human child-rearing financially, too.¹

Increasingly, animal lovers are turning to pet insurance to help save money on the cost of pet care. More than 5.6 million American pets have their own insurance policy – and the number keeps rising, year over year.² Average monthly premiums can range from just $9.68 to $56.30, depending on both the type of pet and type of policy.³

But does the math work out in pet owners’ favor?

How does pet insurance work?

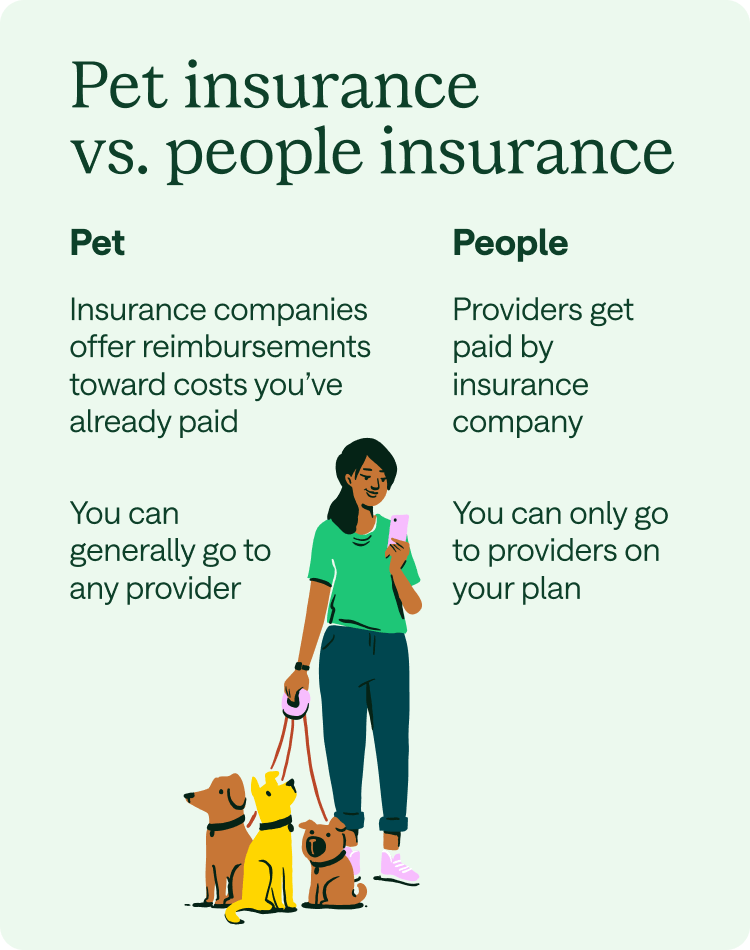

Let’s look at how pet insurance actually works – because it’s not like human medical insurance.

- Instead of working with networks of providers and paying them directly, most pet insurance companies offer reimbursements toward costs you’ve already paid. That means you can pick any vet you want, but it also means you have to foot the bill up front.⁴,⁵

- Additionally, the reimbursements are usually partial. When buying a policy, you’ll choose from tiers ranging from 50% to 90%, although a select few insurers offer 100% reimbursement.⁶,⁷

- The higher your reimbursement tier, the more you’ll pay in monthly premiums – though the type of policy you choose also has a major impact on its cost.

Types of pet insurance

Pet insurance is offered in two main tiers.³

- Accident Only (AO) coverage, as its name suggests, covers the costs related to accidental injuries, like a leg broken during a fall or if your pet swallows something they’re not supposed to.⁸

- Accident & Illness (A&I) coverage adds costs related to ailments like cancer or UTIs – along with care costs incurred by accident.9 However, some pet insurers will refuse to cover incurable, pre-existing conditions, like diabetes or epilepsy.¹⁰

Some companies also offer additional wellness or comprehensive coverage options, which can offset the costs of routine vet visits as well as, in some cases, alternative therapies like chiropractic treatments or acupuncture. (Yes, acupuncture for your pet.)¹¹

Of course, the more coverage you buy, the higher your cost will be. Your pet’s breed and age, as well as where you live, will also affect the policy’s bottom line.¹²

How to calculate if pet insurance is worth it

Pet insurance is worth it if it means you spend less on vet costs than you would without it. The total amount of your monthly premiums, plus the share of the vet cost you’re not reimbursed for, should add up to less than you’d pay out-of-pocket for all your pet’s care.

Life is unpredictable, so there’s no way to know for sure what you’ll spend at the vet. Still, you can make some educated guesses.

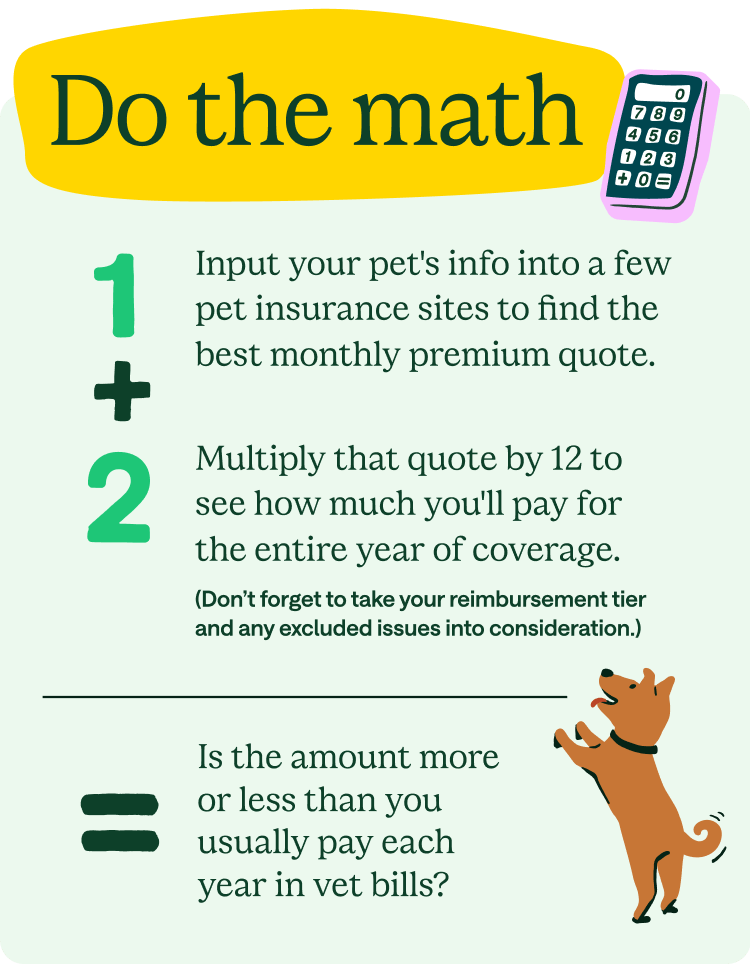

- Start by inputting your pet’s information into a few pet insurance sites. The premiums you’ll be offered will vary substantially based on what type of pet you’re insuring and where you live, regardless of the type of coverage you’re after.

- Once you have your monthly premium quote, multiply it by 12 to see how much you’ll pay for the entire year of coverage. Don’t forget to take your reimbursement tier and any excluded issues into consideration. Does the amount look like more or less than you usually pay each year in vet bills?

Consider your pet's health and personality

If your pet is young and healthy, chances are you’ll pay less at the vet than you would for a high-cost, comprehensive wellness pet insurance plan that covers treatments you don’t need, like hydrotherapy.

But if you and your pup are regular hikers – or your kitty’s sometimes too adventurous of an eater – accident coverage may be worthwhile. (The surgery a dog may need to fix a broken leg could cost up to $5,000.)¹³

As your furry friend celebrates more birthdays, an accident and illness policy might make more sense. Costs to cover age-related illnesses, like cancer, can really add up – and you’ll want to buy your insurance plan before they’re diagnosed (at which point they’re excluded as pre-existing conditions).

Make the call that's right for you

At the end of the day, whether you’ll need pet insurance – like all insurance products – is a bit of a gamble. By doing the math ahead of time, you’ll stack the odds in Fluffy’s favor.

Remember to apply the same logic to other areas of spending, too! For example, determining how much to spend on fitness is all about weighing your goals against your earnings and the activities you most enjoy.