You might recognize Izzy from Season 5 of Love Is Blind. For the unacquainted, Love Is Blind is a reality TV dating show and social experiment from Netflix® where participants look for love and potentially get engaged without seeing each other. While dates can talk to one another, they can only see the other person once they pop the question.

During his season, Izzy and another cast member became enamored with one another and wanted to tie the knot. On their final date before the wedding, the pair had a talk about money. Izzy revealed he had a low credit score. His bride-to-be expressed that his credit, among other things, made her uneasy and she eventually called off the wedding.

Izzy, an insurance agent, was devastated. Getting left at the altar because of your credit score was heartbreaking and a hard lesson learned. Since then, Izzy has taken steps to level up his money moves and improve his credit:

Improving credit is a process

A day before Izzy and his then-fiancée were about to get married, Izzy hired a financial advisor to sort through his credit situation. While a last resort to save his relationship, it was a sign that Izzy was serious about improving his credit score.

Raising your credit doesn’t happen overnight – it takes time to see improvements in your scores. After working with an advisor for about two years, Izzy’s credit scores have increased. To get there, he recommends taking the following steps:

- Pay your credit card on time.

- Don’t go overboard with the splurges: always make sure you can afford to pay back what you buy.

- Take baby steps. Start with a low credit limit, and focus on paying back your balances, little by little.

Talk about money in your relationship

Being on a reality TV show where you only have 10 days to date and 28 days before your engagement to decide whether to get hitched definitely adds a “pressure cooker” element.

Izzy points out that no matter your situation or the pace of your relationship, you should aim to have honest conversations about your finances.

“When I had this conversation with my then-fiancée, it was intimidating,” says Izzy. “We were coming from two different lifestyles, which makes it hard to even talk about it. So try to make it as nice and easy as possible.”

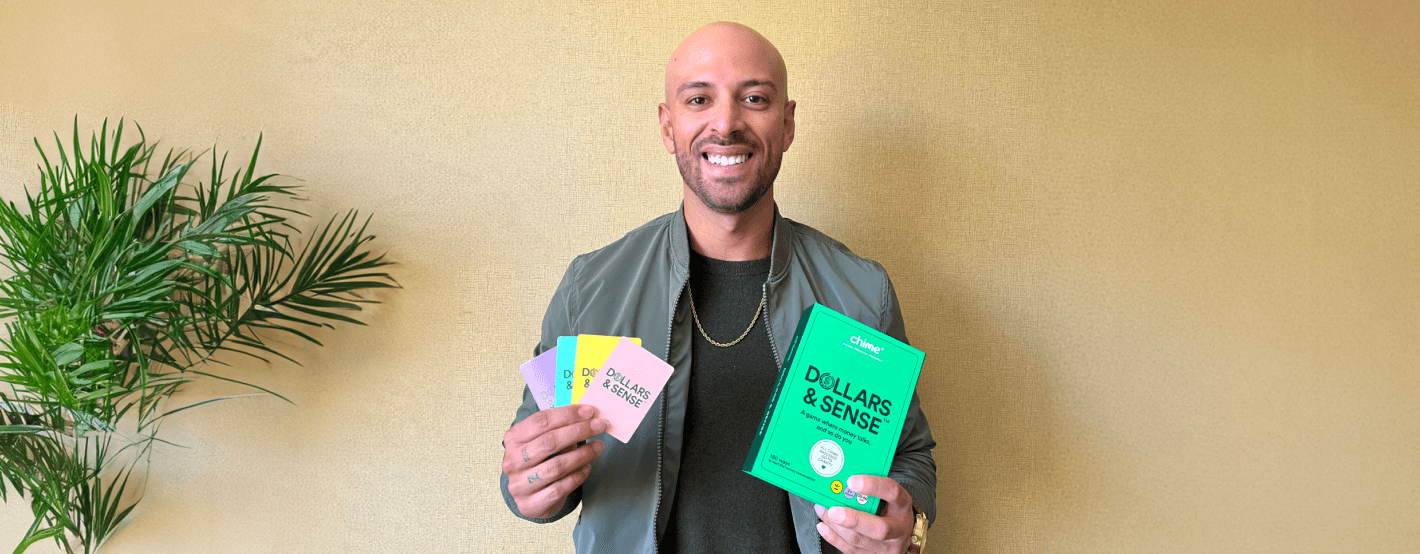

Izzy found that Chime’s new card game, Dollars & Sense™, was a more comfortable and fun way to open up about money – especially with your partner. We played a round with Izzy to get the ball rolling:

View this post on Instagram

Schedule a date to sort out your finances

While there’s no perfect time, you’ll want to bring up the topic of money as you get deeper into your relationship and see yourselves moving toward marriage, Izzy explains. Schedule a “date” with your partner to just talk about money and jot down all your questions ahead of time. To keep things light, you can start with an icebreaker to ease any tension.

Here are some questions you can take turns answering:

- How much do you make?

- How much do you feel we should have in our savings?

- Do you have a 401(k) plan? If so, how much do you have saved in one?

- What’s your credit score?

- Do you have a life insurance policy?

- Once we get married, are we going to have joint bank accounts, or separate ones?

- What’s something you always allow yourself to splurge on?

- Is high student loan debt an issue for you?

- Would you rather own a home but have little savings, or plenty of savings but rent?

Don’t be afraid to dig into the specifics. For instance, in Izzy’s case, his then-fiancée was concerned that he was a 1099 independent contractor, which may have signaled to her that he had inconsistent income. Because people have different financial experiences and beliefs, you never know what matters to them.

“As far as money goes, talk about your do’s and don’ts, what’s tolerated and what’s not, because everyone’s spending habits are different,” says Izzy.

Find out what Izzy wishes he knew back then. Izzy shares what he wishes he knew about credit:

View this post on Instagram

Start with small steps to level up your finances

Izzy realized that his family didn’t discuss the concept of good credit or the importance of a good score during his childhood. His parents were working hard to support Izzy and his sister. “I never got educated on the purpose of having a good credit score, and to make my card payments on time,” he says.

Izzy’s credit took a tumble when he was 19. He didn’t fully understand the basics of credit, and having a credit card felt like free money. “You get a card, go crazy, and forget to make the payments,” he recalls. “You’re just like, ‘Oh, it’s not that big of a deal, I’ll pay it back later.’”

Those beliefs and habits led to Izzy’s card balance climbing up and up – and his credit score was tumbling down.

If he could do it all over again, Izzy says he would put less on his cards, get a card with a lower credit limit, and pay off his balance as quickly as possible. “I would start off with baby steps,” he says. “Then, when I feel responsible enough, I’ll ask for a higher credit limit.”

Don't be blindsided by credit

While Izzy didn’t find everlasting love on the show, it did spark some reflection on his credit score. In turn, Izzy took immediate steps to work on improving his credit.

For those who are in serious relationships, Izzy suggests talking about money sooner rather than later. “Don’t ever be discouraged,” he says. “Break the ice, have the conversation. It makes things a lot easier.”

Want to learn how others are improving their credit? Check out how Chime® member Matthew used Credit Builder to achieve his dreams.

Chime is not affiliated with, sponsored by, or endorsed by Netflix.