How many credit cards is too many?

If you have difficulty managing multiple payments or making sure you have money in your checking account when it’s time to pay, try not to have more than one credit card.

Determining how many credit cards you should have depends on how you use them. If you pay off your cards each month and take advantage of rewards programs, having multiple credit cards can improve your credit score and maybe put a little cash in your pocket.

But if you’re hesitant and wondering, “How many credit cards should I have?” or “How many credit cards is too many?” you’re asking the right questions.

Read on to learn about the pros and cons of managing more than one credit card and how multiple lines of credit can impact your finances.

How many credit cards is too many?

Is it a problem to have multiple credit cards? As convenient as it would be to have a definite answer, there’s no exact number for how many credit cards are too many or too few. Everyone’s financial situation is different. To determine how many credit cards you should have, consider your spending habits and ability to pay bills on time.

Adults should have at least one line of credit, usually a credit card, to start building a credit history. So opening one credit card is a smart move, but when it comes to precisely how many credit cards you should have, it will depend on your financial situation.

So, how many credit cards are good to have?

According to a 2021 survey by Experian, the average American has three-to-four credit cards and two-to-three retail store cards.1 But it’ll be up to you to decide how many credit cards you should have.

Is it bad to have multiple credit cards?

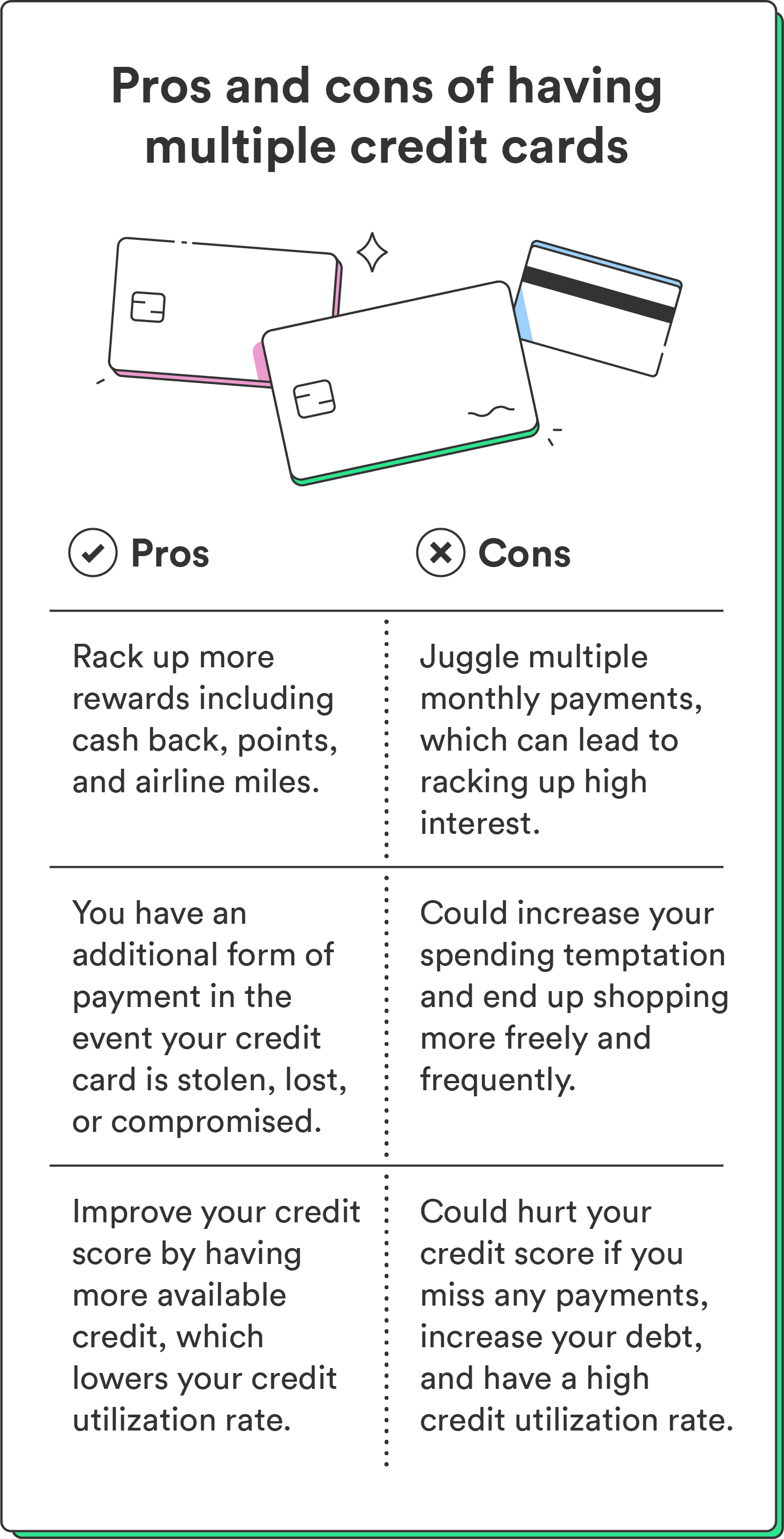

“So, how many credit cards should I have?” Having multiple credit cards can positively or negatively impact your finances. What matters most is how you use them and whether you pay your balances on time every month.

If you’re a pro at managing your payments, you’ll find multiple benefits of having more than one credit card. But if you’re starting your credit journey and struggle with payment deadlines, multiple credit cards might make things more challenging.

Pros of having multiple credit cards

Are you confident you can stay on top of multiple payments and use your cards responsibly? Here are some of the advantages you might enjoy by opening multiple credit cards:

- The more credit cards you have, the more rewards: Rewards like cashback, points, or airline miles can make it worth it to have multiple credit cards, so you earn the maximum available rewards on purchases.

- More credit cards mean more spending power: If you only have an American Express, for example, you might not be able to purchase something from a retailer that only accepts Visa®.

- You’ll have backup credit cards: Having other cards available can come in handy if one is ever lost or stolen.

- Improve your credit score over time: The more available credit you gain through multiple credit cards, the lower your credit utilization rate could be. Low credit utilization can help you build your credit.

Cons of having multiple credit cards

How many credit cards is too many to have? Here are some potential drawbacks to keep in mind before you decide to open a new credit card:

- More credit cards mean more payments to keep track of: It becomes too many credit cards when you struggle with separate due dates and missed payments. This could hurt your credit score.

- The illusion of spending power can be tempting: Multiple cards mean more to spend, but if you don’t have the cash ready in a checking account, you can swiftly fall into debt – credit card APRs tend to be higher than most other lines of credit.

- Poorly managed credit cards can hurt your credit score: Missed payments, rising debt, and high credit utilization will result in a lower credit score. Having many credit cards might also make you look risky to lenders and could keep you from getting approved for additional lines of credit, like a car loan, or approved for favorable interest rates.

How many credit cards should I have to build credit?

You can estimate a number of credit cards you need to build credit based on your expected spending habits and the goal of keeping your credit utilization ratio at 30% or less to improve your credit score.

Your credit utilization ratio is the percentage of your credit limit you are using. The more credit cards you have, the more available credit you have.

For example, let’s say you have a credit card with a $3,000 credit limit and charge an average of $2,000 a month on your card. The amount of available credit you use would be pretty high, around 67%, and a high credit utilization ratio can harm your credit score.

But if you divide your $2,000 across four cards, each with its own $3,000 credit limit (or higher), you could easily keep your credit utilization ratio low.

This ratio is just one of the factors that the FICO® credit scoring model takes into account when determining your score. Credit utilization makes up 30% of your credit score, but your payment history is weighted more heavily at 35%. So no matter how many credit cards seem like too many or the right amount, keeping your balances low and always paying your bills on time is what matters when trying to build credit.

Note: Opening a new credit card can lower your score by a few points due to the hard inquiry made on your credit report.

Credit card tips for beginners

New to the world of credit cards? Spending with credit can be intimidating. But if you’re ready to wield the power of a credit card responsibly, you can boost your credit score to make other big purchases, like a house or a car, more attainable.

Check out our top tips for managing credit cards:

- Educate yourself before applying: Know how credit cards work before opening one. Speak with an experienced friend or family member for advice, or do some online research before applying.

- Don’t apply for multiple credit cards at once: Each time you apply for a credit card, the lender will initiate a hard inquiry on your credit card. Having multiple hard inquiries in a short time can negatively affect your credit score, so try to apply for a new credit card no more than once every six months.

- Use reminders to stay on top of payments: Whether you have one or multiple credit cards, you’ve got to remember your payment date(s) each month. Use whatever resources are most helpful, like smartphone reminders or automatic payments.

- Pay your card off each month in full: To avoid high credit card interest, aim to pay your card off entirely every month. The only exception? True emergencies.

- Start with a secured credit card: If you’re starting to build your credit history, a secured credit card might be the way to go. These are backed by a security deposit, so you can never spend money you don’t have.

Having multiple credit cards can boost your credit score

Is it bad to have multiple credit cards? Not necessarily. Having multiple credit cards can help improve your credit score; how you use each card will determine its impact on your financial health. Before opening a new credit card, consider your spending habits, credit standing, organizational skills, and overall financial security.

If you’re new to building credit, immediately opening multiple cards may not be the best move. Instead, learn how a secured credit card works and how it can be a safe alternative to traditional credit cards.

FAQs

Is 4 credit cards too many?

It depends. Experian’s data shows that the average American has three-to-four credit cards, but how many you should have depends on your financial goals and how well you can manage multiple payments.

Do too many credit cards hurt your credit?

They can. However, it’s only an issue to have multiple credit cards if you struggle to keep up with multiple payments, if you’re applying for one after another resulting in multiple hard inquiries on your credit report, and if you can’t pay off your balance in full each month.

How do I choose the right credit card?

Choosing the best credit card for you will depend on what you are looking for and what you qualify for. Here are some things to keep in mind when shopping around for a new credit card:

- Credit score: Check your credit before applying for a credit card to ensure you qualify. Most cards offering the best rewards and perks are reserved for those who fall under good or excellent credit ranges.

- Features: Consider the features you want in a card, such as rewards, cashback, points, miles, insurance protections, 0% APR promotions, etc.

- Fees: Shop around for the lowest fees, including annual fees, interest charges, late payment fees, and balance transfer fees.

Should I keep my old credit card accounts open?

Keeping some of your old accounts open is typically wise if you’re considering opening new credit cards. The length of your credit history accounts for 15% of your overall FICO Score, so instead of closing accounts, consider taking the cards out of your wallet and storing them elsewhere. This is why having multiple credit cards can be a good thing – to keep your overall credit utilization low.

How often should you apply for a credit card?

How often you should apply for a credit card depends on your financial situation, as there’s no hard and fast rule for this. However, experts typically recommend you wait at least six months between credit card applications. Each time you apply for a new line of credit, it may trigger a hard inquiry, which can lower your credit score. Some credit card issuers might have their own limits on how often you can apply for new credit.