Mobile deposits are a convenient way to deposit paper checks immediately with mobile banking. Using the bank’s app, you can scan the front and back of the check with your phone’s camera to deposit it into your account.

However, you should know how to endorse a check for mobile deposit so you don’t run into any issues. Though the steps may seem straightforward, there are several steps to ensure you receive the money. Continue reading to learn about endorsing a mobile deposit check, troubleshoot reasons why a mobile deposit didn’t work, and uncover frequently asked questions.

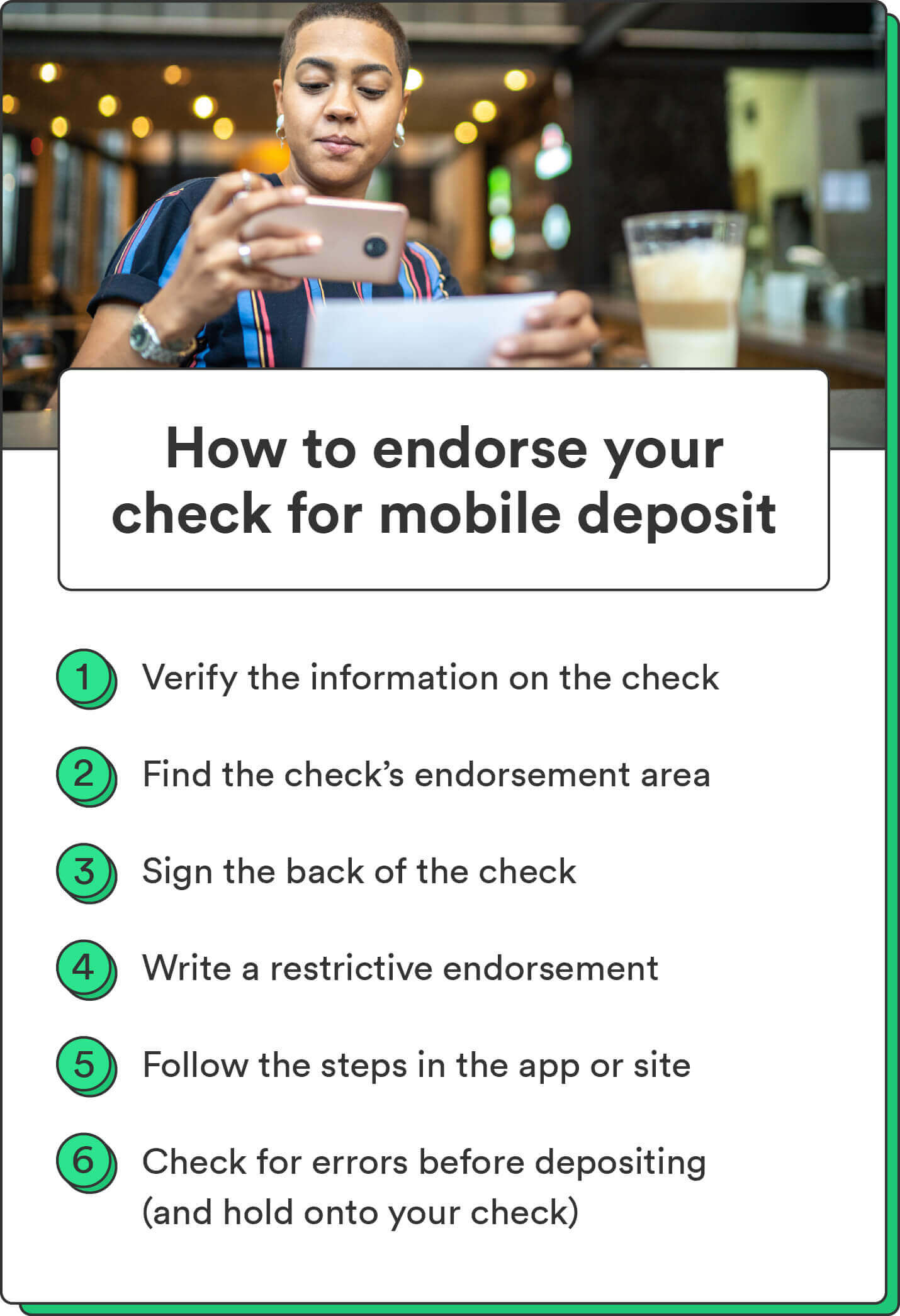

How to endorse your check for mobile deposit step-by-step

Endorsing a mobile deposit can help save time when you can’t squeeze a bank visit into your day. But, if it’s your first time depositing money via a banking app, you may wonder where to begin.

Whether you’re worried about the money going through or check fraud, follow these steps to endorse a check for mobile deposit properly.

1. Verify that the information on the check is correct

Before you attempt to deposit your check, first ensure the person paying you wrote the check correctly. Here are some common mistakes that people could make when writing checks:

- Misspelling a name

- Account or routing number errors

- Scratching out minor errors with a pen

- Missing signature

- A date older than six months

Your bank may reject the deposit if something’s wrong with the information on your check. Though some banks may allow a minor misspelling in your name or where the issuer writes out the number, others may be stricter. If your bank denies your deposit, reach out to the issuer and the bank to see how you can proceed.

2. Find the endorsement area on the back of the check

Before making a mobile deposit, write your signature in the check’s endorsement area. This typically looks like a few gray lines under text that says, “Endorse check here” on the back of the check.

Endorsement for a mobile deposit ensures that the right person will receive their money. If you accidentally endorse the check in the wrong place, contact your bank to determine the next steps. You may have to re-endorse it at the bank with a teller.

3. Sign the back of the check

Now that you know where the endorsement area is, it’s finally time to sign your check for a mobile deposit. Here are some best practices for endorsing a check:

- Use blue or black ink: Do not endorse a check with red ink or a pencil. Banking computers can read blue and black ink better than any other writing method.

- Sign in the endorsement area: If you sign your name above or below the endorsement area, you may have to follow a re-endorsement process at your bank.

- Use your signature: The endorsement area isn’t a place to experiment with a new and unique John Hancock. Keep it simple and use your recognizable signature.

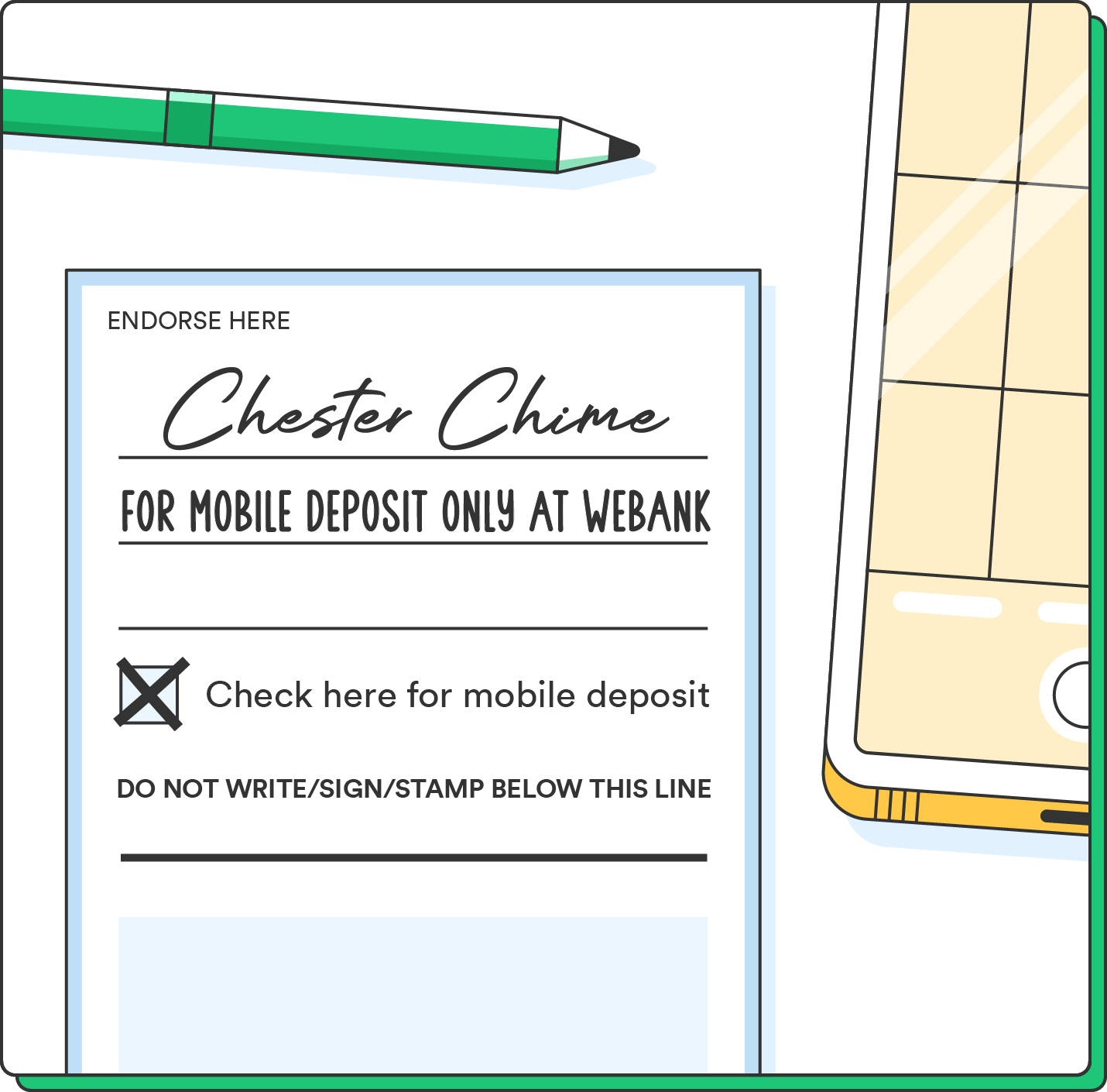

4. Write a restrictive endorsement

Mobile check deposits typically require a restrictive endorsement for the bank to recognize them.

Banks may ask you to write out a custom restrictive endorsement that looks like the following:

- “For mobile deposit only.”

- “For deposit into checking account [Account Number] only.”

- “For mobile deposit at [Bank Name] only.”

- “For mobile deposit only on [insert date].”

Some checks even have a checkbox in the endorsement area that signifies you are depositing it via a mobile app. However, many banks will still require a restrictive endorsement in your own handwriting.

5. Follow the steps in the app or site

Now, you can finally deposit your check into your bank account. Though the process will vary depending on your bank and mobile app, here are the typical steps for how to make a mobile deposit:

- Open up your banking app where you want to deposit the money.

- Navigate to a tab that says “Deposit” or “Mobile Deposit.”

- Enter the check’s information, like the amount of money.

- Endorse your check and write a restrictive endorsement if you haven’t already.

- Make sure you put your check on a solid surface and have decent lighting.

- In the app, take a picture of the front and back of the check.

- Follow the instructions to get to the submission view.

6. Check for errors before depositing (and hold onto your check)

Double-check that all the information you put into the mobile app is correct, especially the deposit amount. Compare your input amount to the check to ensure the deposit goes through.

- Verify that the bank is depositing your money.

- Hold onto the check until the money lands in your account.

It may take time for the mobile deposit to hit your bank account.Some larger financial institutions can potentially send you the money quickly, but others may take a few days. If the check doesn’t appear in your account within three days, contact your bank and see how you can fix the issue.

Why do I need to endorse a check?

Endorsing a check allows the bank to verify that the money belongs to you. This security measure ensures you alone receive the money, and it doesn’t go to anybody else. An endorsement also shows that a check is valid.

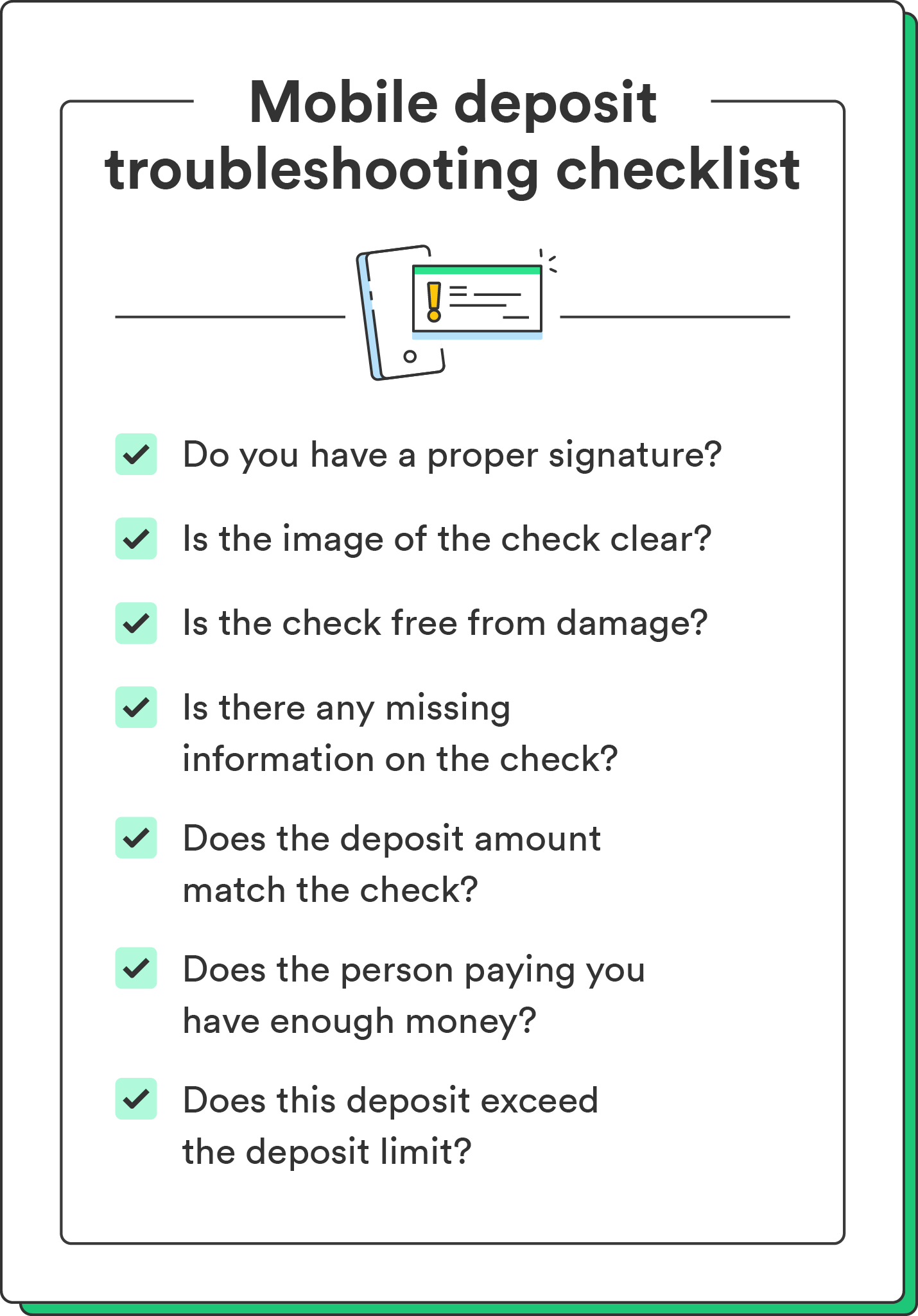

Why didn't my mobile check endorsement work?

Sometimes, a mobile deposit doesn’t work because of incorrect endorsement or inaccurate information on the check itself.

Your mobile deposit might not go through if the following issues occur:

- Missing signature: Properly endorse the check to deposit your money.

- Blurry image: Retake the picture of the check for your deposit to go through.

- Damaged check: If the check is visibly damaged, you may need to go into the bank for a deposit.

- Duplicate deposit: Your financial institution may contact you if someone has already deposited the check into another account.

- Missing information: Double-check all the information on the check for accuracy.

- Wrong deposit amount: Make sure the amount on the check and the number you put into your mobile app match.

- Insufficient funds: If the person who wrote the check doesn’t have enough funds for your deposit, you may not receive your money. Contact the account holder or your bank for the next steps.

- Exceeds deposit limit: Most institutions only allow you to deposit a certain amount of money per day. Wait 24 hours and try again.

Fast and easy access to your money

It’s normal to feel nervous if this is your first time learning how to endorse a check for mobile deposit. You can practice on a blank sheet of paper beforehand to avoid mistakes since you’ll need to do your real check endorsement in blue or black ink.

Once you’re a pro at endorsing checks for mobile deposits, read about how long a mobile deposit usually takes.

FAQs about mobile check endorsements

Still have questions about mobile check endorsements? Find answers below.

Where do I sign a check?

You will sign a check in the designated endorsement area on the back. This is usually a gray box with lines inside of it and text that says, “Endorse check here.”

What are my mobile check deposit limits?

Most financial institutions have specific daily and monthly check deposit limits, which can vary between account types. For specific information on your mobile check deposit limits, check the Mobile Deposit section on your app or financial institution’s website, or call them directly.

How do I endorse a check to someone else?

You can endorse a check written to you for somebody else in the check’s endorsement area. Write “Pay to the order of,” followed by the recipient’s name. Then, you’ll both need to sign the check.

What are my options if I accidentally mess up the endorsement?

If you accidentally mess up an endorsement, cross out the endorsement with a simple line and put your initials next to it. Then, you’ll re-endorse the check with a proper signature.